Shell Plc and Exxon Mobil Corp. canceled a proposed deal to promote pure fuel property within the North Sea to upstart agency Viaro Vitality.

Shell mentioned in an announcement that the oil majors couldn’t full the transaction to promote the strategic Bacton onshore fuel terminal and 11 offshore services to grease tycoon Francesco Mazzagatti’s Viaro. The ending of the transaction follows a protracted regulatory assessment by the North Sea Transition Authority, which mentioned it had wanted additional info from Viaro earlier than any determination.

“The events have labored laborious and in shut alignment to attempt to full this transaction over many months, however regardless of this being a completely funded alternative, the completion circumstances weren’t met as industrial and market circumstances developed and we mutually agreed to not proceed,” Mazzagatti mentioned Wednesday.

When it introduced the deal in the summertime of 2024, Shell mentioned the transaction was anticipated to finish in 2025. The NSTA, which was lately given new powers to supervise mergers and acquisitions within the North Sea, mentioned the regulator was “ready to obtain the extra info requested from the buying get together to decide.”

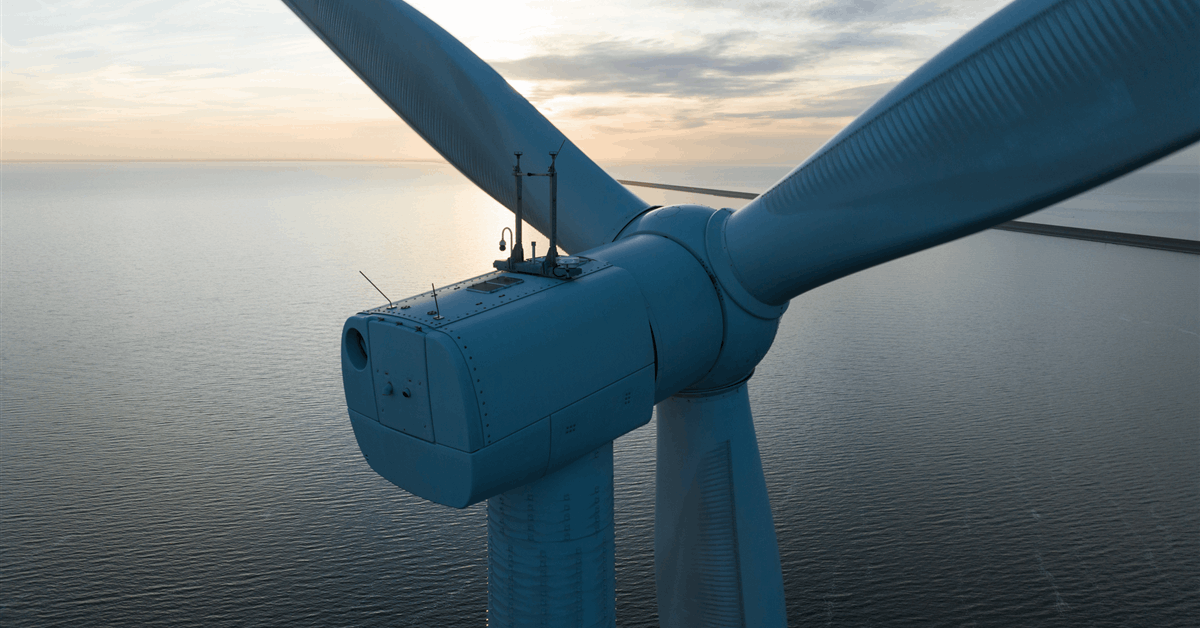

The deal included the Bacton terminal on the east coast of England, a website of “strategic nationwide significance,” in line with Shell. It’s the only entry level for fuel from Belgium and the Netherlands, supplying as a lot as one-third of the UK’s fuel provide.

Mazzagatti, Viaro’s founder, is dealing with prison prices in Italy and civil forgery and fraud allegations within the UK. He denies all allegations made towards him.

The halt to the deal has paused an acquisition streak that made Viaro probably the most prolific purchaser of UK oil and fuel property over the previous 5 years, in line with information compiled by Bloomberg. The choice additionally follows a London Courtroom of Enchantment ruling over a three way partnership with an Abu Dhabi agency on the finish of final 12 months — judges overturned an earlier judgment in favor of Mazzagatti.

Shell and Exxon should now decide whether or not to pursue different patrons. Exxon has in any other case been shrinking its UK asset footprint. A multi-year saga to dump the Bacton property included Shell whittling down bidders to 3 remaining contenders, Bloomberg reported in 2023. Ithaca Vitality Plc and Perenco SA had been finalists together with Viaro.

Since asserting the deal, Shell has spun off its UK North Sea enterprise and mixed it with Equinor’s to create the basin’s largest unbiased fossil gas producer in a brand new agency known as Adura. Shell stays operator of the asset.

Generated by readers, the feedback included herein don’t replicate the views and opinions of Rigzone. All feedback are topic to editorial assessment. Off-topic, inappropriate or insulting feedback can be eliminated.