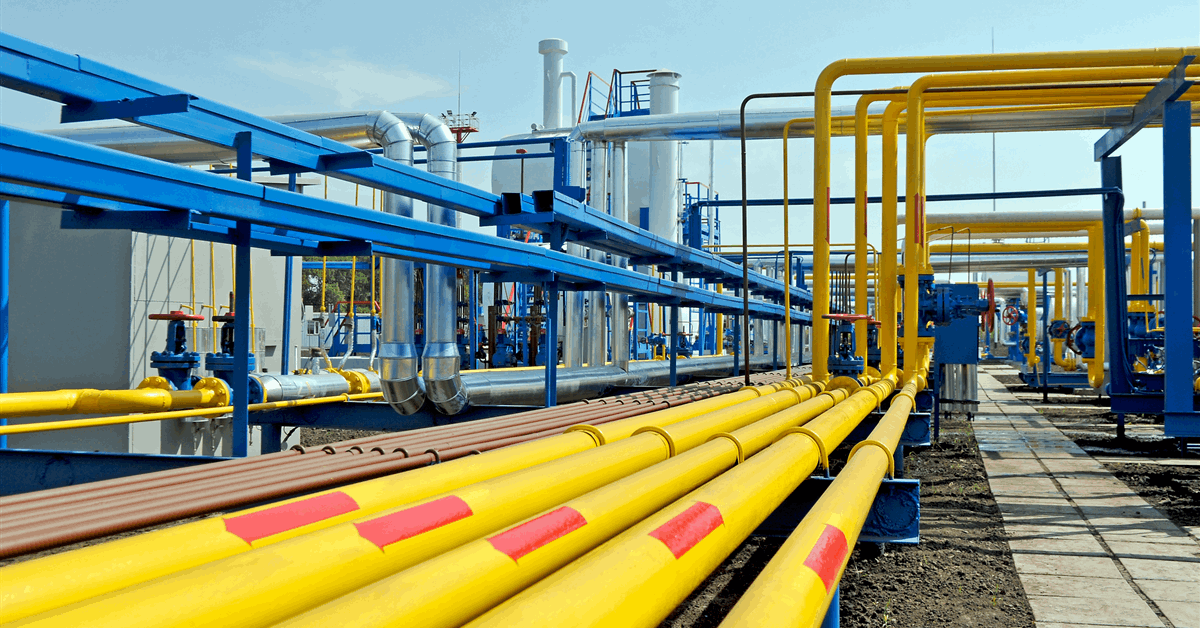

Naftogaz Group over the past week introduced loans of EUR 300 million ($347.25 million) from the European Funding Financial institution (EIB) and UAH 3 billion ($71.97 million) from Ukraine’s state-owned Oschadbank to purchase pure fuel for Ukraine.

