Oil limped to a 3rd week of losses, weighed down by indicators the market is tipping into the excess analysts have been awaiting.

West Texas Intermediate ended the day little modified close to $57 a barrel, down 2.3% this week in its longest dropping streak since March.

Information on oversupply saved piling up this week. The Worldwide Power Company raised its estimate for subsequent yr’s world overhang by about 18%. And a US storage dealer reported a surge in bids for securing tank capability on the nation’s key crude hub in Cushing, Oklahoma, underscoring that merchants are positioning themselves for the glut. Costs for flagship US oil grades have additionally weakened.

Crude merchants are additionally following the on-again, off-again tensions between Washington and Beijing.

President Donald Trump on Friday stated greater tariffs in opposition to China weren’t “sustainable” expressed optimism that an upcoming assembly with Xi may yield an enduring commerce peace after final week threatening a further 100% tariff on Beijing’s items. The shift in sentiment eased some considerations that the continued tit-for-tat between the 2 largest crude shoppers may cripple vitality consumption.

Trump, in the meantime, stated he would maintain a second assembly with Russian counterpart Vladimir Putin “inside two weeks or so” geared toward ending the struggle in Ukraine, a state of affairs that stands to ship costs towards $50 a barrel, in accordance with Citigroup Inc. The US president on Friday shrugged off considerations Putin could also be manipulating him.

“Crude is weighing Trump’s assembly with Putin in opposition to constructing proof of oversupply,” stated Joe DeLaura, world vitality strategist at Rabobank. “With oil markets in contango from the second quarter of subsequent yr onward, the following path is down for crude except demand surprises to the upside, which we view as unlikely.”

Western nations are turning the screws on Russia’s vitality sector in a bid to curb the circulation of petrodollars to the Kremlin and restrict Putin’s capability to finance the struggle. India’s oil refiners stated they count on to scale back — not cease — the acquisition of Russian crude following remarks by Trump that the South Asian nation would halt all shopping for.

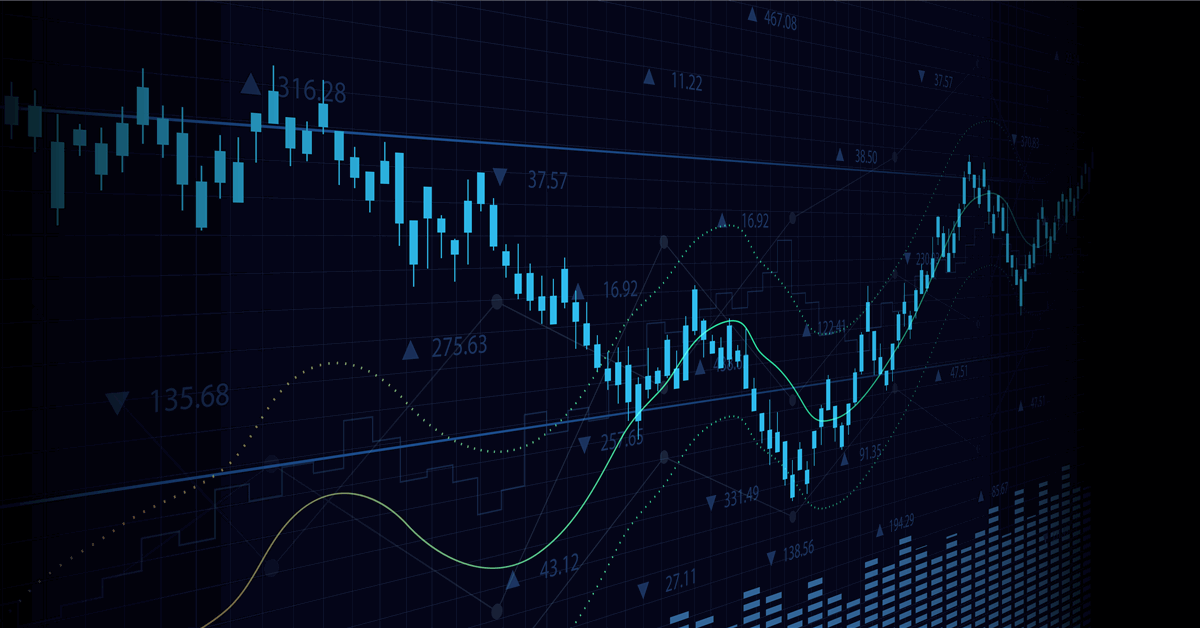

Oil Costs

- WTI for November supply added 8 cents to settle at $57.54 a barrel in New York.

- Brent for December settlement rose 23 cents at settle at $61.29 a barrel.

What do you suppose? We’d love to listen to from you, be part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all vitality professionals to Converse Up about our business, share data, join with friends and business insiders and interact in an expert neighborhood that may empower your profession in vitality.