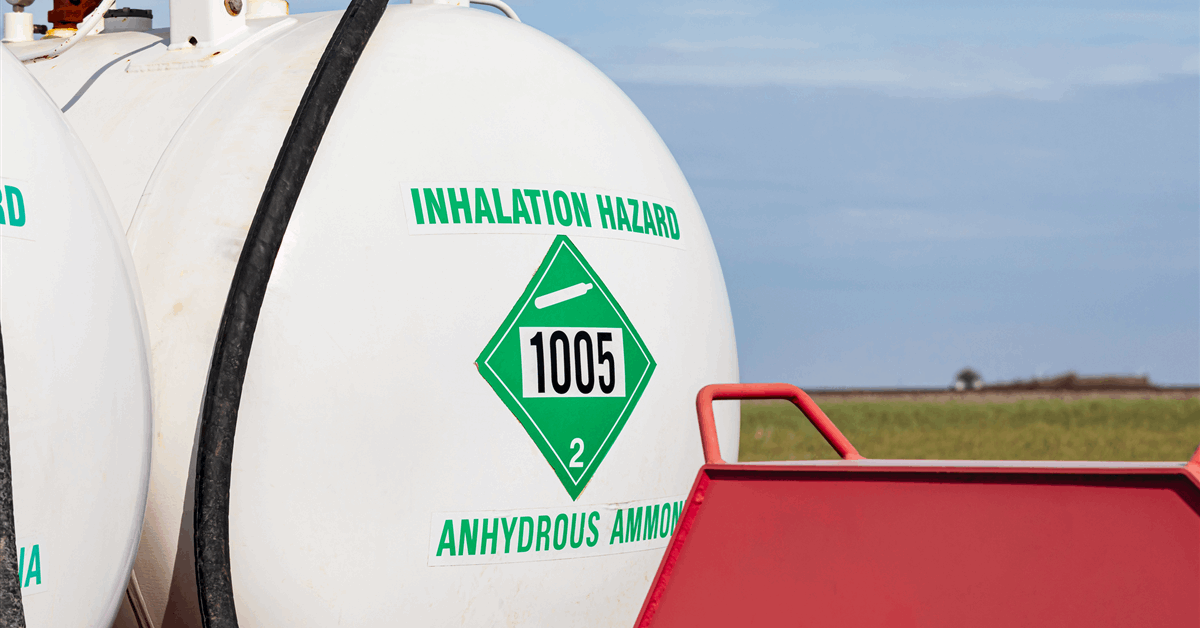

Woodside Vitality Group Ltd’s Beaumont New Ammonia (BNA) venture in Texas has reached the testing stage and is on observe for industrial startup “early” subsequent yr, the Australian firm stated Monday.

BNA, which has a manufacturing capability of 1.1 million metric tons a yr, “produced first ammonia following the completion of techniques testing, representing the primary section of operations commissioning of the power”, Woodside stated in an internet assertion.

“Business manufacturing of ammonia from BNA is predicted to start following handover to Woodside Vitality from OCI World in early 2026. Manufacturing of lower-carbon ammonia is focused to start out within the second half of 2026.

“Demand for lower-carbon ammonia continues to develop globally, with sturdy curiosity from prospects in Europe and Asia as they pursue vitality safety and decarbonization aims.

“Woodside has additionally finalized agreements with main international prospects to provide important volumes of standard ammonia from the BNA facility. Deliveries will begin in 2026 and proceed by means of yearend, underneath contracts that mirror prevailing market costs.

“Further agreements are being superior to align with anticipated BNA output, together with for lower-carbon ammonia”.

Woodside added, “Within the lead-up to handover, the venture will proceed with extra verification, efficiency testing and operational preparedness actions”.

In addition to ammonia, BNA will even produce “hydrogen-adjacent merchandise”, Woodside stated.

“As soon as operational, BNA has the potential to roughly double U.S. ammonia exports, contributing to regional financial progress and supporting American vitality management”, it stated.

Woodside acquired the venture from Amsterdam-based OCI final yr for $2.35 billion.

In a press release September 30, 2024, OCI stated it could “proceed to handle the development, commissioning and startup of the power by means of provisional acceptance” after the divestment.

“Manufacturing of decrease carbon ammonia is conditional on provide of carbon-abated hydrogen and ExxonMobil’s CCS [carbon capture and storage] facility turning into operational”, OCI stated.

“The all-cash consideration of roughly $2,350 million is inclusive of capital expenditure by means of completion of the primary section, with $1,880 million paid and the remaining $470 million to be paid at venture completion”, it stated.

OCI had signed an settlement with Linde PLC for the provision of emissions-abated hydrogen, in addition to nitrogen, to the Beaumont venture, as introduced by OCI February 6, 2023.

On April 4, 2023, Linde and ExxonMobil introduced an settlement underneath which ExxonMobil would transport and completely retailer as much as 2.2 million metric tons a yr of carbon dioxide from Linde’s hydrogen plant, anticipated to start out up this yr.

To contact the writer, electronic mail jov.onsat@rigzone.com

What do you suppose? We’d love to listen to from you, be a part of the dialog on the

Rigzone Vitality Community.

The Rigzone Vitality Community is a brand new social expertise created for you and all vitality professionals to Converse Up about our trade, share data, join with friends and trade insiders and have interaction in knowledgeable group that may empower your profession in vitality.