Monumental Power Corp mentioned Wednesday it has agreed to fund New Zealand Power Corp’s (NZEC) share of workover prices to restart flows at a number of wells within the Waihapa/Ngaere subject within the onshore Taranaki basin.

“These workovers will observe the identical royalty construction as that established for the profitable Copper Moki packages, whereas Monumental will earn a 25 p.c royalty on NZEC’s manufacturing share after full restoration of its capital funding, which shall be repaid from 75 p.c of NZEC’s internet income curiosity”, Vancouver, Canada-based Monumental mentioned in a press launch. Monumental is a shareholder in NZEC.

L&M Power will shoulder the remaining half as NZEC’s equal accomplice within the marketing campaign, Monumental mentioned.

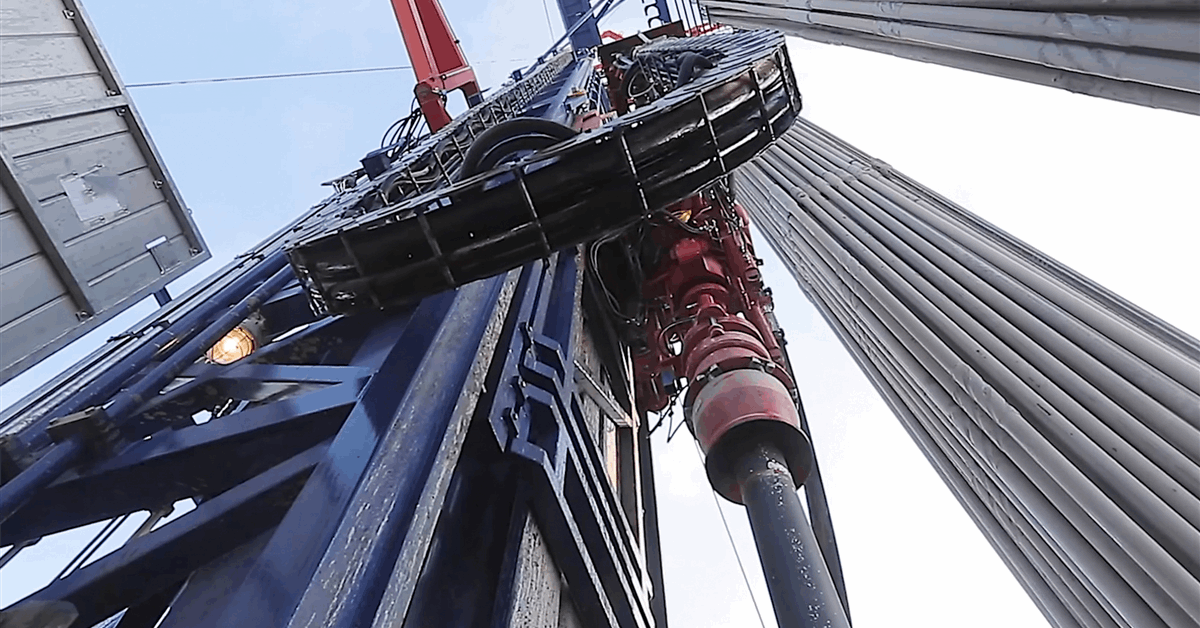

The workovers contain the Waihapa-H1 effectively and the Ngaere 1, 2, and three wells.

“The Waihapa-H1 effectively, drilled within the early 2000s, initially flowed oil at charges of roughly 1,500 barrels per day from fracture porosity inside the Tikorangi horizontal part”, Monumental mentioned. “Manufacturing ceased because of a collapse within the higher part of the wellbore.

“A workover program proposed to return the effectively to manufacturing consists of jetting clean-out and the set up of recent tubing. The effectively website is situated roughly 600 meters from, and simply linked to, the Waihapa manufacturing facility.

“The Ngaere 1, 2, and three wells traditionally produced oil from the Tikorangi Formation. Nevertheless, a assessment of electrical logs and drilling knowledge has recognized a number of shallower, hydrocarbon-charged sand intervals in every effectively that current alternatives for added oil and gasoline manufacturing. A subject redevelopment program has been designed to entry and produce these bypassed pay zones.

“The metal casing in every effectively shall be perforated on the goal intervals, adopted by manufacturing testing. All three wells are linked by way of current pipelines to the Waihapa manufacturing and export services, permitting for instant oil and gasoline gross sales upon profitable completion.

“Within the occasion of success, anticipated circulate charges per effectively are anticipated to vary from the tens to low tons of of barrels of oil per day”.

Monumental vp for company growth and director Max Sali mentioned, “This participation represents the continued development of Monumental’s technique to generate non-dilutive, cash-flow-generating alternatives by means of partnerships in confirmed manufacturing property”.

In late July Monumental restarted manufacturing on the Copper Moki-1 effectively, marking the completion of its workover marketing campaign in Taranaki’s Copper Moki subject with the sooner reactivation of Copper Moki-2, in accordance with bulletins by the corporate.

It mentioned in an replace August 19, “Each Copper Moki-1 and Copper Moki-2 have been onstream for nearly a month delivering a mixed manufacturing fee of roughly 125 barrels of oil per day. These charges proceed to pattern upward as pump speeds are step by step elevated to optimize circulate whereas stopping sand from getting into the borehole”.

“Along with oil manufacturing, each wells are actually exporting related gasoline to the neighboring Waihapa Manufacturing Station for processing and sale”, Monumental added.

Copper Moki began manufacturing 2011. Flows halted 2022, in accordance with knowledge from New Zealand’s Enterprise, Innovation and Employment Ministry.

Monumental famous within the replace, “On the time of the unique drill program at Copper Moki, New Zealand confronted a gasoline surplus, and the sphere remained remoted from the gasoline community. In the present day, the sphere has been totally built-in into the gasoline infrastructure, presenting a significant income alternative that was beforehand unavailable”.

“CM-1 and CM-2 have been initially shut-in because of mechanical points over time, slightly than any reservoir-related issues. The wells required solely normal upkeep, and tools upgrades to renew manufacturing”, Monumental added.

Final 12 months Monumental agreed to fund the workovers in NZEC’s Copper Moki. Monumental is entitled to 75 p.c of income, internet of manufacturing prices, till its funding is recovered. Afterward, it’s going to obtain a 25 p.c internet income curiosity or royalty within the allow, in accordance with NZEC’s announcement of the deal October 28, 2024.

To contact the writer, e-mail jov.onsat@rigzone.com