Russian oil producer Lukoil PJSC has agreed to promote its worldwide belongings to power dealer Gunvor Group, every week after being hit by US sanctions.

The nation’s No. 2 oil producer stated it had accepted a suggestion from Gunvor and made a dedication to not negotiate with different potential patrons. If profitable, the deal would contain the switch of a sprawling international community of oil fields, refineries and fuel stations to one of many world’s prime unbiased commodity merchants.

The US final week blacklisted oil giants Rosneft PJSC and Lukoil as a part of a recent bid to finish the battle in Ukraine by depriving Moscow of revenues. It was the primary main package deal of sanctions on Russia’s petroleum business since US President Donald Trump took workplace, and has left governments and enterprise companions clambering to grasp the affect.

The provide — for which no worth was disclosed — consists of Lukoil Worldwide’s buying and selling arm Litasco, however not the enterprise models in Dubai which have lately turn into topic to sanctions, stated an individual conversant in the matter.

Gunvor itself has had an extended historical past with Russia. Its co-founder Gennady Timchenko was positioned below US sanctions within the wake of the Kremlin’s annexation of Crimea in 2014, with the US authorities claiming on the time that Russian President Vladimir Putin had “investments in Gunvor,” which the corporate has persistently denied.

Since Timchenko offered his shares, it’s now majority-owned by co-founder and chief government officer Torbjorn Tornqvist.

After making document income from latest volatility in power markets, cash-rich commodity merchants are spending massive on belongings to assist lock in higher margins for the long run. A possible deal might present Gunvor with a system of upstream and downstream companies akin to the buying and selling models of majors like BP Plc and Shell Plc.

The deal is topic to clearance from the US Treasury’s Workplace of International Property Management, together with different relevant authorizations. Gunvor has already began conversations with US authorities, in line with an individual conversant in the matter.

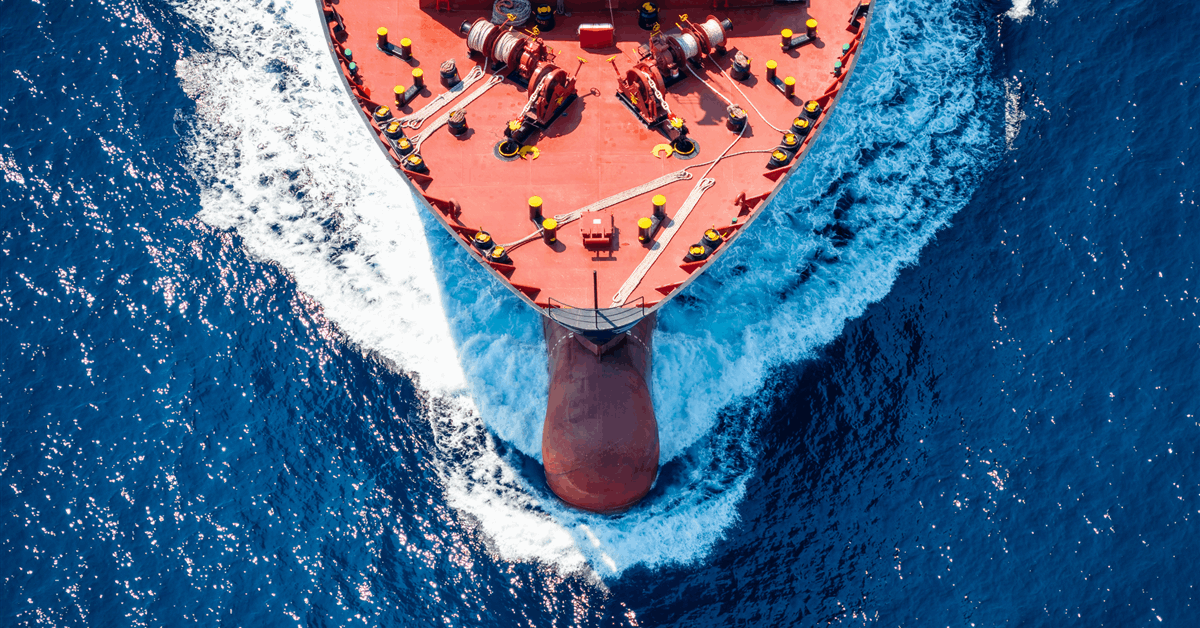

Lukoil is probably the most internationally numerous of Russia’s oil giants. Its belongings embody oil fields, refineries and a community of greater than 5,000 fuel stations from the US to Belgium.

