Oil steadied to finish the week, with OPEC+ anticipated to concentrate on one other modest output improve when key members convene this weekend and as US President Donald Trump denied that he was planning a navy strike on Venezuela.

West Texas Intermediate climbed about 0.7% to settle at $60.98, little modified from the earlier week. A 3rd month-to-month output improve of 137,000 barrels a day could be the bottom case for Sunday talks among the many Group of the Petroleum Exporting International locations and its allies, delegates stated earlier this week, matching market expectations.

Oil costs had been up earlier within the session on studies that the US plans to carry out navy strikes on targets in Venezuela that embrace navy services used to smuggle medicine, in line with the Wall Avenue Journal and the Miami Herald, citing US officers and folks conversant in the matter. Trump later denied the report, and contradicted his personal previous statements that he was getting ready land assaults after a collection of boat strikes, inflicting futures to ease.

Merchants had largely priced within the prospect of curtailed flows from OPEC member Caracas after Trump deployed naval property to the Caribbean this 12 months, saying Venezuelan President Nicolas Maduro is an illegitimate chief who’s facilitating trafficking. It is unlikely {that a} navy marketing campaign would goal power property, market members say.

The escalation is occurring towards a backdrop of a looming worldwide crude glut.

“If the US intention is regime change, there’s a vested curiosity in conserving power infrastructure roughly intact, as that would offer monetary assist for no matter authorities succeeds Maduro,” stated Gregory Brew, a geopolitical analyst on the Eurasia Group.

In the meantime, merchants proceed to evaluate the potential affect of US sanctions on Russia’s two largest oil producers — one thing that the boss of Europe’s largest oil refiner stated the market was under-appreciating. Processors accounting for greater than half of India’s imports of Russian crude have paused shopping for for the approaching months.

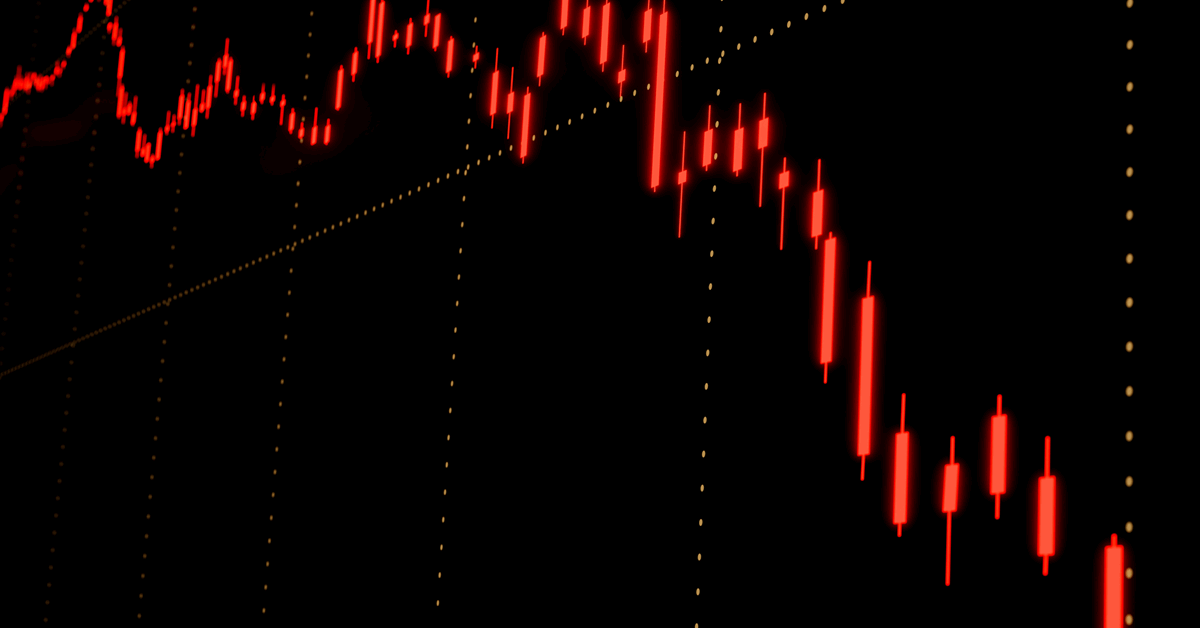

WTI crude has fallen greater than 10% this 12 months as elevated provide from each inside and out of doors OPEC+ outstrips demand development. The cartel’s upcoming assembly comes at an important time. OPEC+ has already restored one tranche of curbed provides, amounting to 2.2 million barrels a day, a 12 months forward of schedule. The group has adopted a extra cautious tempo with the following layer of additives, ready to see how the market develops.

Whereas crude markets are wrestling with oversupply, there’s been energy in refined fuels, significantly after US sanctions on Russian producers Rosneft and Lukoil. Diesel costs are at their largest premiums to crude since early 2024, bolstering refining margins, which may in flip enhance demand for crude.

Oil Costs

- WTI for December supply rose 0.7% to settle at $60.98 a barrel in New York.

- Brent for January settlement edged 0.6% increased to settle at at $64.77 a barrel.

- The December contract expires Friday

What do you suppose? We’d love to listen to from you, be part of the dialog on the

Rigzone Vitality Community.

The Rigzone Vitality Community is a brand new social expertise created for you and all power professionals to Converse Up about our trade, share information, join with friends and trade insiders and have interaction in an expert neighborhood that can empower your profession in power.