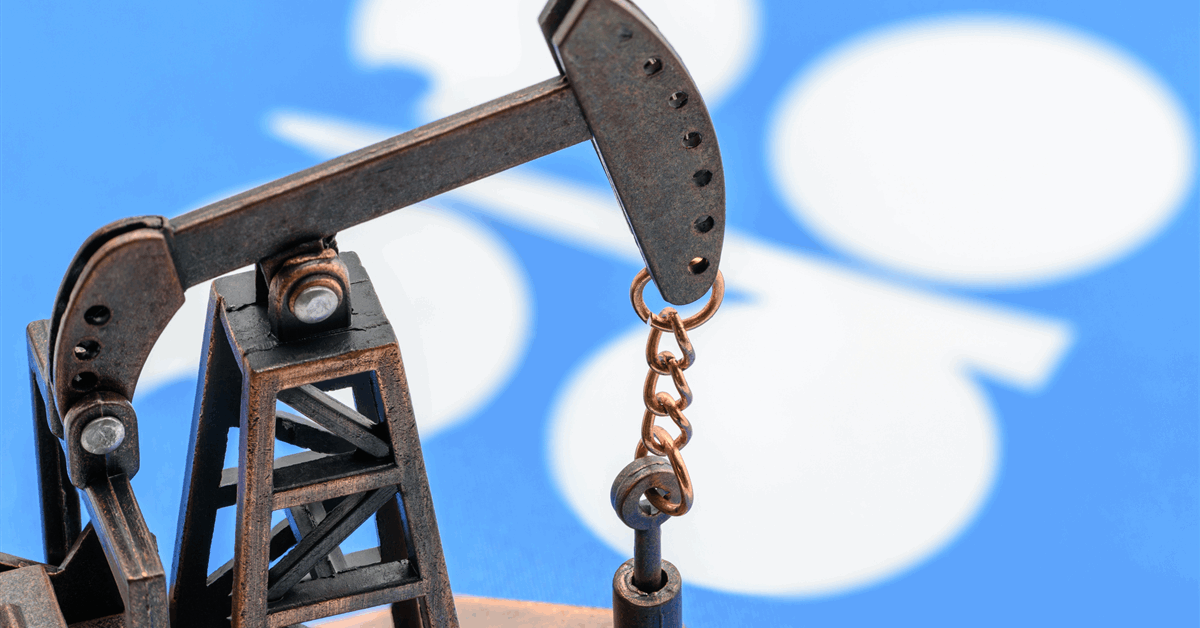

The monetary sting of OPEC+’s shock transfer to open the oil faucets seems to be fading — in the meanwhile.

When Saudi Arabia and its companions agreed 4 months in the past to quickly revive crude manufacturing, the fallout appeared catastrophic: costs crashed to a four-year low, leaving producers with widening funds deficits as state revenues dwindled.

However the ensuing months, which noticed the Group of the Petroleum Exporting International locations and its companions announce additional provide will increase, have introduced some solace.

As benchmark Brent recovers to $70 a barrel and the international locations’ manufacturing targets rise, the nominal worth of output from 4 of OPEC’s key Center East members has climbed to the very best since February. This month it jumped to nearly $1.4 billion per day, in accordance with calculations utilizing knowledge from Rystad Power A/S.

The primary uncertainty, nonetheless, is whether or not this tentative rebound will endure.

Oil forecasters at Goldman Sachs Group Inc. and JPMorgan Chase & Co. extensively anticipate a value hunch later this yr as additional barrels from OPEC+ swell the excess created by faltering Chinese language demand and brimming US provide. That would slash OPEC+ revenues once more, and even strain the coalition to roll again the newest output hikes.

Eight key OPEC+ nations will resolve this weekend on one other bumper manufacturing hike for September, which might full the restart of a 2.2 million-barrel provide tranche a yr forward of schedule.

The alliance remains to be raking in much less money than earlier than it loosened the spigot, and will face a deeper hunch within the months forward. However for now Riyadh can take comfort that the hit from pushing by means of such a daring technique wasn’t a lot worse.

Generated by readers, the feedback included herein don’t replicate the views and opinions of Rigzone. All feedback are topic to editorial evaluate. Off-topic, inappropriate or insulting feedback will likely be eliminated.