A BofA International Analysis report despatched to Rigzone by the BofA crew not too long ago famous that BofA sees “a[n] [oil price] ground possible forming at $55 per barrel”.

That report additionally revealed that the corporate is sustaining its Brent forecast of $61 per barrel within the fourth quarter of 2025 and $64 per barrel within the first half of 2026.

The report went on to warn, nevertheless, that “if U.S.-China commerce tensions escalate within the midst of the OPEC+ manufacturing ramp up, Brent might drop under $50 per barrel”.

Within the report, BofA stated market members have been “sick fearful a few crude oil glut for nearly a yr now” and identified that entrance month Brent and WTI crude oil costs have come down by about 50 % from their respective peaks of $128 per barrel and $124 per barrel in 2022.

“In fact, weaker oil costs this yr have rather a lot to do with OPEC+ agreeing to extend quotas throughout the Group of 8 by about 4 million barrels per day over 18 months beginning in April 2025,” the report famous.

“Oil markets have already been on a surplus for a while, though inventories throughout the OECD stay low as a result of most extra barrels have gone into Chinese language strategic storage,” it added.

“Fast strategic oil stockpiling in China and a looming surplus in 1H26 have resulted in an odd time period construction in Brent: tight within the entrance, free within the again,” it continued.

“But, oil costs have come down rapidly in current days as China reimposed some limits on uncommon earth parts (REE), the U.S. threatened China with contemporary tariffs, and Iran threw down the gauntlet by turning on transponders to indicate the world the place its oil goes,” the report went on to state.

BofA famous in its report that the present long-term contango of almost $4 per barrel and near-term oil backwardation construction is an outlier and won’t final.

“In our estimates, solely 5 % of months within the final 20 years have featured a backwardated near-term curve with a contangoed long-term curve,” the report acknowledged.

“Right this moment’s long-term contango of almost $4 per barrel is a major outlier in comparison with ranges of near-term backwardation like these we see now,” it added.

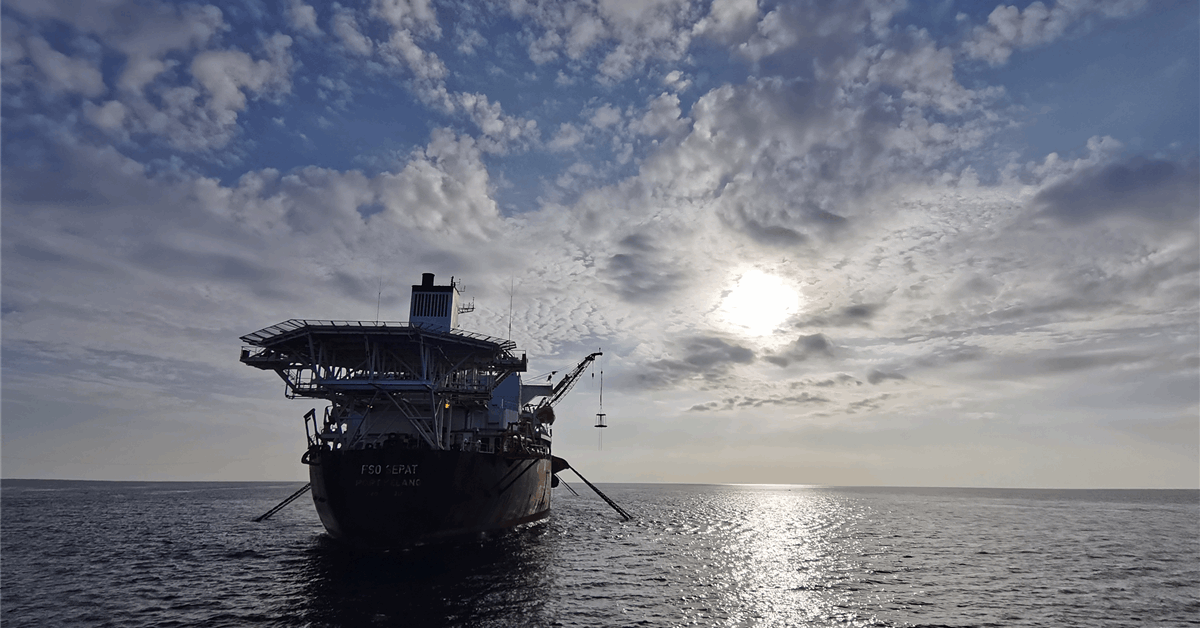

BofA stated within the report that one of many higher corners of the market to search for steering is the intermediate step between manufacturing and business oil inventories.

