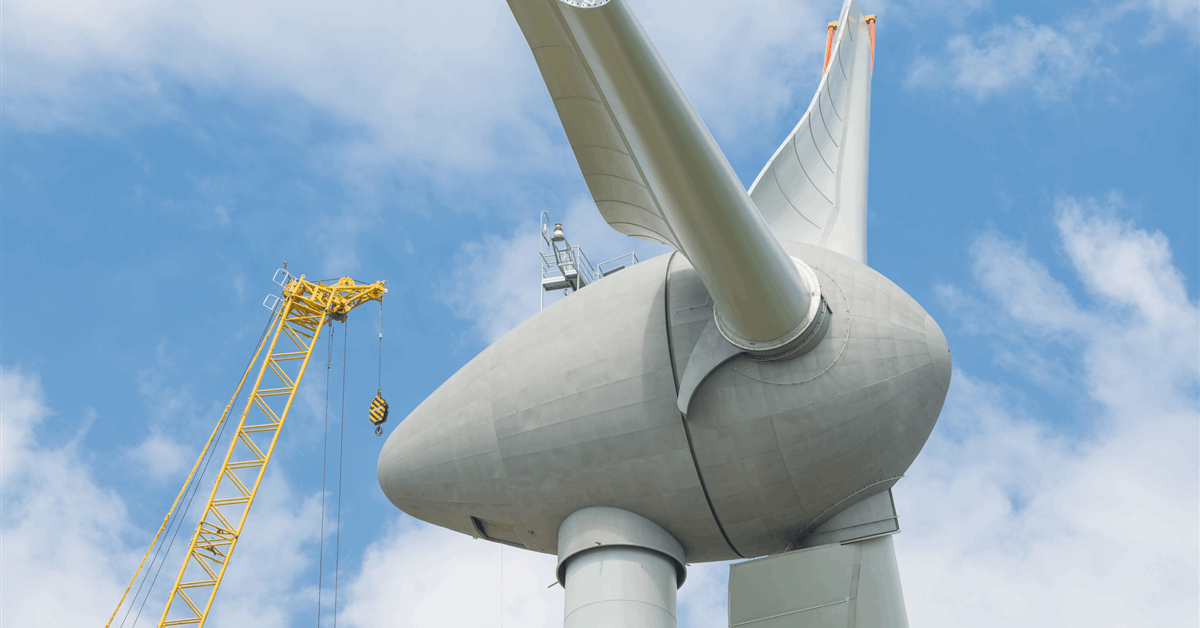

Orsted A/S raised 60 billion Danish kroner ($9.4 billion) by way of a rights providing that is essential for the corporate to deal with the downturn dealing with the wind energy trade.

The fund elevate, the largest for a European power firm in over a decade, will permit the state-backed Danish agency to shore up its steadiness sheet after the Trump administration’s strikes towards offshore wind upended Orsted’s enterprise mannequin.

Buyers took up 99.3 % of the greater than 900 million shares provided within the totally underwritten capital enhance, in response to a press release late Monday. The corporate mentioned demand for the shares was “terribly excessive.”

Orsted had the backing of its largest shareholder – the Danish authorities, which owns a 50.1 % stake – to hold out the deal. Norwegian power firm Equinor ASA, the second-biggest shareholder, additionally mentioned that it could preserve its 10 % stake.

The corporate’s shares plunged by roughly a 3rd when it introduced the capital elevate in August. Lower than two weeks later, the inventory hit one other contemporary low after the Trump administration ordered it to halt work on the Revolution Wind farm it’s constructing off the coast of Rhode Island.

However Orsted sued to dam the order and shortly gained an injunction permitting it to renew work on the undertaking. Since then, shares within the firm have rallied, closing at 122.35 Danish kroner Monday afternoon, up some 27 % from the low it hit after the cease work order first got here into impact.

Whereas the US was as soon as seen as a significant progress alternative for the corporate, that wager has gone from unhealthy to worse in recent times. Hovering prices and provide chain points led Orsted to cancel two main American tasks in recent times. Later, the Trump administration halted work on one other undertaking owned by Equinor.

Whereas that wind farm was additionally in the end capable of proceed, the developments have left traders cautious of the sector, making it not possible for Orsted to promote a stake within the Dawn Wind undertaking it is constructing off the coast of New York. That left a gap within the firm’s funds, pushing it to show to its traders for money as an alternative.

With the brand new funds, Orsted says will probably be in a powerful place to ship a collection of tasks at present underway within the US and Europe by the tip of 2027. The corporate goals to complete two main tasks within the US within the coming years after which refocus on the extra established and steady European offshore wind market.

A rights problem is a type of capital enhance that offers shareholders the choice to purchase inventory at a reduced worth in proportion to their present holding. Shareholders can both train their rights to keep away from being diluted or promote them to different traders.

What do you suppose? We’d love to listen to from you, be part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all power professionals to Converse Up about our trade, share information, join with friends and trade insiders and interact in an expert group that may empower your profession in power.