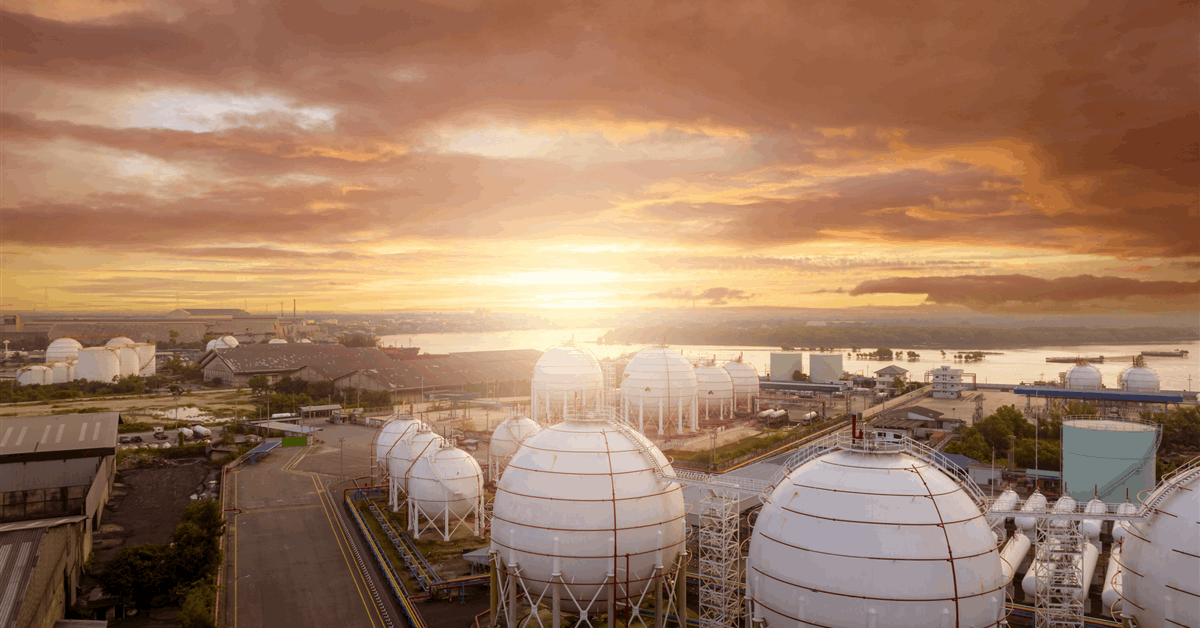

Oil eked out a acquire with Washington planning on shopping for 1 million barrels of crude for the nationwide stockpile, however held close to a five-month low on expectations of a looming international surplus.

West Texas Intermediate traded in a greater than $1 vary earlier than settling close to $58 a barrel. Though the US plan to refill the Strategic Petroleum Reserve supported costs, it wasn’t sufficient to shift sentiment in a market that has declined by greater than 10% since late September. WTI futures are heading in the right direction for a 3rd month-to-month loss.

The quantity of crude on tankers at sea has risen to a document excessive, signaling {that a} long-anticipated surplus might have began to materialize, whereas time spreads are beginning to sign ample provide. The Worldwide Power Company expects world oil inventories to exceed demand by nearly 4 million barrels a day subsequent 12 months as OPEC+ and a few nations exterior the alliance ramp up output, doubtless in a bid to recapture market share.

“We have got provide progress working thrice sooner than demand progress,” Bob McNally, founder and president of Rapidan Power Group, mentioned in an interview on Bloomberg Tv. “Close to-term we have now a glut.”

Commodity buying and selling advisers, in the meantime, might doubtlessly attain a maximum-short place within the subsequent few periods, serving to ship costs decrease, in line with information from Bridgeton Analysis Group. The robotic merchants are presently 91% brief in each Brent and WTI, and will speed up if futures fall by roughly 1%, the agency added.

Merchants are additionally keeping track of relations between the US and China, the world’s prime producer and shopper of oil. US President Donald Trump once more signaled that an anticipated assembly with counterpart Xi Jinping in South Korea subsequent week may not materialize.

The US benchmark crude future’s November expiry on Tuesday additionally contributed to uneven buying and selling.

Oil Costs

- WTI for November supply, which expires on Tuesday, gained 0.5% to settle at $57.82 a barrel in New York.

- The more-active December contract settled at $57.24 a barrel.

- Brent for December settlement edged up 0.5% to settle at $61.32 a barrel.

What do you assume? We’d love to listen to from you, be a part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all power professionals to Communicate Up about our trade, share information, join with friends and trade insiders and interact in knowledgeable group that can empower your profession in power.