“Traditionally, transport charges have tended to extend as crude barrels move into the water,” the report highlighted.

“We estimate {that a} rise in transport prices at this time exhibits up in elevated oil-on-water round 4-6 weeks later, and there are some indicators that the going day by day charge for oil vessels is rising,” it added.

“With oil-on-water growing counter seasonally and at a quick charge too, we be aware that onshore inventories additionally have a tendency to construct, though this course of might take round 3 to 4 months,” it stated.

“Nonetheless, macro cyclical circumstances matter for demand and the information exhibits rangebound exercise. So, it doesn’t level to a transparent up or draw back breakout for oil costs,” it identified.

The BofA report acknowledged that, with extra oil on the water, each transport prices and macro cyclical circumstances will possible present an early indication of the place costs are heading.

“However a lot of the excess continues to be increase in China, a state of affairs we anticipate to proceed,” BofA famous within the report.

“Oil balances might look cleaner by 2H26 due to fiscal and financial coverage easing and a comparatively weak USD,” it added.

“Past macro components and the chance that OPEC+ adjustments course on scheduled manufacturing will increase, we consider ample storage capability, comparatively agency demand, and declining U.S. output ought to all come collectively to assist oil costs considerably under the present ranges,” it continued.

“Wanting into 2026, we see U.S. crude oil manufacturing flatlining, whereas demand might enhance if America strikes ahead with commerce offers over the approaching months. In that case, Brent crude is unlikely to break down to $40 per barrel regardless of surplus volumes over the approaching quarters,” the BofA report went on to state.

In a report despatched to Rigzone by the Skandinaviska Enskilda Banken AB (SEB) crew on Tuesday, SEB Chief Commodities Analyst Bjarne Schieldrop stated, “we expect OPEC(+) will trim/reduce manufacturing as wanted into 2026 to forestall an enormous build-up in world oil shares and a crash in costs however for now we’re nonetheless heading decrease – into the $50ies per barrel”.

Rigzone has contacted OPEC for touch upon the BofA and SEB reviews. Rigzone has additionally contacted the White Home, the U.S. Division of Vitality, the State Council of the Folks’s Republic of China and the Worldwide Press Heart of China’s Ministry of Overseas Affairs, and the Iranian Ministry of Overseas Affairs for touch upon the BofA report. On the time of writing, not one of the above have responded to Rigzone.

In a report despatched to Rigzone final Friday by the Macquarie crew, Macquarie strategists, together with Vikas Dwivedi, highlighted that “most market members have very bearish balances for 4Q25 and 1Q26”.

“Nevertheless, value stays range-bound and construction stays backwardated, and crude value will not be but reflecting the big, broadly anticipated surpluses,” the strategists added.

A BMI report despatched to Rigzone by the Fitch Group on the identical day revealed that BMI was forecasting that the Brent crude value will common $68 per barrel in 2025 and $67 per barrel in 2026.

A report despatched to Rigzone by the Normal Chartered crew on October 8 confirmed that Normal Chartered was projecting that the ICE Brent close by future crude oil value will common $61 per barrel this yr and $78 per barrel subsequent yr.

In its newest brief time period vitality outlook (STEO), which was launched on October 7, the U.S. Vitality Data Administration (EIA) projected that the Brent crude spot value will common $68.64 per barrel in 2025 and $52.16 per barrel in 2026.

To contact the creator, e-mail andreas.exarheas@rigzone.com