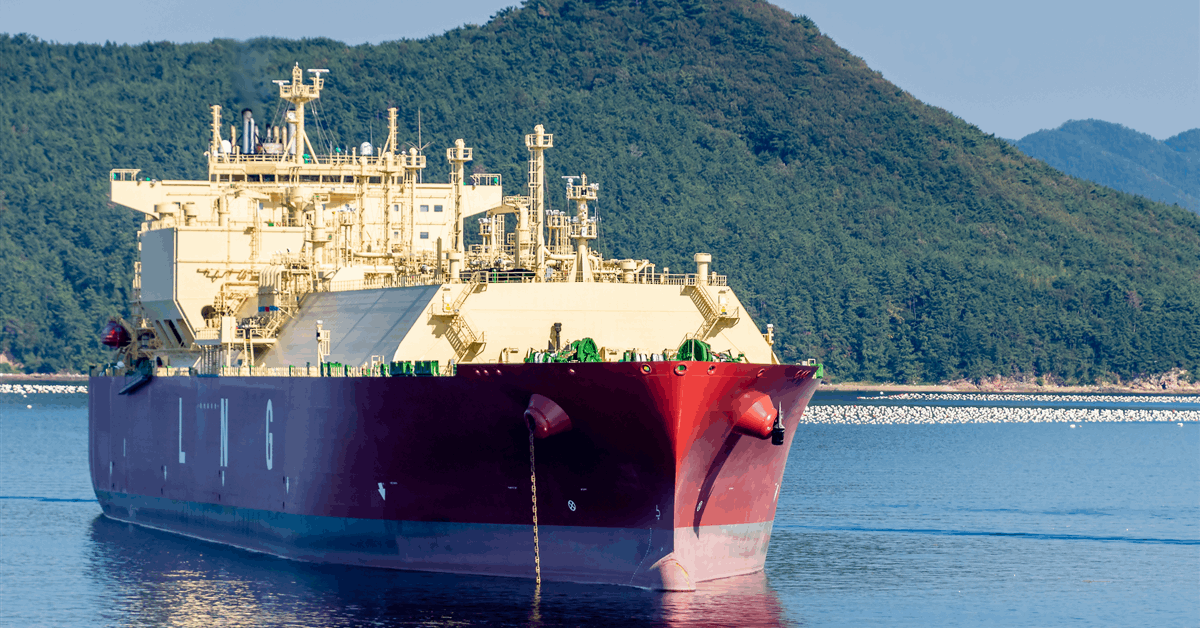

EIG World Power Companions’ MidOcean Power mentioned it has entered into definitive agreements to spend money on Petroliam Nasional Bhd’s (Petronas) Canadian companies, together with by buying a stake within the just lately fired up LNG Canada.

“The transaction features a 20 % curiosity within the North Montney Upstream Joint Enterprise (NMJV), which holds Petronas’ upstream funding in Canada, and a 20 % curiosity within the North Montney LNG Restricted Partnership (NMLLP), which holds Petronas’ 25 % collaborating curiosity within the LNG Canada challenge”, MidOcean mentioned in a press release on its web site.

With a capability of 14 million metric tons each year (MMtpa) from two trains, LNG Canada targets the Asian market. The LNG Canada three way partnership introduced June 30 the Kitimat, British Columbia facility had dispatched its first cargo, introducing Canada as an LNG-exporting nation.

The LNG Canada three way partnership mentioned on the time it was finding out the potential to develop with two extra trains, which might double the capability.

Shell PLC is the most important proprietor in LNG Canada with 40 % by Shell Canada Power. Malaysia’s state-owned Petronas holds 25 % by NMLLP. Japan’s Mitsubishi Corp and China’s state-backed PetroChina Co Ltd every have 15 % by Diamond LNG Canada Partnership and PetroChina Kitimat LNG Partnership respectively. Korea Gasoline Corp owns 5 % by Kogas Canada LNG Partnership.

In the meantime the NMJV holds over 800,000 gross acres of mineral rights with 53 trillion cubic toes of reserves and contingent sources, MidOcean famous.

“Following completion of the transaction, MidOcean will maintain a place throughout the built-in worth chain, spanning upstream useful resource improvement within the North Montney and downstream liquefaction and export by LNG Canada by way of its participation in NMLLP”, MidOcean mentioned. “Via this partnership with Petronas, MidOcean could have the power to safe an related LNG Quantity of 0.7 MTPA with potential to develop by LNG Canada Section II”.

MidOcean chair and EIG chief govt R. Blair Thomas mentioned, “Our participation additional strengthens MidOcean’s portfolio, secures significant LNG offtake and reinforces our dedication to constructing a diversified and resilient LNG enterprise for the a long time forward”.

MidOcean expects the transactions with Petronas to be accomplished within the fourth quarter.

Petronas mentioned individually it “stays dedicated to its investments in Canada and this fairness participation won’t have an effect on Petronas’ current management over NMJV and NMLLP”.

The partnership with Petronas represents the second LNG funding introduced by MidOcean this 12 months. Earlier it signed a preliminary deal to shoulder 30 % of development prices and be entitled to 30 % of manufacturing at Power Switch LP’s deliberate Lake Charles LNG in Louisiana.

“This settlement has the potential to rework MidOcean’s portfolio, offering a fabric quantity of advantaged Atlantic Basin provide”, MidOcean chief govt De la Rey Venter mentioned in a press release August 9. “This enhances our present belongings, that are allotted within the Asia-Pacific Basin.

“Geographical range is a key enabler for worth supply from an LNG portfolio. MidOcean considers Lake Charles LNG to be one of the advantaged US LNG initiatives beneath improvement”.

MidOcean mentioned its share of Lake Charles LNG manufacturing can be round 5 MMtpa.

“The HOA [heads of agreement] additionally offers that MidOcean Power could have the choice to rearrange for fuel provide for its share of LNG manufacturing and that MidOcean will decide to long-term fuel transportation on Power Switch pipelines”, MidOcean mentioned.

To contact the creator, electronic mail jov.onsat@rigzone.com

What do you assume? We’d love to listen to from you, be a part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all power professionals to Communicate Up about our trade, share data, join with friends and trade insiders and interact in an expert group that can empower your profession in power.