The world’s largest oilfield-service suppliers need to manufacturing will increase within the Center East to assist offset a slowdown in US shale.

That’s one of many huge takeaways from feedback this week made by executives at Helmerich & Payne Inc. and Patterson-UTI Power Inc., who pointed to alternatives in nations corresponding to Saudi Arabia to assist drive development. The feedback echoed outlooks from among the greatest names within the trade, together with SLB and Weatherford Worldwide Plc, who anticipate the Center East to steer a rebound in exercise for the tip of 2026 via 2027.

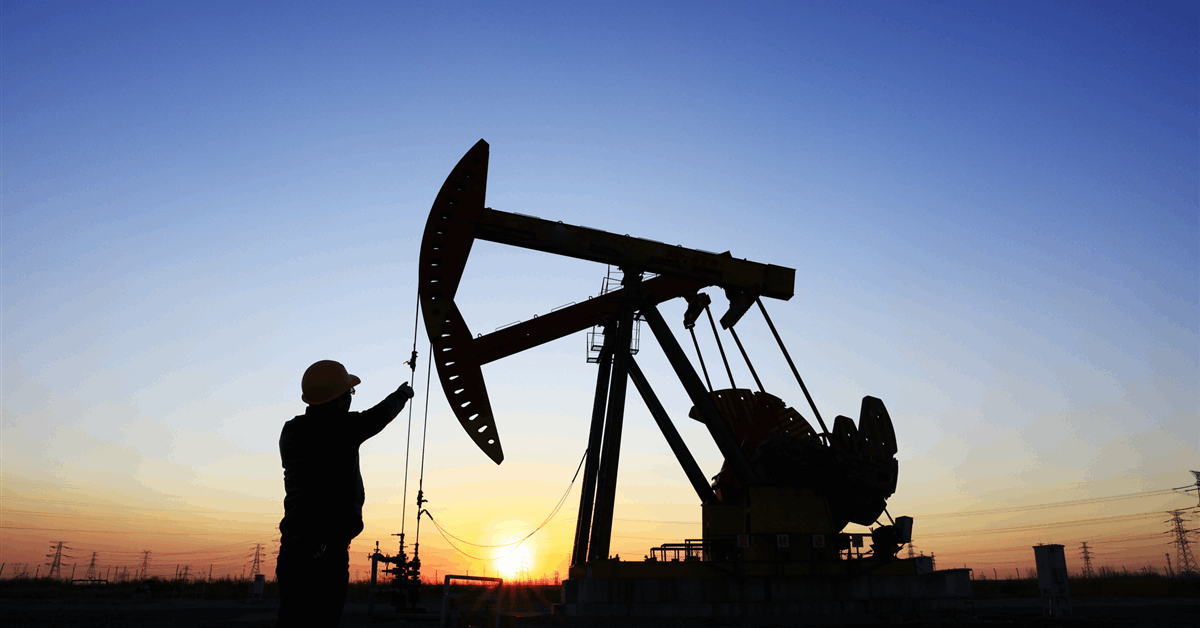

Operators within the US shale patch, as soon as the world’s chief in oil manufacturing development, at the moment are intently watching commodity markets as they hover close to the extent that makes drilling worthwhile for producers. If crude costs drop into the low $50-per-barrel vary for a number of months, corporations are anticipated to make extra drastic cuts to drilling and fracking within the US.

World oil costs have steadily declined prior to now a number of months on expectations of a glut. West Texas Intermediate, the US benchmark, has fallen greater than 10% over the previous 12 months, buying and selling round $63 a barrel on Thursday.

However some producers within the Center East can higher maintain the decrease crude costs, which underscores why the oilfield-services corporations are wanting there for development. Initiatives to frack for pure gasoline have additionally emerged within the area, as governments face rising electrical energy demand, industrial growth and petrochemical build-outs.

Right here’s a take a look at latest feedback from oilfield-services corporations:

Helmerich & Payne

- One of many prime drilling-rig contractors on the US shale patch, the corporate stated the reactivation of its suspended rigs in Saudi Arabia is underway.

- On an earnings name Thursday, incoming Chief Govt Officer Trey Adams stated the corporate stays looking forward to additional alternatives within the area

Patterson-UTI Power

- The corporate opened a drill bit manufacturing facility in Saudi Arabia that began operations in December, CEO Andy Hendricks stated in a name discussing fourth-quarter outcomes Thursday.

SLB

- A rebound in oil manufacturing pushed by OPEC+ coverage and gasoline turning into a precedence to fulfill regional demand will result in a “favorable” subsequent few years, SLB CEO Olivier Le Peuch stated throughout an earnings name on Jan. 23.

- “The Center East market shall be characterised by rebounds in drilling and workover exercise in Saudi Arabia, with rig counts probably returning to early 2025 ranges by the tip of 2026, and this has already begun,” Le Peuch stated.

Weatherford

- Weatherford Worldwide, which will get lots of its enterprise from the Center East/North Africa area, sees a “robust alternative” in Saudi Arabia and momentum in nations together with the United Arab Emirates, Kuwait and Oman, CEO Girish Saligram stated throughout an earnings name Wednesday.

Halliburton

- Halliburton Co., the world’s greatest supplier of fracking providers, took a extra cautious view, with the corporate estimating exercise within the area being flat or down barely in 2026, CEO Jeff Miller stated throughout an earnings name on Jan. 21.

- “I’m effectively conscious of the exercise development in Saudi Arabia, however taking a bit extra conservative view of the timing and pacing of that coming again,” Miller stated. “It probably will, nevertheless it’s much less clear to me how impactful and the way early that might be.”

Generated by readers, the feedback included herein don’t mirror the views and opinions of Rigzone. All feedback are topic to editorial assessment. Off-topic, inappropriate or insulting feedback shall be eliminated.