The dimensions of Lukoil’s worldwide enterprise might make the mechanics of such a deal advanced — Gunvor had a complete fairness of $6.5 billion on the finish of 2024, with round 85% owned by Tornqvist. It additionally holds stakes in belongings corresponding to a fuel energy plant in Spain and an oil refinery in Germany.

Lukoil Worldwide’s 2023 annual report exhibits it had fairness of 19.1 billion euros ($22.2 billion), that means the deal is prone to be vital in dimension, underscoring the corporate’s huge scale in international oil markets.

Its buying and selling arm Litasco, which operates from Geneva and Dubai, purchased and offered a mean of 1.19 million barrels a day final 12 months, in line with its annual report, although it got here below stress from banks and different commodity sellers after sanctions have been imposed on Lukoil by the US and UK.

The Russian firm holds 75% of Iraq’s large West Qurna 2 oil undertaking, which might produce near 500,000 barrels a day, and 80% of Block 10 in the identical space. Its upstream companies additionally embody minority stakes in initiatives in nations corresponding to Kazakhstan, Uzbekistan and Azerbaijan, in addition to plenty of African nations. Their share in Lukoil’s complete crude manufacturing final 12 months was solely 5%, in line with the corporate’s annual report.

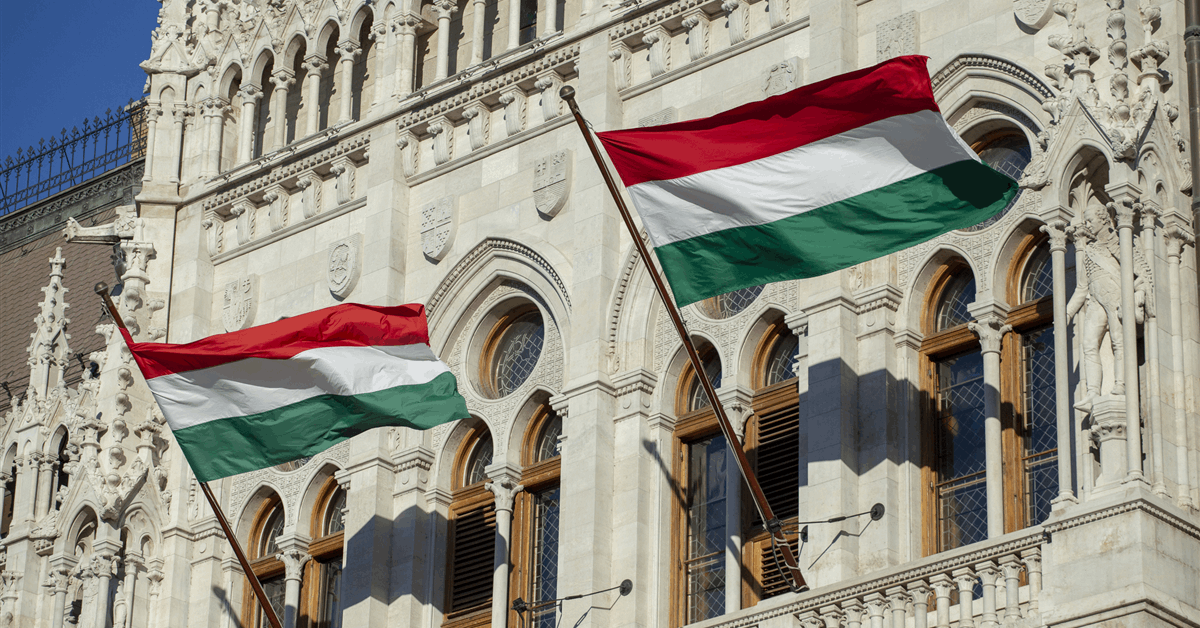

The agency additionally owns an oil refinery in Bulgaria, the place the nation’s power minister had been in talks with the US Treasury about sustaining operations after sanctions have been imposed.

Generated by readers, the feedback included herein don’t mirror the views and opinions of Rigzone. All feedback are topic to editorial assessment. Off-topic, inappropriate or insulting feedback will probably be eliminated.