State-owned Kenya Pipeline Co., which the East African state is itemizing via an preliminary public providing, plans to triple capital expenditure on tasks to widen its community, improve storage and diversify into pure fuel.

The corporate plans to spend 110 billion shillings ($852.6 million) over the subsequent 5 years, greater than 3 times the 34 billion-shilling outlay between 2021 and 2025, in line with the IPO prospectus for the sale of a 65% stake.

It can increase the financing via “a mixture of internally generated money flows and revolutionary financing constructions together with entry to debt capital markets, particular function automobile challenge financing, joint ventures and partnerships,” the itemizing doc stated.

KPC is retaining not one of the $824 million raised from the sale. The Kenyan authorities will as a substitute make the most of the proceeds to capitalize an infrastructure fund for its deliberate mega tasks.

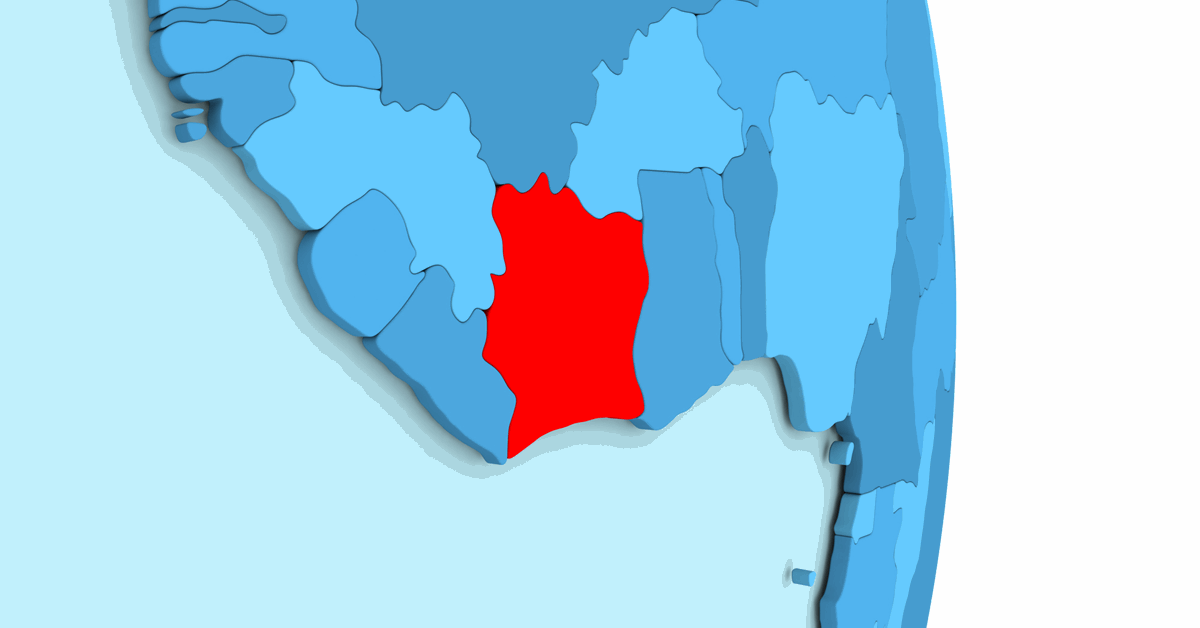

KPC’s tasks features a new pipeline from the Rift Valley metropolis of Eldoret to Uganda’s capital, Kampala, and onward to Rwanda. As well as, it is going to construct an oil buying and selling hub in Mombasa.

The port metropolis is the long run website of a bulk pure fuel dealing with facility for imports from Tanzania for energy technology. The corporate plans further storage services for Kenya’s strategic petroleum reserves.

KPC intends to commercialize an influence plant situated on the defunct Kenya Petroleum Refineries Ltd. plant to provide electrical energy to the grid, along with photo voltaic farming.

A crude refinery shut in 2013 will probably be transformed right into a biofuel refinery to supply mixing elements and sustainable aviation gas. Eni SpA is enterprise research on the proposed enterprise, in line with KPC.

Uganda’s plans for a refinery to be operation by 2030 poses “a big danger to KPC when it comes to its regional growth technique,” it stated.

“It can take a very long time for the Japanese African regional market consumption ranges to justify crude refining scale and margins at the most effective world oil markets stage. Landed refined oil will stay extra aggressive into the long run,” in line with KPC.

Generated by readers, the feedback included herein don’t mirror the views and opinions of Rigzone. All feedback are topic to editorial overview. Off-topic, inappropriate or insulting feedback will probably be eliminated.