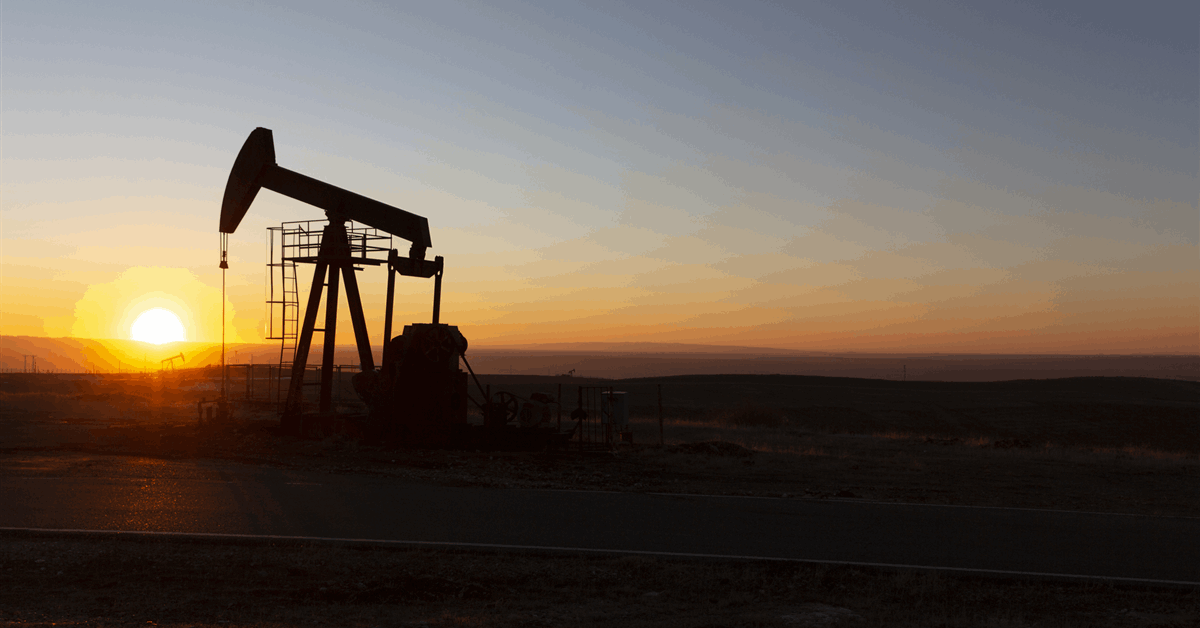

Exxon Mobil Corp. expects decrease oil and fuel costs to scale back the corporate’s earnings by about $1.5 billion as a unstable quarter for commodity costs weighs on second-quarter income.

Oil costs pulled down earnings by about $1 billion whereas fuel contributed one other $500 million hit when in comparison with the primary quarter, the Spring, Texas-based firm stated in a press release Monday. European rival Shell Plc’s shares fell 3.3% Monday after guiding to “considerably decrease” buying and selling earnings than the earlier quarter.

The 2 oil giants’ outlook factors to a downbeat quarter for the trade, which was already struggling to generate sufficient free money to cowl the dividends and share buybacks firms hiked after document earnings in 2022. President Donald Trump’s commerce warfare and larger-than-expected provide will increase from OPEC and its allies weighed on oil costs, whereas US and Israeli assaults on Iran solely offered a short lived uplift.

Exxon expects some respite from refining margins, which can add about $300 million to earnings, the corporate stated. The steerage solely refers to market pricing and doesn’t consider operational efficiency like modifications to manufacturing or prices, the corporate stated.

Exxon’s steerage is “bang in line” with analysts’ estimates for the second quarter, RBC Capital Markets analyst Biraj Borkhataria stated in a analysis word. Exxon “has a a lot smaller buying and selling group than its European peer Shell, and thus was not impacted by the identical points.”

Generated by readers, the feedback included herein don’t mirror the views and opinions of Rigzone. All feedback are topic to editorial evaluate. Off-topic, inappropriate or insulting feedback will likely be eliminated.