Eni SpA’s chemical arm, Versalis SpA, has transferred its oilfield chemical substances property to a brand new firm referred to as Versalis Oilfield Options SRL in an growth bid, Eni mentioned Tuesday.

“The operation goals to consolidate Versalis’ place within the oilfield providers sector by bringing collectively key experience and strategic actions in a single, targeted and operationally environment friendly entity”, Italy’s state-controlled Eni mentioned in an internet assertion.

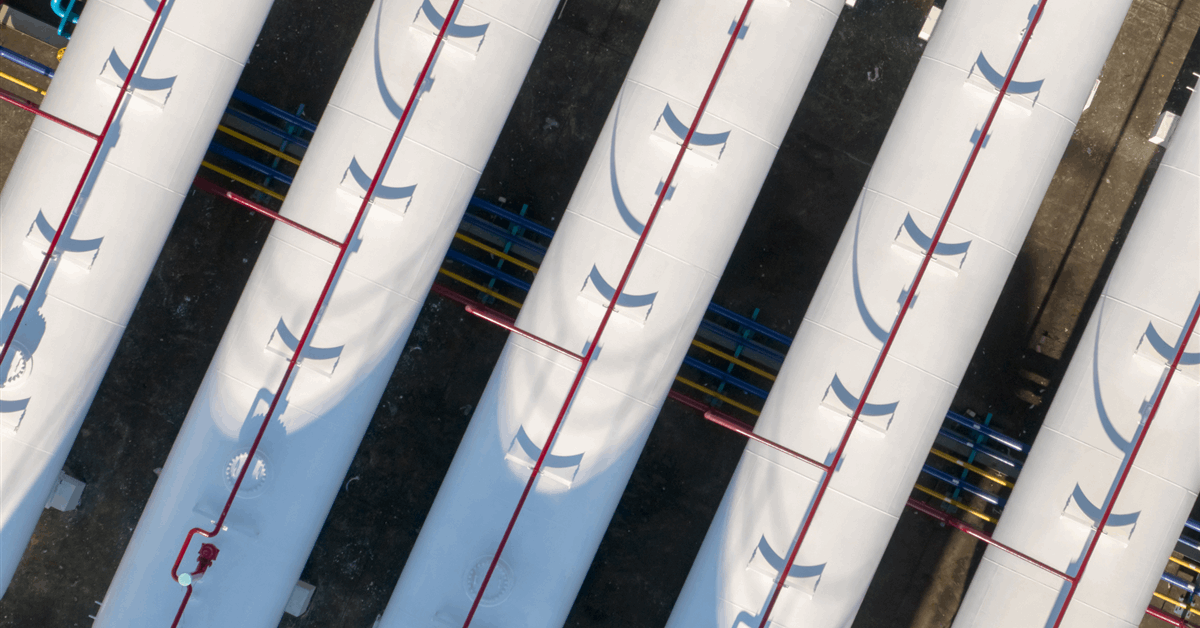

“Versalis’ oilfield operations embody analysis and improvement of superior chemical formulations, outsourcing their manufacturing and advertising solvents and components designed for the oil drilling trade. Merchandise are tailor-made to satisfy particular consumer necessities, whereas providers embody gross sales and after-sales assist, guaranteeing steady and certified technical help”.

Launched 2010, Eni’s oilfield chemical substances enterprise now operates in Africa, the Americas, Asia and Europe, in keeping with the corporate.

Versalis Oilfield Options will broaden “the scope of actions when it comes to services, obtain greater income targets, and keep robust profitability”, Eni mentioned.

Final yr Eni finalized a plan to remodel Versalis, which makes primary chemical substances, chemical merchandise together with plastics and biochemical merchandise reminiscent of biolubricants.

With an funding of round EUR 2 billion ($2.36 billion), the plan “goals to scale back emissions by roughly 1 million tonnes of CO2, at present about 40 p.c of Versalis’ emissions in Italy”, Eni mentioned in a press launch October 24, 2024.

“It contains the set-up of latest industrial crops according to the power transition and decarbonization of commercial websites throughout sustainable chemistry, in addition to biorefining and power storage”, Eni added. “To allow the development of the brand new crops, exercise on the cracking crops in Brindisi and Priolo, and the polyethylene plant in Ragusa, will likely be phased out”.

“Eni goals to considerably cut back Versalis’ publicity to primary chemical substances, a sector that’s dealing with structural and irreversible decline in Europe, and which has led to financial losses which were near 7 billion in money phrases over the past 15 years, 3 billion of which was within the final 5 years”, the corporate mentioned.

Eni expects to finish the plan by 2029.

In its “Capital Markets Replace” February 2025, Eni mentioned, “We count on Versalis to realize an EBIT break-even by 2027, an EBIT adjusted turnaround of round EUR 900 million by 2028 (vs 2024), a discount in capital depth of ~EUR 350 Mln versus the earlier Plan resulting in FCF break-even additionally by 2028, with a ROACE associated to the brand new platforms of round 10 p.c by 2030”.

To contact the creator, e-mail jov.onsat@rigzone.com

What do you assume? We’d love to listen to from you, be part of the dialog on the

Rigzone Vitality Community.

The Rigzone Vitality Community is a brand new social expertise created for you and all power professionals to Converse Up about our trade, share data, join with friends and trade insiders and have interaction in an expert neighborhood that can empower your profession in power.