An industry-commissioned evaluation discovered the importation of pure fuel into New Zealand is technically viable, however one of many corporations that ordered the examine mentioned Thursday constructing liquefied pure fuel (LNG) infrastructure within the nation seems to be “more difficult than anticipated”.

The examine, commissioned following a fast fall in home fuel that prompted a reversal on local weather coverage, checked out conventional-scale LNG import infrastructure and smaller-scale options. The “New Zealand LNG Import Feasibility Evaluation” was performed by the United Kingdom-based Gasoline Methods Group Ltd. with help from New Zealand-based Wooden Beca Ltd. for about 10 weeks from mid-September 2024.

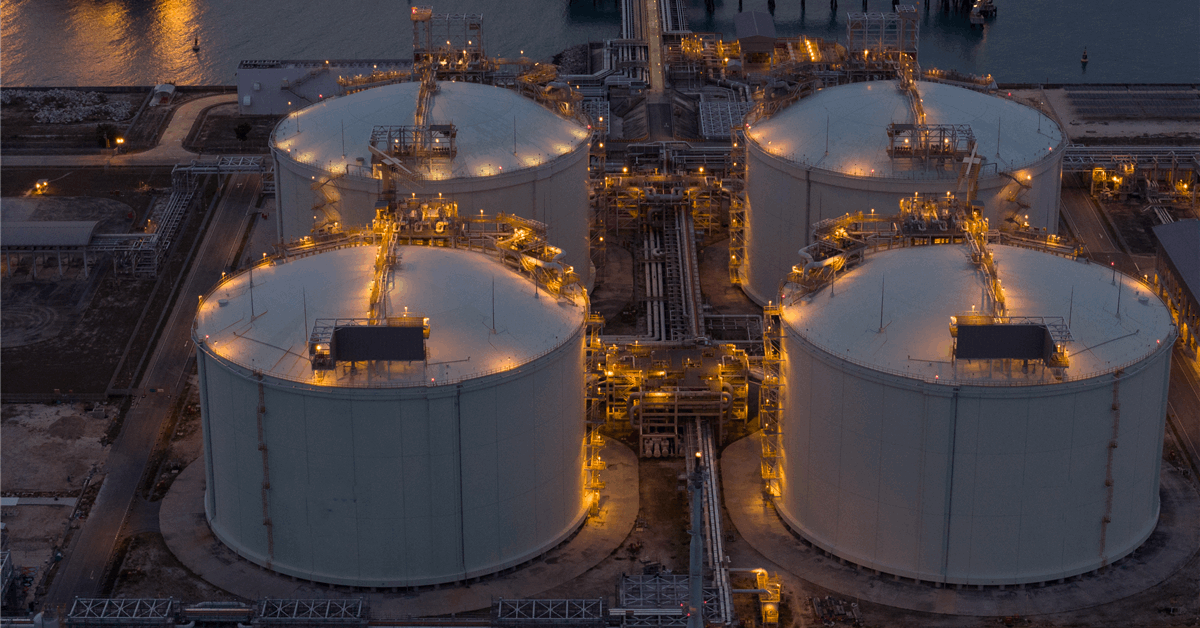

For LNG importation via conventional-size vessels, capital value estimates to construct the wanted infrastructure vary from NZD 189 million ($113.75 million) to NZD 1 billion. The price relies on port modifications at a given location, pipeline upgrades and onshore regasification installations.

The vary is “a major funding given the uncertainty round how typically LNG imports could be wanted”, Clarus, one of many corporations that commissioned the examine, mentioned in a press release on-line.

“The worldwide LNG commerce has standardized round giant vessels (carrying round 170,000-180,000m3, or 4.5 PJ of fuel), with a lot of the storage and regasification tools situated on completely moored ships (often called Floating Storage and Regasification Models or FSRUs)”, Clarus, previously Firstgas Group, mentioned.

