Delfin Midstream Inc. is shifting nearer to a optimistic last funding choice (FID) for its deepwater port venture in Louisiana with the signing of two agreements.

Delfin entered into an settlement with Siemens Vitality Inc. to order manufacturing capability for 4 SGT-750 gasoline turbine mechanical drive packages, the corporate mentioned in a information launch. The tools can be used to drive the mixed-refrigerant compressors for Delfin’s liquefied pure gasoline (LNG) liquefaction system.

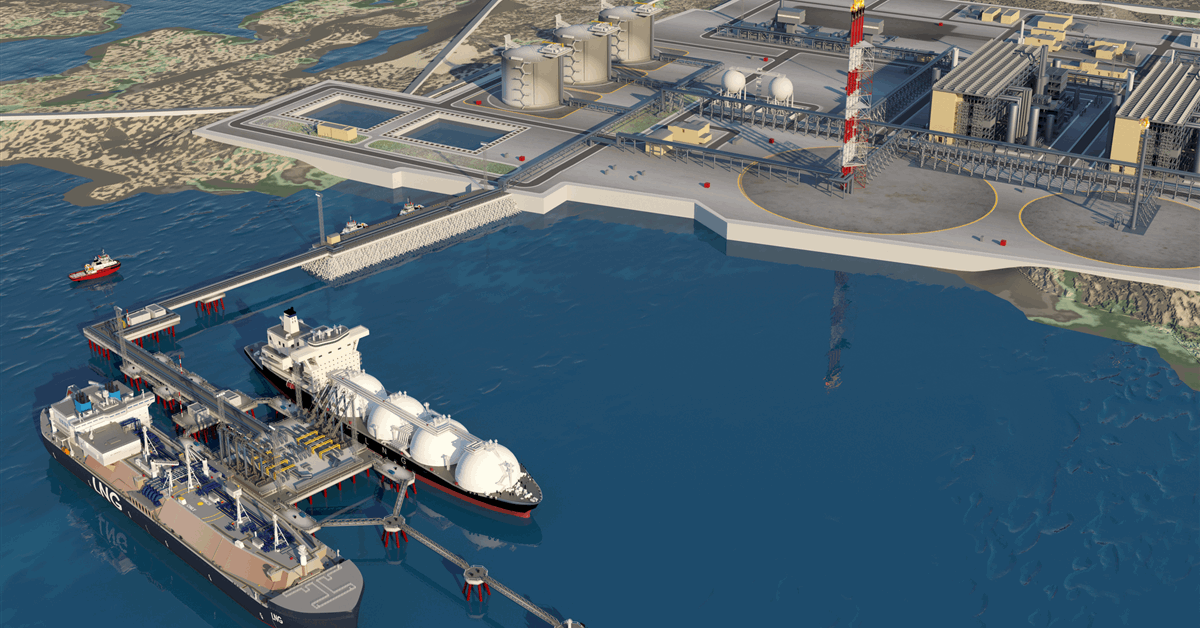

Delfin mentioned it additionally agreed to an Early Works program with Samsung Heavy Industries and Black & Veatch Inc. to additional element floating liquefied pure gasoline (FLNG) vessel design specs as the premise for the lump-sum, turn-key engineering, procurement, building, and integration (EPCI) contract and to arrange each contractors for the execution of the venture.

Monetary phrases of the contracts weren’t disclosed.

The work will de-risk venture execution and guarantee each contractors are ready for fast venture execution following a optimistic FID, anticipated within the fall of 2025, Delfin mentioned.

Delfin CEO Dudley Poston mentioned, “That is an extremely thrilling time for the event of Delfin’s crucial power infrastructure venture. Following the profitable issuance of the deepwater port license by MARAD, all workstreams are on schedule and the venture is at the moment on observe for FID within the fall of 2025. By making this massive funding to lock-in crucial manufacturing capability, we’ve got secured our execution schedule with the anticipated supply of our first FLNG vessel from Samsung Heavy Industries shipyard in 2029”.

Siemens Vitality government board member Karim Amin mentioned, “Siemens Vitality is worked up to assist Delfin’s power infrastructure venture by offering the crucial Gasoline Turbine Mechanical Drive packages the Firm wants because it strikes in direction of delivering the primary offshore LNG venture in the USA. The modular design, excessive power-to-weight ratio and talent to function below numerous circumstances make Siemens Vitality gasoline generators an revolutionary and superb know-how resolution for this main low-emissions power infrastructure venture”.

In March, Delfin Midstream subsidiary Delfin LNG LLC acquired a license from the Maritime Administration (MARAD) to personal, assemble, function, and ultimately decommission a deepwater port that goals to export LNG from the USA.

The brownfield deepwater port that Delfin is growing “requires minimal further infrastructure funding” to assist as much as three floating LNG vessels producing as much as 13.2 million metric tons of LNG yearly, the corporate mentioned.

Delfin acknowledged that the license was issued pursuant to the Deepwater Port Act of 1974 and MARAD’s 2017 Report of Determination and is in accordance with President Trump’s Govt Order titled, “Unleashing American Vitality,” signed January 20, 2025.

The Division of Vitality (DOE) authorised an LNG export allow extension for Delfin LNG, granting further time to start exports from the venture. The allow extension had been delayed below the earlier administration, in keeping with the corporate.

Delfin LNG acquired a optimistic Report of Determination from MARAD and approval from DOE for long-term exports of LNG to international locations that do not need a Free Commerce Settlement with the USA.

Delfin LNG owns the UTOS pipeline which runs from Station 44 to the WC-167 platform. Delfin has a long-term lease settlement for the HIOS pipeline working from WC 167 south to the Delfin Deepwater Port location. The UTOS pipeline is the one 42-inch pipeline within the Gulf and was previously owned and operated by Enbridge, in keeping with the corporate.

To contact the creator, e-mail rocky.teodoro@rigzone.com

What do you suppose? We’d love to listen to from you, be part of the dialog on the

Rigzone Vitality Community.

The Rigzone Vitality Community is a brand new social expertise created for you and all power professionals to Communicate Up about our trade, share data, join with friends and trade insiders and have interaction in an expert group that may empower your profession in power.