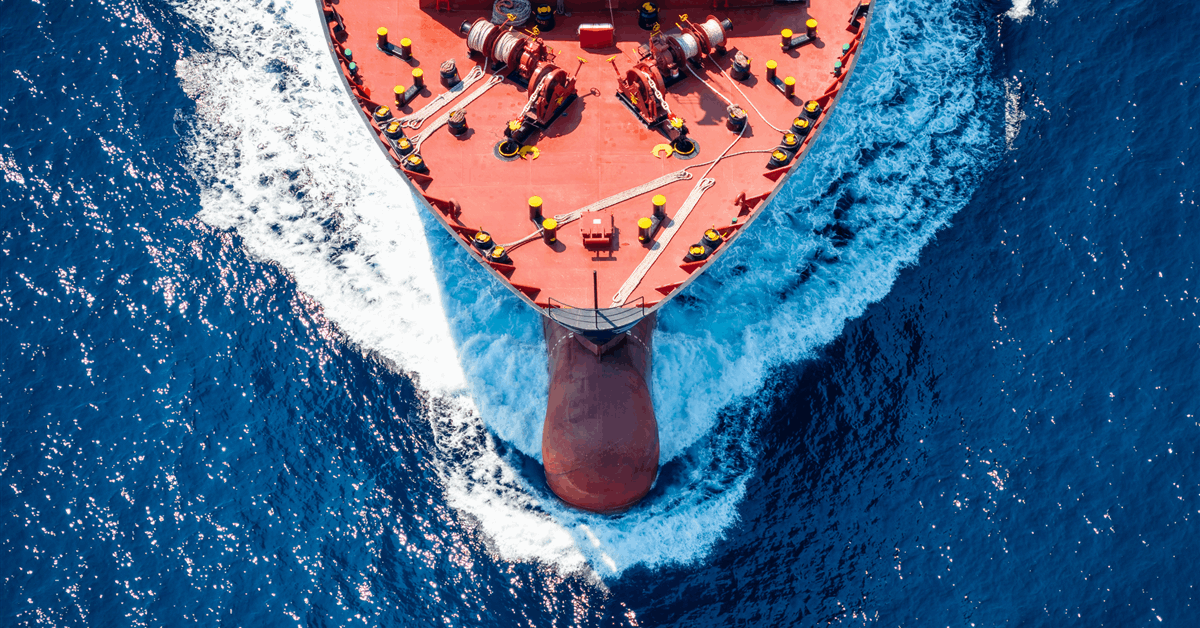

Chinese language oil refiners are shunning Russian shipments after the US and others blacklisted Moscow’s high producers and a few of its prospects.

State-owned giants comparable to Sinopec and PetroChina Co. are staying on the sidelines, having canceled some Russian cargoes within the wake of US sanctions on Rosneft PJSC and Lukoil PJSC final month, in response to merchants. Smaller personal refiners, dubbed teapots, are additionally holding off, terrified of attracting related penalties to these confronted by Shandong Yulong Petrochemical Co., which was not too long ago blacklisted by the UK and European Union.

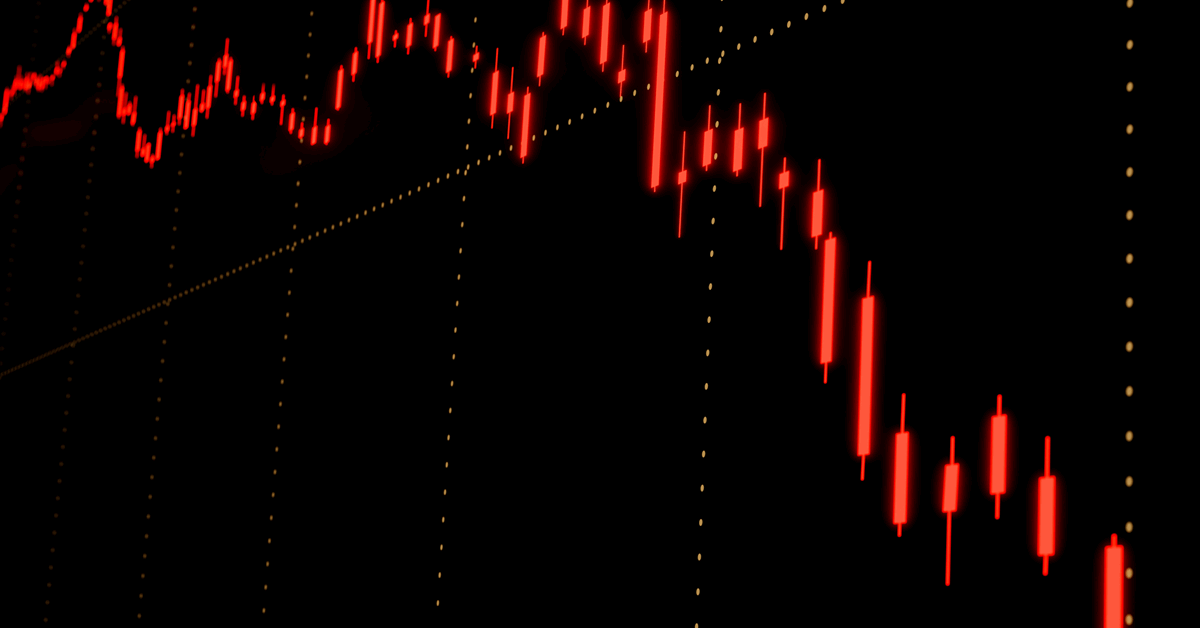

The Russian crudes affected embody the widely-favored ESPO grade, which has seen costs plunge. Consultancy Rystad Power AS estimates some 400,000 barrels a day, or as a lot as 45 p.c of China’s whole oil imports from Russia, are affected by the patrons’ strike.

Russia has cemented itself as China’s greatest international provider, partly as a result of its oil is so closely discounted as a result of penalties imposed by different nations after the invasion of Ukraine.

The US and its allies at the moment are ratcheting up these sanctions, on each Russian producers and their prospects, in a bid to cease the struggle by choking off Moscow’s oil revenues. China is the world’s greatest crude importer, and any constraints on sourcing from its neighbor are more likely to work to the good thing about different suppliers.

These may embody the US, which agreed a landmark commerce truce with Beijing at a gathering final week between leaders Donald Trump and Xi Jinping. However the sanctions aren’t a complete loss for Moscow. Blacklisted Yulong, which has had cargoes canceled by western suppliers, has turned closely to Russian oil due to an absence of different choices.

In the meantime, different personal refiners are watching developments and refraining from actions that might set off related sanctions, in response to Rystad. In any case, teapots are operating up in opposition to a scarcity of import quotas for crude oil, after tax adjustments shrank their use of different feedstocks. That is more likely to impede teapots’ purchases of Russian oil for the rest of the 12 months even when they have been prepared to skirt sanctions.

And if something, the assembly between Trump and Xi has solely added to the muddle. Whereas the leaders have been capable of set up new floor guidelines for commerce in gadgets like semiconductors, uncommon earths and soybeans, what to do about Russian oil wasn’t talked about in any public readouts.

What do you assume? We’d love to listen to from you, be a part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all vitality professionals to Communicate Up about our trade, share information, join with friends and trade insiders and interact in knowledgeable group that can empower your profession in vitality.