Oil edged greater after the US suggested ships to avoid Iranian waters when navigating the Strait of Hormuz, reviving a danger premium that had ebbed in latest days amid nuclear talks.

West Texas Intermediate crude futures rose 1.3% to settle above $64 a barrel after the US Division of Transportation stated in a maritime advisory on Monday that American-flagged ships ought to keep so far as attainable from Iranian waters. The company cited a latest incident wherein Iran’s Islamic Revolutionary Guard Corps harassed a US-flagged tanker because it was transiting via the waterway final week.

The steering stoked investor fears of a short-term disruption within the important Hormuz chokepoint, via which a couple of third of the world’s oil flows, in addition to a broader conflagration within the oil-rich Center East area. Iran has threatened to shut Hormuz throughout instances of geopolitical pressure.

The event reversed bearish momentum that adopted pledges by Iran and the US to proceed talks following what they described as optimistic discussions in Oman on Friday. Tehran stated the session, aimed toward defusing tensions over the Islamic Republic’s nuclear program, was “a step ahead.”

US President Donald Trump, who has repeatedly threatened Tehran with airstrikes, stated there can be one other assembly this week. The US chief can be on account of see Israeli Prime Minister Benjamin Netanyahu on Feb. 11, whereas getting ready tariffs towards international locations doing enterprise with Tehran.

Crude has pushed greater this yr regardless of widespread considerations a couple of looming glut, with positive factors supported by geopolitical tensions in addition to halts to some flows, together with from Kazakhstan. Nonetheless, costs fell final week on indicators of progress between Iran and the US.

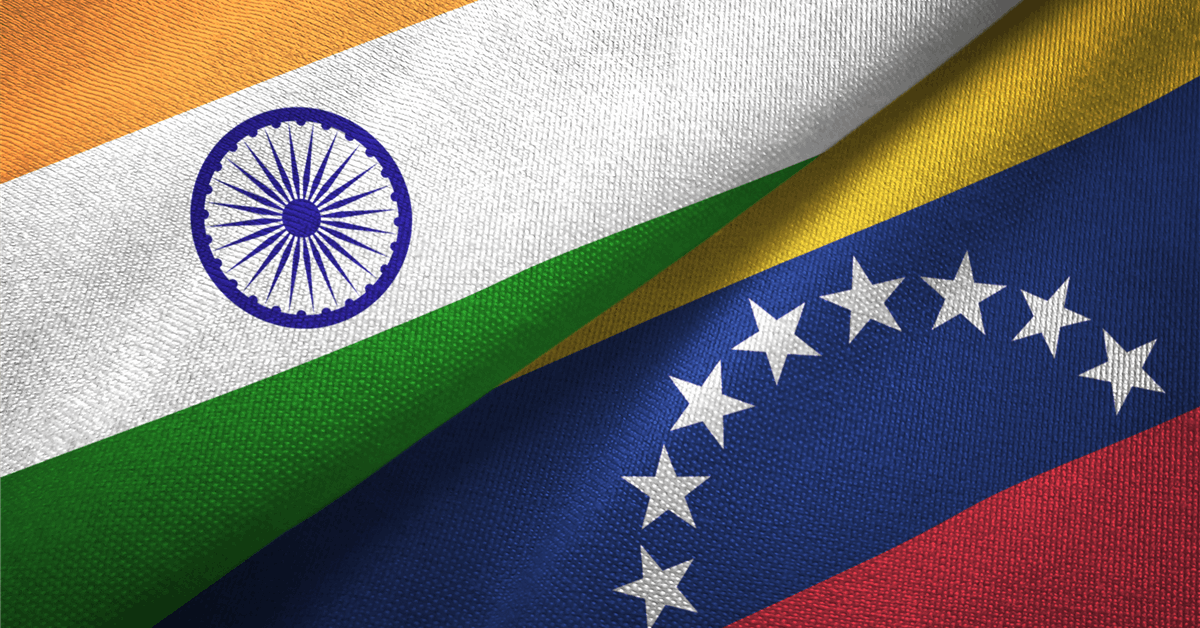

India Flows

Merchants had been additionally taking a look at oil flows to India. The nation’s imports of Russian oil are anticipated to drop by about half from already weaker latest ranges, in response to individuals with direct information of the purchases, after Trump stated the South Asian nation agreed to halt crude imports from Moscow as a part of a commerce deal.

Nonetheless, New Delhi has but to instantly affirm the dedication, with the federal government emphasizing that power safety stays its high concern.

“If India stops Russian oil purchases following the US-India commerce deal, we would want to see Russian oil reductions widening in an effort to seek out different patrons,” stated Warren Patterson, head of commodities technique at ING Groep NV. Failing to seek out different takers would in the end imply a tighter stability, he stated.

This week is probably going to supply loads of clues in the marketplace outlook, with the official US forecaster, OPEC, and the Worldwide Power Company on account of situation up to date analyses.

Elsewhere, Mexico has halted its oil shipments to Cuba after Trump’s risk to sanction international locations that offer it. Oil imports to the island reached zero in January for the primary time since 2015. The stress on gasoline provides is squeezing the Cuban financial system, with residents dealing with shortages of all the things from cooking gasoline to water and electrical energy.

Oil Costs

- WTI for March supply rose 1.3% to settle at $64.36 a barrel in New York

- Brent for April settlement climbed 1.5% to settle at $69.04 a barrel

What do you assume? We’d love to listen to from you, be part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all power professionals to Communicate Up about our trade, share information, join with friends and trade insiders and have interaction in knowledgeable group that may empower your profession in power.