Noble Corp on Monday reported $798 million in income for the third quarter, down from $849 million for the prior three-month interval as decrease rig utilization offset decrease contract drilling providers prices.

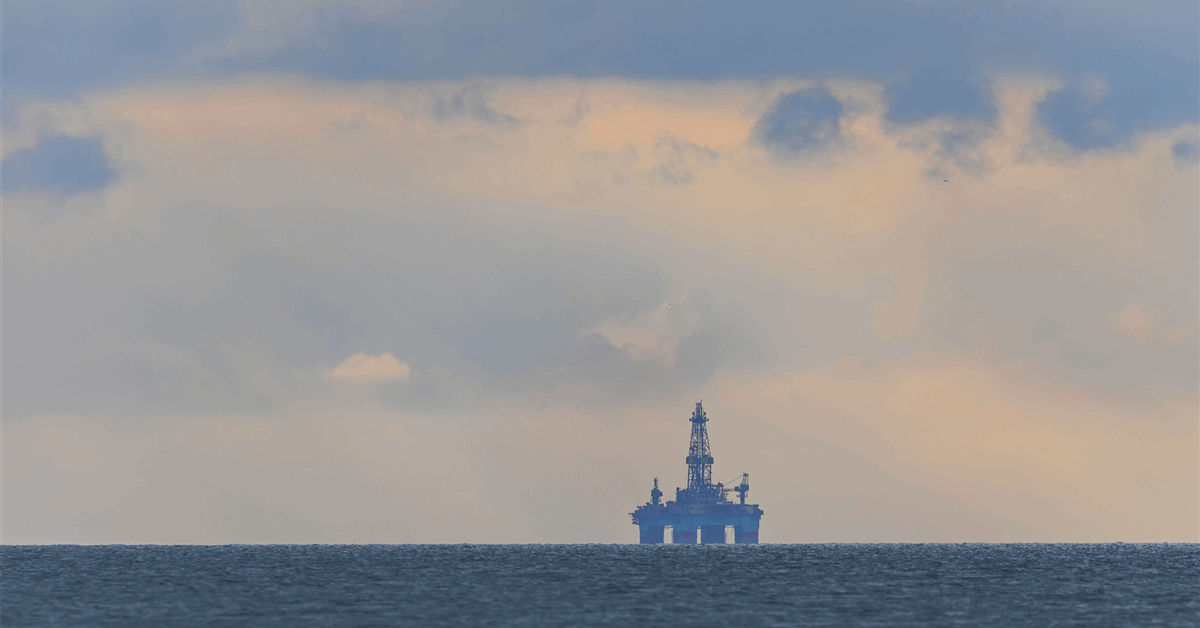

“Utilization of the 35 marketed rigs was 65 p.c within the third quarter of 2025 in comparison with 73 p.c within the prior quarter”, the offshore driller stated in its quarterly report.

“Contract drilling providers prices for the third quarter have been $480 million, down from $502 million within the prior quarter”.

Noble logged a internet lack of $21 million for Q3, in comparison with a internet revenue of $43 million for Q2. It recorded a internet lack of $6.23 million from the sale of working belongings and an impairment lack of $60.7 million.

Throughout the quarter it offered the Noble Highlander jackup, the Pacific Meltem drillship and Noble Reacher, beforehand deployed as an lodging and intervention unit. The divestments generated mixed internet proceeds of $114.5 million. “The Noble Globetrotter II stays held on the market”, Noble added.

Q3 internet outcome adjusted for nonrecurring gadgets was $30 million, up from $20 million for Q2. Adjusted diluted earnings per share stood at $0.19, lacking the Zacks Consensus Estimate of $0.29 per share. Noble maintained its dividend at $0.5 per share.

Adjusted EBITDA for Q3 totaled $254 million, down from $282 million for Q2.

Web money from working actions for the primary 9 months was $764.55 million, up from $519.26 million for January-September 2024.

Noble recorded $7 billion in backlog, excluding mobilization and demobilization income, as of October 27. “Noble’s fleet of 24 marketed floaters was 67 p.c contracted in the course of the third quarter in contrast with 78 p.c within the prior quarter”, it stated. “Current backlog additions since final quarter have added over 4 rig years of whole backlog, bringing whole rig years of backlog added throughout 2025 to 22 rig years.

“Current dayrate fixtures for Tier-1 drillships have remained within the low to mid $400,000s. Utilization of Noble’s eleven marketed jackups was 60 p.c within the third quarter versus 63 p.c utilization in the course of the prior quarter. Vanguard dayrates for harsh atmosphere jackups within the North Sea have remained secure throughout a restricted variety of contract fixtures”.

Noble narrowed its full-year steering for income from $3.2-3.3 billion to $3.23-3.28 billion and adjusted EBITDA from $1.08-1.15 billion to $1.1-1.13 billion.

“Our current backlog enlargement and constructive buyer dialogue proceed to help the formation of a deepwater utilization restoration by late 2026 or early 2027”, stated president and chief govt Robert W. Eifler.

“Whereas we anticipate a reasonably decrease earnings and money move profile in H1 2026 in comparison with H2 2025, the muse for an enhancing market and corresponding earnings inflection is nicely underway”.

Noble ended Q3 with $1.36 billion in present belongings together with $477.95 million in money and money equivalents and $678.29 million in internet accounts receivable.

Present liabilities stood at $779.27 million together with $304.98 million in accounts payable.

To contact the creator, e-mail jov.onsat@rigzone.com

Generated by readers, the feedback included herein don’t replicate the views and opinions of Rigzone. All feedback are topic to editorial evaluation. Off-topic, inappropriate or insulting feedback can be eliminated.