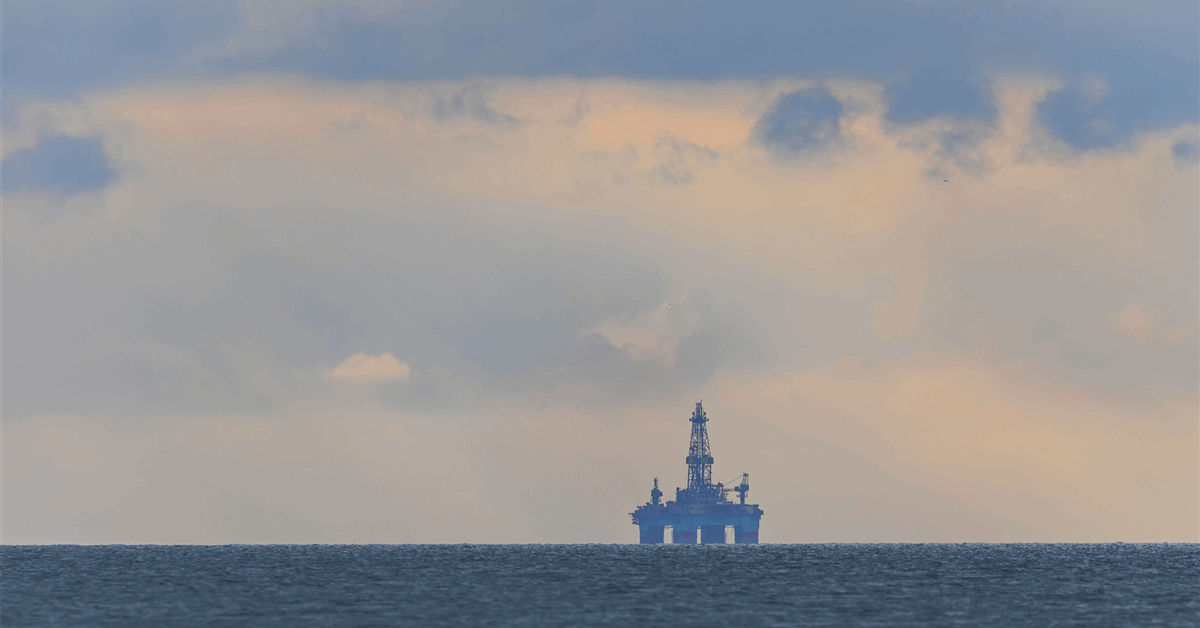

Oil declined as mounting indicators of oversupply quelled a bumper rally triggered by US sanctions on key Russian producers final week.

West Texas Intermediate fell 1.9% to once more settle near $60 a barrel, the steepest day by day drop in additional than two weeks. Traders are higher positioned to resume bets now {that a} looming surplus will push costs down after a large liquidation of speculative wagers.

The quantity of oil being shipped the world over’s oceans hit a file excessive, indicating that extra provides proceed to rise. As well as, OPEC+ could agree so as to add extra manufacturing at a gathering this weekend.

Final week, US President Donald Trump’s administration imposed sanctions on Russia’s two largest oil producers — Lukoil and state-controlled Rosneft PJSC — to strain the Kremlin to finish the struggle in Ukraine. The transfer spurred the largest unwinding of crude futures positions on file, with bearish wagers held by hedge funds at an all-time excessive earlier than the sanctions had been introduced.

The following value spike left cleaner positioning for these trying to guess on a drop. Value swings are additionally set to be exacerbated by the expiry of tens of 1000’s of Brent choices contracts nonetheless held close to $65 a barrel.

The impression of the sanctions continues to be unclear, with merchants carefully following actions taken by Chinese language and Indian power firms, high patrons of Russian crude.

“The market is now questioning the precise effectiveness of the sanctions,” stated Ole Hvalbye, an analyst at SEB AB. “Whereas a full blacklisting sounds dramatic, the mechanisms for enforcement stay unclear, and thus far, there aren’t any indicators of disrupted Russian flows.”

One Indian refiner plans to hunt non-Russian barrels, whereas others are contemplating whether or not they can proceed to take some discounted Russian oil cargoes by leaning on small suppliers, as a substitute of Lukoil and Rosneft.

Indian Oil Corp. is “completely not going to discontinue” its purchases of Russian crude so long as it complies with worldwide sanctions, director of finance Anuj Jain stated in a convention name on Tuesday. A personal Chinese language processor, in the meantime, has been busy scooping up provides from Moscow after it was sanctioned, underscoring the cross-current of impacts.

Following the sanctions, Lukoil stated it intends to promote its worldwide belongings. Geneva-based oil dealer Litasco, based in 2000 as a buying and selling arm for Lukoil, is being shunned by banks whereas no less than some staff mull leaving. And Russian seaborne crude shipments have slipped, however analysts say that could be extra of a symptom of climate than sanctions.

Oil is headed for a 3rd straight month-to-month loss as OPEC+ and rival drillers step up output. Merchants are additionally monitoring progress towards a US-China commerce deal, with Trump and his counterpart Xi Jinping as a result of meet at a summit on Thursday after negotiators cleared the best way for an settlement.

Forward of the assembly, Trump has stated he could elevate the difficulty of Russian oil imports with Xi.

Elsewhere, Israeli Prime Minister Benjamin Netanyahuordered what he referred to as “forceful strikes” towards Hamas in response to assaults on troopers in Gaza, reviving considerations about flows from the Center East, supply of one-third of the world’s crude.

Oil Costs

- WTI for December supply was 1.9% decrease to settle at $60.15 a barrel in New York.

- Brent for December settlement fell 1.9% to settle at $64.40.

What do you assume? We’d love to listen to from you, be part of the dialog on the

Rigzone Vitality Community.

The Rigzone Vitality Community is a brand new social expertise created for you and all power professionals to Converse Up about our business, share data, join with friends and business insiders and interact in knowledgeable group that may empower your profession in power.