Oil sank because the outlook for the world’s largest financial system darkened after a barrage of poor US information and tariff bulletins, weighing on the prospects for vitality demand progress.

West Texas Intermediate crude fell 2.8% to settle close to $67 a barrel on Friday, the most important plunge in a single day since June 24. Costs additionally got here beneath strain as traders extensively anticipate that OPEC and its allies will determine so as to add extra provides to the market throughout an upcoming weekend assembly.

US jobs progress cooled sharply over the previous three months, whereas manufacturing facility exercise contracted in July on the quickest clip in 9 months, in an indication the financial system is shifting right into a decrease gear amid widespread uncertainty. The swath of bearish information elevated investor issues that the affect of US President Donald Trump’s ever-changing tariff charges — which had to this point been muted — has lastly begun to weigh on financial progress.

The weaker information come as Trump finalized plans for tariffs on a number of international locations, together with a better charge on neighbor Canada, although oil is exempt.

“Tariffs at the moment are formally part of each day life. With the catalyst within the rearview, focus should shift to the fallout,” stated Daniel Ghali, a commodity strategist at TD Securities.

Oil merchants had been compelled to the sidelines in current weeks as quite a few wild playing cards surrounding US commerce coverage and OPEC+ manufacturing confounded supply-and-demand outlooks. The unpredictable atmosphere, which initially triggered wild value swings earlier within the yr, has dampened risk-on sentiment and sapped volatility from the market.

The potential onset of an financial slowdown threatens to coincide with a interval for oversupply extensively anticipated for later this yr. Second-quarter earnings for oil business giants blew out expectations, with document oil manufacturing blunting the affect of decrease crude costs. Exxon Mobil Corp. pumped essentially the most oil for this time of yr in 1 / 4 century, and expressed little intention of slowing down US shale output. In the meantime, Chevron Corp. is anticipated to carry output to an all-time excessive of just about 4 million barrels of oil equal a day later this yr.

Fueling additional bearish sentiment, merchants count on OPEC+ to agree on one other 548,000 barrels-a-day increase. The cartel is scheduled to fulfill this weekend.

“With these dynamics, we most likely see some value strain within the second half of the yr,” Chevron Chief Monetary Officer Eimear Bonner stated in an interview. “We’re positioned for all value environments so if we see the softening, if it does the truth is play out, we’re in a great place.”

Nonetheless, there are bullish elements at play. Costs eased off of intraday lows on Friday after Trump stated in a social-media put up that he deployed two nuclear submarines in response to “extremely provocative” statements from former Russian President Dmitry Medvedev.

“Merchants seem like taking a wait-and-see strategy, as there’s nonetheless time earlier than the negotiation deadline and that is extra of a deterrent motion,” stated Rebecca Babin, a senior vitality dealer at CIBC Non-public Wealth Group.

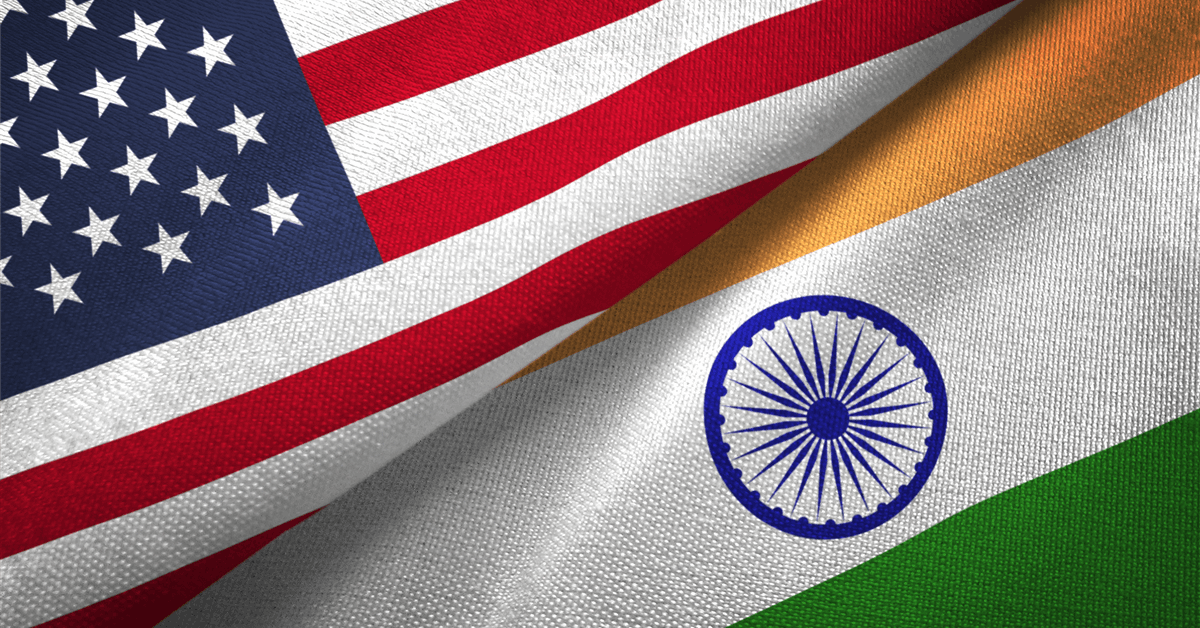

Trump’s determination to deploy the submarines is according to his hardening stance towards Russia over current weeks. His risk to impose tariffs on nations shopping for barrels from Moscow had helped propel oil costs to the best in a month earlier this week. The US President singled out India for getting Russian crude, a transfer that triggered the nation’s state-run refiners to give you plans to purchase alternate options, a directive amounting to situation planning, in response to an individual aware of the matter.

On Friday, one Indian refiner snapped up massive volumes of provides from the US and UAE.

Oil Costs

- West Texas Intermediate for September supply fell 2.8% to $67.33 a barrel.

- Brent for October settlement sank 2.8% to $69.67 a barrel.

What do you assume? We’d love to listen to from you, be part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all vitality professionals to Communicate Up about our business, share data, join with friends and business insiders and interact in an expert neighborhood that can empower your profession in vitality.