Oaktree Capital Administration LP has entered a preliminary settlement to promote round 14.1 million shares it holds in TORM PLC to Hafnia Ltd for $311.43 million, or $22 per share.

The quantity corresponds to about 14.45 p.c of TORM’s issued share capital, Hafnia, a part of Singapore-based BW Group, stated in an announcement on its web site.

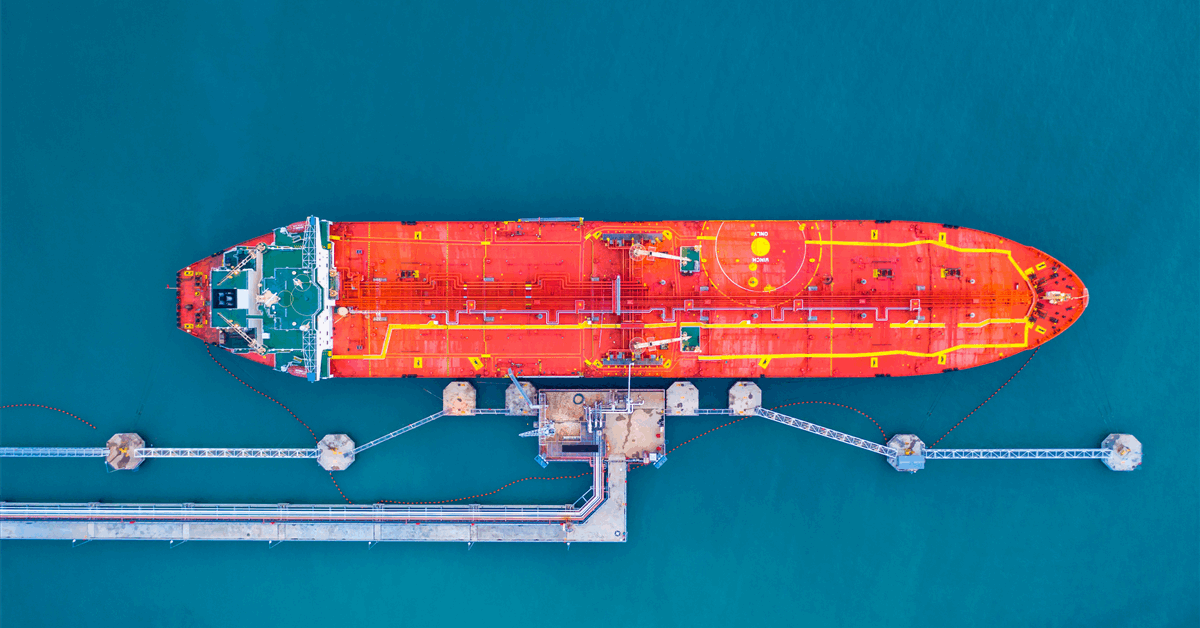

Hafnia and TORM personal tanker fleets that ship oil, oil merchandise and chemical substances. Hafnia says it owns about 200 vessels. TORM says it owns over 80 vessels. Oaktree in the meantime is a Los Angeles-based investor.

Hafnia trades on the Oslo Inventory Alternate and the New York Inventory Alternate whereas TORM is listed on the Copenhagen Inventory Alternate and Nasdaq in New York.

“Hafnia seems ahead to creating this sizeable funding in TORM with the idea that TORM is a well-managed firm with a high-quality fleet”, Hafnia stated.

“With respect to Hafnia’s long-term place as a shareholder in TORM, Hafnia believes typically that consolidation is optimistic for the tanker business however has made no selections on this regard”.

TORM stated individually, “TORM has not been concerned within the transaction and has no additional data”.

Market Outlook

Earlier Hafnia reported $346.56 million in working income for the second quarter, down from $563.1 million for 2Q 2024. Working revenue was $83.09 million, down from $262.14 million for 2Q 2024. Revenue earlier than revenue tax landed at $78 million, down from $260.77 million. Web revenue was $75.34 million, or $0.15 per share – down from $259.2 million.

“Robust product demand, low international inventories, enhancing refining margins and excessive export volumes have regularly supported the second quarter product tanker market and have continued into the third quarter”, Hafnia stated.

“Refined product volumes on water have steadily elevated, and each day loadings of refined merchandise have grown much more within the third quarter, signaling additional power available in the market as we method the height incomes season.

“Underlying demand stays robust, with the IEA forecasting a 0.7 million barrel per day improve in international oil demand in 2025 to 103.7 million barrels per day. OPEC+ plans to spice up manufacturing by 0.5 million barrels per day in September, supporting near-term crude tanker charges and benefiting the product tanker market by greater refinery throughput and exports.

“International product inventories have fallen under historic averages, with continued drawdowns in each Europe and the US. The continued closure of refineries in these areas is anticipated to additional tighten diesel and jet gasoline provide, with alternative barrels seemingly provided from the Center East Gulf, including to product tonne-miles. Refining margins are trending greater, with low refinery upkeep exercise anticipated within the third quarter; these indicators level towards sustained robust oil demand.

“The outlook for the product tanker provide stays optimistic, with restricted newbuild exercise deliberate for 2025. As of August 2025, the product tanker orderbook-to-fleet ratio is about 20 p.c, however vessel scrapping has began, supported by an getting older fleet, as many vessels constructed within the early 2000s are actually reaching scrapping age.

“Moreover, vessels constructed within the latter a part of the 2000s are nearing the top of their main buying and selling life. Moreover, the capability from newbuild deliveries has been absorbed by a lot of LR2s and LR1s getting into the soiled commerce.

“The current EU sanction package deal on Russia has additional tightened the tanker provide successfully, by probably pushing extra vessels into the shadow fleet. By Q3 2025, a complete of roughly 800 tankers have been sanctioned.

“The ban on merchandise refined from Russian crude oil would additionally contribute to market inefficiencies, develop commerce routes, and improve tonne-miles.

“Looking forward to the remainder of 2025, we imagine the product market is well-positioned for a robust winter season.

“Nevertheless, a number of key elements may affect market dynamics, equivalent to commerce coverage developments, adjustments in oil commerce routes, sanctions, and ongoing geopolitical tensions”.

To contact the creator, e mail jov.onsat@rigzone.com