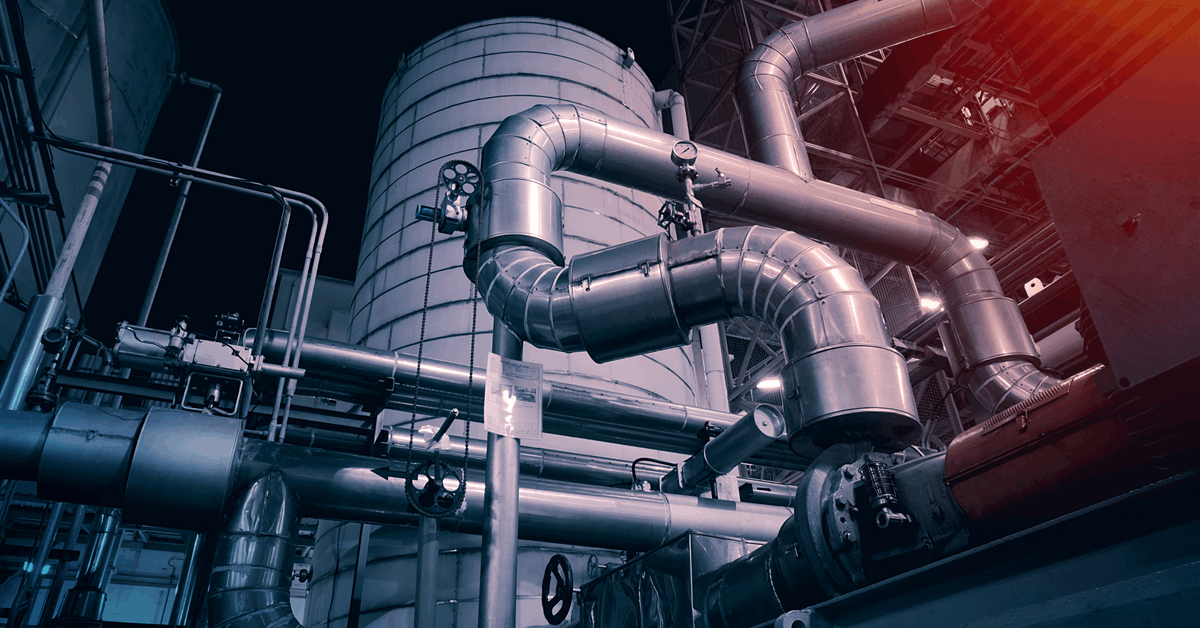

The EIB mortgage is a part of the European Union financial institution’s Ukraine Power Rescue Plan, unveiled October 2024 with as much as EUR 600 million in pressing and medium-term power financing.

“This new financing [EUR 300 million] from the EIB will assist reinforce Ukraine’s power safety throughout the winter, offering very important assist to communities and companies”, EIB president Nadia Calviño stated in an announcement from the financial institution October 1.

“This mortgage combines fast disaster response with a long-term view. It helps the nation’s shift to cleaner, extra sustainable power – a cornerstone of the nation’s restoration and EU integration”, stated EIB vp Teresa Czerwinska, who oversees the financial institution’s Ukraine operations.

Underneath the settlement, Ukraine’s state-owned built-in oil and fuel firm Naftogaz will reinvest an equal quantity in renewable power and different decarbonization tasks. In one other financing introduced June 2024, the EIB dedicated EUR 400,000 for technical assist to assist Naftogaz craft its decarbonization technique.

“EUR 300 million from the EIB is substantial and sensible assist that can assist us assure the nation’s power resilience forward of the winter”, Naftogaz chief govt Sergii Koretskyi stated in an announcement from the corporate.

Ukraine Prime Minister Yuliia Svyrydenko was quoted by Naftogaz as saying, “Because of this financing, Ukraine will be capable of safe fuel reserves and guarantee a secure provide of warmth this winter for a whole bunch of hundreds of households, even amid ongoing enemy assaults”.

The European Fee agreed to ensure the mortgage by way of the Ukraine Funding Framework (UIF), the EIB stated.

The UIF is a part of the EU’s Ukraine Facility, a platform to mobilize as much as EUR 50 billion – EUR 33 billion in loans and EUR 17 billion in grants – from 2024 to 2027, based on the European Council, which gave the ultimate greenlight for the ability February 2024. The UIF goals to mobilize EUR 40 billion of investments for restoration, reconstruction and modernization, based on its implementer the European Fee.

The EIB mortgage introduced final week was signed in Kyiv as a part of European Commissioner for Enlargement Marta Kos’ go to, the mortgage events stated.

On Thursday Naftogaz introduced an Oschadbank mortgage of UAH 3 billion for fuel importation.

Earlier the European Financial institution for Reconstruction and Growth (EBRD) dedicated a two-year revolving mortgage of EUR 500 million, 90 % of which is assured by the European Fee by way of the UIF, to assist Naftogaz procure fuel.

The London-based EBRD has now offered 4 funding packages for Naftogaz since Russia invaded Ukraine in 2022, the EBRD stated in an announcement August 12. The newest “brings the full financial institution financing to Naftogaz to EUR 1.6 billion, together with EUR 1.27 billion in EBRD loans and EUR 330 million (NOK 3.63 billion) in grants offered by Norway by way of EBRD”, the financial institution stated.

“The transaction can even assist the reform targets of earlier EBRD engagement, with Naftogaz working in direction of the combination of the Ukrainian fuel market with that of the EU”.

Ukraine had 88.13 terawatt hours of saved fuel, a filling degree of 27.49 %, as of Wednesday, based on the newest replace on the web monitoring dashboard of the European Community of Transmission System Operators for Gasoline.

To contact the writer, e mail jov.onsat@rigzone.com

Generated by readers, the feedback included herein don’t mirror the views and opinions of Rigzone. All feedback are topic to editorial evaluation. Off-topic, inappropriate or insulting feedback might be eliminated.