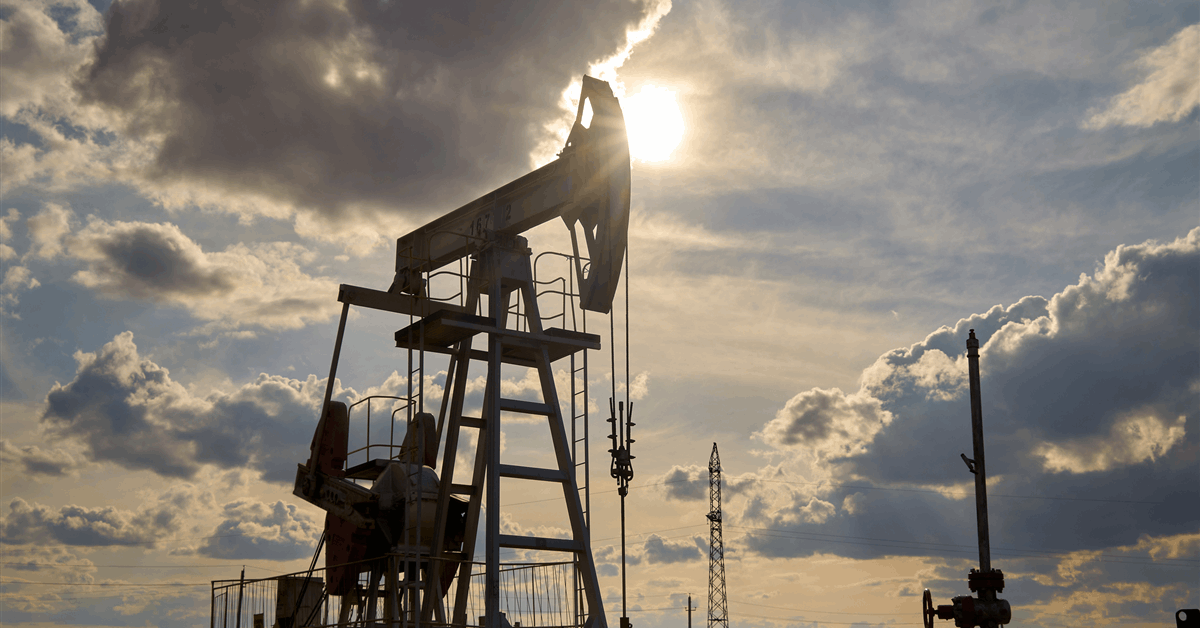

Oil edged increased as merchants assessed US President Donald Trump’s assertion that the US had reached a “framework” for a deal on Greenland.

West Texas Intermediate rose lower than 1% to settle beneath $61 a barrel, following equities and the greenback increased. Trump stated he would chorus from beforehand threatened tariffs on European nations opposing his effort to take possession of Greenland. The US’s renewed push to accumulate the sovereign Danish territory threatened to set off a commerce conflict that would curb financial development and convey down oil costs.

Markets additionally digested renewed considerations over army motion in Iran, including to a geopolitical threat premium that additional supported costs. Trump continues to be urgent aides on “decisive” army choices in Iran, the Wall Avenue Journal reported Tuesday.

Response within the oil markets has appeared comparatively muted, stated Frank Monkam, head of macro buying and selling at Buffalo Bayou Commodities.

“The value motion immediately is mainly vary commerce with an upside bias the place dips are being purchased till we get readability on Iran, which has taken a backseat to Greenland/Davos talks for now,” Monkam stated.

Serving to add a flooring to the market, the IEA elevated its forecast for international oil demand development in 2026, barely trimming a projected provide glut that has weighed on costs. The projections, nonetheless, nonetheless depart oil markets going through a big extra.

Stockpiles are on observe to swell by 3.7 million barrels a day this 12 months, in response to the IEA’s newest evaluation, although the company has cautioned that the precise overhang might not attain these ranges in apply. The surplus provide has cushioned in opposition to uncertainties in Iran, Russia, Kazakhstan, and Venezuela, the company added.

In Kazakhstan, the operator of the Tengiz oilfield has declared power majeure on crude deliveries into the Caspian Pipeline Consortium, including a hurdle that has provided some assist to costs, although beforehand present points within the CPC that had hampered the nation’s provide seem like nearing decision.

Bitterly chilly climate within the US can also be main the power advanced increased. Diesel futures settled 4% increased, one other sharp improve following dramatic spikes in pure gasoline.

Oil Costs

- WTI for March settlement rose 0.4% to settle at $60.62 a barrel in New York.

- Brent for March settlement added 0.5% to settle at $65.24 a barrel.

What do you suppose? We’d love to listen to from you, be part of the dialog on the

Rigzone Vitality Community.

The Rigzone Vitality Community is a brand new social expertise created for you and all power professionals to Converse Up about our trade, share information, join with friends and trade insiders and interact in an expert group that can empower your profession in power.