Oil swung between features and losses on the again of the most important weekly enhance since June as consideration turned to the broader outlook for provide because the US and China made progress on commerce.

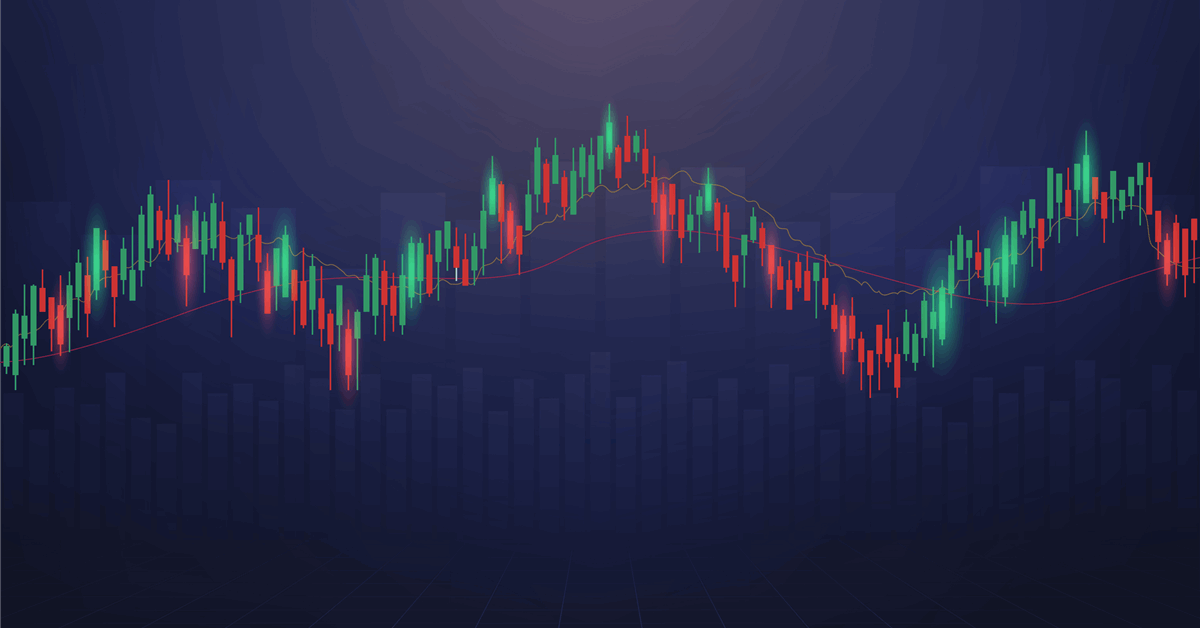

West Texas Intermediate slipped 0.3% to settle simply above $61, extending its decline for a second day. High Chinese language and US negotiators stated they got here to phrases on a spread of factors, setting the desk for President Donald Trump and counterpart Xi Jinping to finalize a deal to ease commerce tensions between the world’s two greatest economies and crude importers.

Nonetheless, oil was little modified Monday after including almost 7% final week when the US sanctioned Russian oil giants Rosneft and Lukoil to squeeze Russia over its ongoing warfare in Ukraine. The transfer added output dangers to a market that is displaying indicators of coming into a surplus. Lukoil introduced in an announcement that it intends to promote its worldwide property as a result of newest sanctions.

“The market is taking a breather right here,” stated Dennis Kissler, senior vice chairman for buying and selling at BOK Monetary. “Whereas US-China negotiations proceed, no actual end result has been agreed as of but…and the sanctions on Russia could halt some shipments although it is extra probably most of that oil will nonetheless discover a dwelling.”

The Trump administration is in search of to make Russia’s commerce more durable, costlier and riskier, however with out forcing a sudden provide shock which may spike international oil costs, officers aware of the matter stated over the weekend.

The measures helped oil rebound from a five-month low final week, however a part of the transfer was probably pushed by excessive market positioning. Merchants had amassed report bearish wagers on the worldwide Brent benchmark in anticipation of oversupply within the subsequent few months. Within the meantime, commodity buying and selling advisers, or CTAs, are set to speed up upward momentum in costs, in response to Daniel Ghali, a commodity strategist at TD Securities.

“We finally anticipate minimal disruptions from the current wave of sanctions, however within the imminent-term quant fund shorts will drive value motion over the approaching classes,” Ghali stated.

Nonetheless, with the OPEC+ alliance persevering with so as to add barrels, and a few members together with Kuwait suggesting there could possibly be additional increments, the issues a couple of glut stay.

The commodity was unfazed after Bloomberg reported the cartel is at the moment anticipated to concentrate on reviving a 3rd month-to-month enhance of 137,000 barrels a day in December as a base case when key members meet this weekend, suggesting market members had largely priced on this chance.

Oil costs are more likely to reasonable on account of ample provide over the approaching days and weeks, the Worldwide Power Company stated Monday. The market will probably be in surplus as output from the Americas helps outpace the expansion in demand this yr, IEA Govt Director Fatih Birol stated.

What Bloomberg strategists say:

“On one hand, there’s proof of giant storage build-ups, significantly at sea. That is drawn promoting stress every time Brent futures check $65. On the identical time, contemporary US sanctions on Russian oil have elicited dip-buying across the $60 mark. The impact has been to strengthen the $60-$65 vary because the market’s ceiling and flooring.

-Nour Al Ali, Macro Markets & Squawk. Click on right here for the complete evaluation.

Oil Costs

- WTI for December supply slid 0.3% to settle at $61.31 in New York.

- Brent for December settlement notched close to 0.5% to settle at $65.62 a barrel.

What do you suppose? We’d love to listen to from you, be a part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all power professionals to Converse Up about our business, share information, join with friends and business insiders and interact in an expert neighborhood that can empower your profession in power.