Oil edged down barely amid indicators of easing tensions between the US and China, whereas merchants took inventory of mounting proof {that a} long-anticipated surplus is lastly beginning to emerge.

West Texas Intermediate was little modified to settle close to $57 a barrel as buyers rolled over positions forward of the November contract’s expiry this week, including to uneven buying and selling. US President Donald Trump earlier expressed optimism a couple of potential deal between the world’s prime oil customers. Enthusiasm surrounding this improvement was restricted, although, as oil saved on tankers rose to a contemporary excessive, among the many most tangible indicators but that markets are oversupplied.

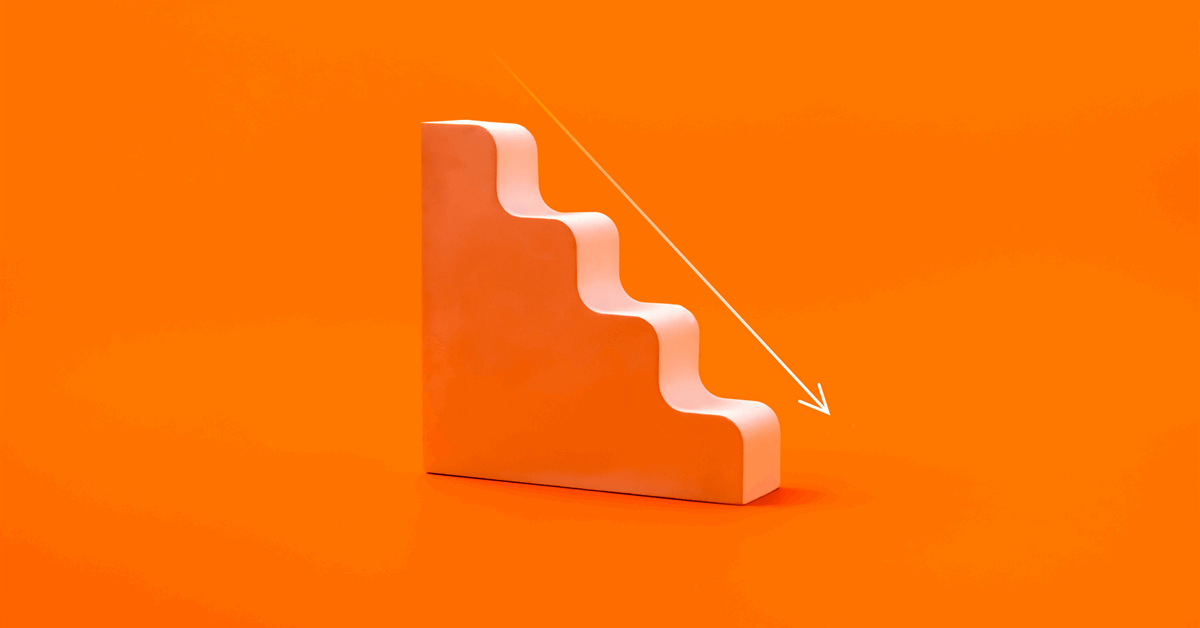

Oil futures have tumbled greater than 20% from their summer season highs because the Group of the Petroleum Exporting international locations and its allies ramp up manufacturing, whereas main forecasters mission a flood of provides persevering with into subsequent yr.

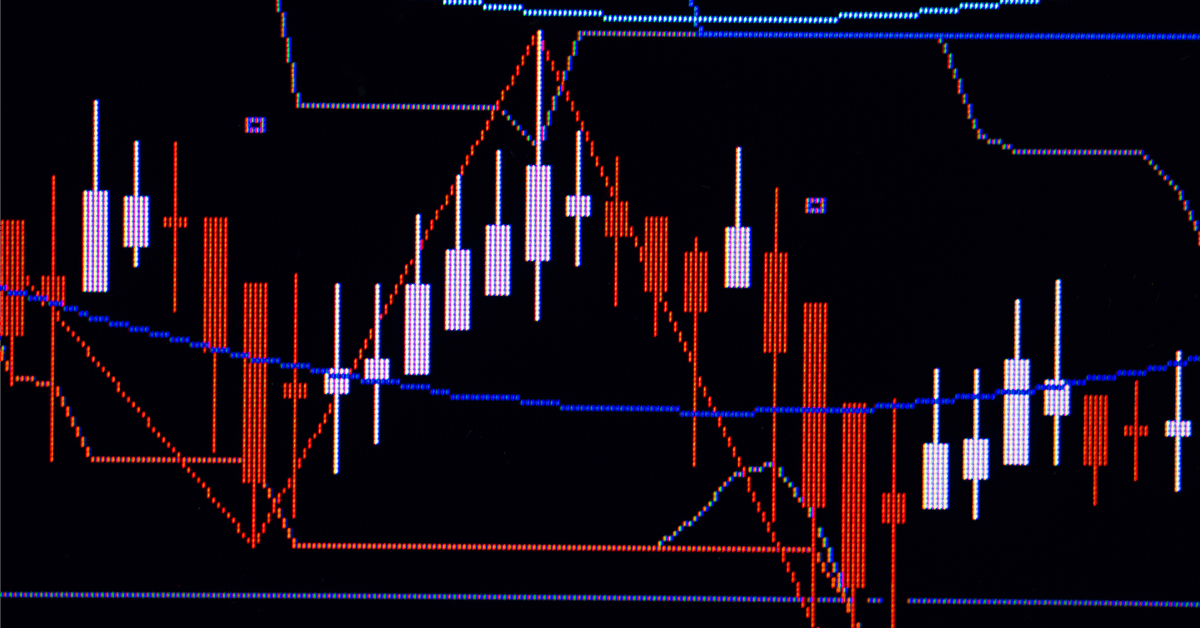

Even so, WTI earlier edged into oversold territory on the nine-day relative power index for the primary time since Might, a doable indication that costs lurched decrease too quick. It additionally suggests a reversal could also be within the playing cards.

“Crude futures proceed to commerce on the defensive amid concepts a looming provide surplus is close to,” mentioned Dennis Kissler, senior vp for buying and selling at BOK Monetary. Worth help for WTI rests at round $56.15, although an in depth under $55 dangers an additional value slide, he added.

Geopolitical forces are additionally at play. Costs have been weighed down by restricted progress towards a de-escalation of the warfare in Ukraine, a situation that would push oil towards $50 a barrel, in accordance with Citigroup Inc. President Donald Trump final week mentioned he would maintain a second assembly with Russia’s Vladimir Putin searching for to finish the battle, although earlier talks have carried out little to stem the hostilities.

In the meantime, China’s economic system slowed for a second straight quarter, undermined by diminished client and firm spending, although Beijing signaled its full-year progress purpose of about 5% continues to be on monitor.

Different key market metrics are softening. The US benchmark’s December-January time unfold for the primary time since Might flipped into contango, a bearish pricing sample that is characterised by nearer-term contracts buying and selling at a reduction to longer-dated ones. The unfold between the 2 nearest December contracts flipped right into a bearish contango construction in October.

Oil Costs

- WTI for November supply, which expires on Tuesday, fell 2 cents to settle at $57.52 a barrel in New York.

- Brent for December settlement slipped 28 cents to settle at $61.01 a barrel.

What do you assume? We’d love to listen to from you, be a part of the dialog on the

Rigzone Vitality Community.

The Rigzone Vitality Community is a brand new social expertise created for you and all power professionals to Communicate Up about our trade, share data, join with friends and trade insiders and interact in an expert neighborhood that may empower your profession in power.