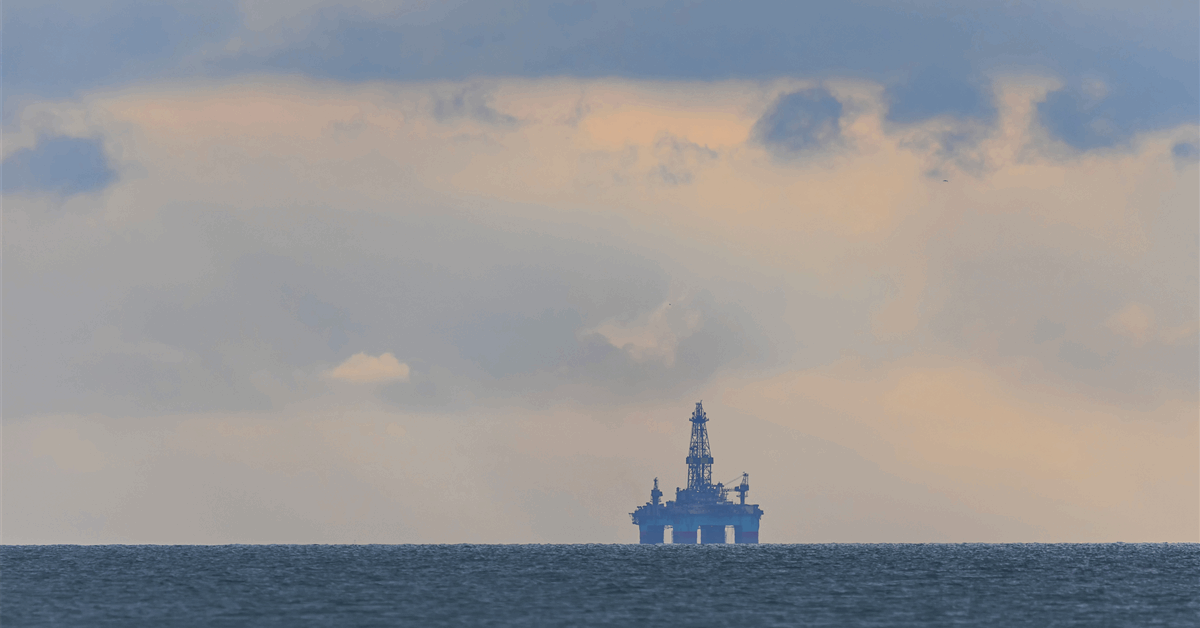

Oil rose amid indicators of tighter provides within the close to time period and on stronger demand indicators within the US.

West Texas Intermediate crude rose 1.7% to settle above $67 a barrel, snapping a three-day shedding streak. Fairness markets superior — sometimes a bullish indicator for commodities — after better-than-expected US financial information allayed some fears of oil demand deterioration.

Costs additionally discovered help from indications of a tighter near-term bodily crude market on Thursday. US crude inventories slid final week and Iraq has misplaced about 200,000 barrels a day of oil manufacturing because of drone assaults on a number of fields in Kurdistan. Chevron Corp. stated it was on the cusp of reaching a manufacturing plateau within the largest US oil area.

“Whereas inventories globally have constructed very considerably, shares within the pricing centres – particularly within the US – are nonetheless fairly low,” Daan Struyven, head of oil analysis at Goldman Sachs, stated on Bloomberg Tv. Market focus has shifted to “draw back dangers to provide,” he stated.

Limiting the rally, Iraq authorized a plan for its semi-autonomous Kurdish area to renew oil exports which have been halted since March 2023. The Kurdistan Regional Authorities will provide Iraq’s state oil marketer SOMO at the least 230,000 barrels a day for export, the federal authorities stated.

Provide issues had been additionally mirrored within the ahead curve for crude. It’s at present buying and selling in backwardation, the place a premium is paid for sooner supply over longer-dated contracts.

Within the US, distillate stockpiles stay on the lowest seasonal stage since 1996 even after final week’s improve.

Oil Costs

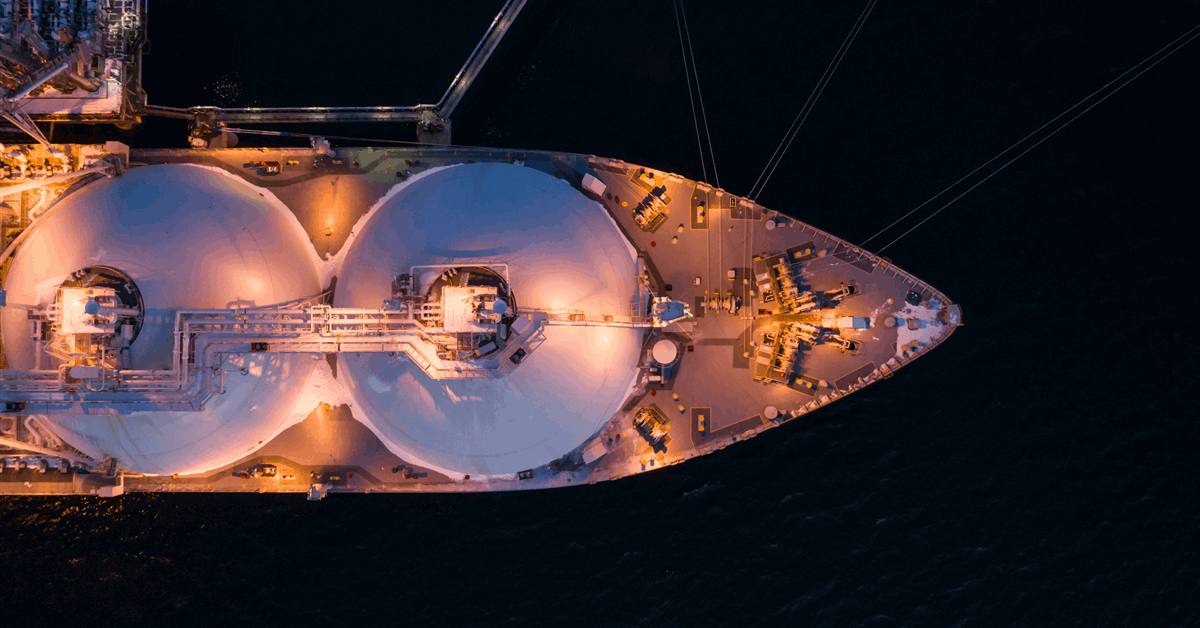

- WTI for August supply gained 1.7% to settle at $67.54 a barrel in New York.

- Brent for September settlement climbed 1.5% to $69.52 a barrel.

What do you suppose? We’d love to listen to from you, be part of the dialog on the

Rigzone Vitality Community.

The Rigzone Vitality Community is a brand new social expertise created for you and all vitality professionals to Communicate Up about our business, share information, join with friends and business insiders and have interaction in an expert neighborhood that can empower your profession in vitality.