The examine recognized six most popular websites throughout the North Island. “No single location in New Zealand has the present mixture of adequate water depth, benign metocean situation and current fuel pipeline capability to fulfill demand eventualities”, the primary of two findings experiences mentioned. “Due to this fact, all areas would require monetary funding to handle a number of of those points.

“LNG imports are unlikely to be achieved in lower than 4 years except the present allowing and consenting course of is fast-tracked and / or some monetary danger is taken to decide to long-lead objects prematurely of taking a remaining funding determination on the mission. These measures may cut back the timeline by as much as one yr”.

The primary findings report mentioned, “The expectation of this Evaluation is that the landed worth of LNG in New Zealand might be roughly the Japan Korea Marker (‘JKM’) worth – the Asian spot worth – or a modest premium to that worth (as much as US$0.25/MMBtu) relying on market circumstances on the time a cargo is sourced”.

“This provides a landed LNG worth vary in New Zealand of roughly US$10.12 to US$10.37/MMBtu [million British thermal units], or roughly NZ$17.83 to NZ$18.27/GJ primarily based on a ahead trade price of 1.67 NZ$ per US$”, the report added. “This landed worth is on the entry level to the import terminal, i.e. Delivered Ex Ship (‘DES’). Terminal and home fuel transportation prices and losses could be further to the landed worth.

“Given the size and uncertainty of LNG demand, the expectation of this Evaluation is that LNG might be sourced below short-term or spot offers”.

Clarus mentioned, “The massive dimension of the ships concerned in conventional-scale LNG imports would necessitate important infrastructure funding, together with port or pipeline upgrades”.

Alternatively, New Zealand may go for smaller-scale developments that use current port infrastructure with out main retrofits, assuming LNG might be purchased from an current facility in neighboring Australia, in keeping with the examine. Port Taranaki would supply probably the most advantageous website for the import terminal, it mentioned.

“Assuming a typical small-scale LNG worth chain with a 15,000 m3 LNG provider (‘LNGC’) ‘shuttling’ backwards and forwards between Australia and Port Taranaki, as much as ca. 9 PJ of LNG might be delivered yearly”, the second report mentioned.

The benchmark small-scale landed LNG worth at Port Taranaki for the utmost annual supply potential could be US$ 11.41-11.92 per MMBtu.

“If the identical JKM worth foundation is utilized to the 2024 Evaluation [for conventional-scale LNG], the benchmark costs for small-scale landed LNG are round 25 % increased.

“The small-scale landed LNG worth contains the price of transporting LNG to Port Taranaki together with chartering a small-scale LNGC, whereas within the 2024 Evaluation such prices had been the duty of the provider and included within the spot cargo worth unrelated to a selected supply location”.

“The event of a small-scale LNG idea is probably going be constrained by the modalities and business preparations of the LNG provide supply”, the second report mentioned.

“The operational danger is that episodic poor metocean circumstances at Port Taranaki may result in the LNGC being unable to unload its cargo and return to Australia throughout the subsequent loading window.

“Present mission offtakers is not going to wish to settle for disruption to their very own loading schedules for the needs of serving a small-scale commerce, so agreeing operational phrases within the LNG provide settlement to accommodate these dangers with out triggering conventional ‘take or pay’ obligations might be key”.

Whereas there are various sources ought to Australian provide be reduce off, “it might be that the LNG worth chain evolves in the direction of a conventional-scale answer”, the second report mentioned.

Clarus mentioned the findings had been forwarded to authorities officers, “whose help could be crucial for any choice to proceed”.

“The examine companions emphasised that LNG is only one of a number of choices being explored to help power resilience”, Clarus added. “Funding in renewables, demand-side administration and electrification stay central to the nation’s low-carbon power transition”.

Clarus chief government Paul Goodeve commented, “Finally, our power future might be formed by a mixture of power choices and this work ensures the choice of LNG is correctly understood”.

The examine was commissioned by Clarus, Contact Power Ltd., Genesis Power Ltd., Mercury NZ Ltd. and Meridian Power Ltd.

To contact the writer, electronic mail jov.onsat@rigzone.com