Civitas Assets Inc., an oil and gasoline explorer that has been weighing a sale, is contemplating a merger with Permian Basin rival SM Vitality Co., based on individuals accustomed to the matter.

Civitas has been discussing a take care of SM that wouldn’t embrace a premium and can be structured as a merger of equals because it explores strategic choices, stated the individuals, who requested to not be recognized as a result of the small print aren’t public. No deal has been finalized and different events are circling Civitas, the individuals added.

Representatives for Civitas and SM Vitality declined to remark.

If a transaction is consummated, the mixed firm can be value not less than $14 billion, together with debt, making it one of many yr’s largest oil and gasoline offers, based on information compiled by Bloomberg.

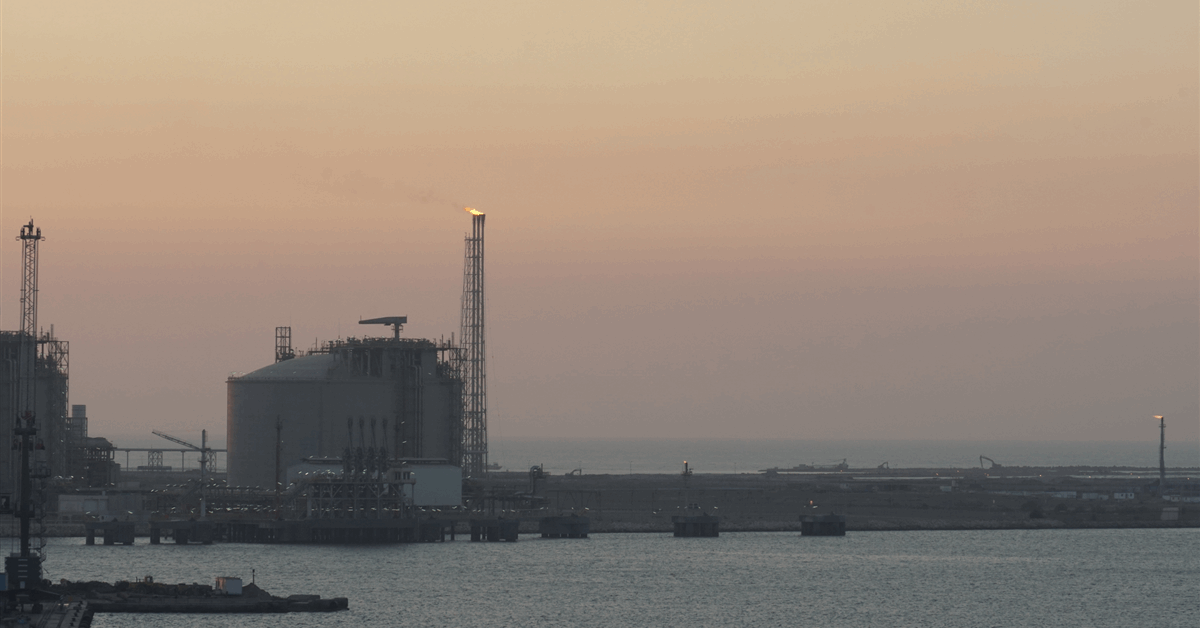

The Permian Basin of West Texas and New Mexico — the biggest and best US oil subject — has seen a blitz of merger exercise lately as small gamers pair as much as acquire scale and main operators search for a toehold. In August, Crescent Vitality Co. agreed to purchase Permian Basin rival Important Vitality Inc. for $3.1 billion.

This deal would deliver collectively two of the area’s midsize, public gamers. Civitas, with a market worth of about $3.2 billion, produces oil throughout about 140,000 internet acres all through the basin, in accordance to an investor presentation in August. SM has a market worth of about $2.9 billion and about 109,000 acres in a well-developed swathe of the Permian often known as the Midland Basin.

SM has an enterprise worth of about $5.5 billion whereas Civitas is value about $8.5 billion, together with debt. EOG Assets Inc.’s $5.6 billion takeover of Encino Acquisition Companions is the biggest deal introduced this yr within the US oil and gasoline exploration sector, based on information compiled by Bloomberg.

The businesses’ operations lengthen past the Permian. SM has acreage within the Eagle Ford shale of South Texas and Utah’s Uinta Basin whereas Civitas has a place in Colorado’s Denver-Julesburg Basin.

Civitas has been promoting belongings to pay down debt, together with a package deal of lower-margin belongings within the Denver-Jules. In August, Interim Chief Government Officer Wouter van Kempen took the helm of the corporate from Chris Doyle.

Bloomberg Information reported final month that Denver-based Civitas was weighing choices together with a sale.

Generated by readers, the feedback included herein don’t replicate the views and opinions of Rigzone. All feedback are topic to editorial assessment. Off-topic, inappropriate or insulting feedback can be eliminated.