Santos Restricted stated it has entered right into a course of and exclusivity deed with a consortium led by XRG P.J.S.C. associated to its non-binding indicative proposal to amass 100% of the issued shares of Santos for $5.76 (AUD 8.89) per share in money.

XRG, a subsidiary of Abu Dhabi Nationwide Oil Firm (ADNOC), is the lead investor of a consortium that features Abu Dhabi Growth Holding Firm and Carlyle.

The method deed governs the idea upon which the XRG consortium “can have the chance to undertake due diligence and gives for the events to barter in good religion, in parallel with the due diligence, a binding scheme implementation deed to implement the potential transaction,” Santos stated in a information launch.

The consortium has been granted unique due diligence entry for a interval of six weeks from June 27. The exclusivity provisions embrace customary “no store”, “no speak”, “no due diligence” and “notification” obligations that apply through the exclusivity interval, Santos stated.

A fiduciary exception applies enabling the Santos board to take care of different proposals from competing acquirers beginning 4 weeks from June 27, the corporate stated.

The consortium has additionally agreed to a confidentiality settlement with Santos, the corporate acknowledged.

“The proposal is for the acquisition of the entire strange shares on challenge in Santos for a money supply value of $5.76 per Santos share”, which might be adjusted for dividends paid earlier than a last proposal comes into pressure, Santos stated in an earlier assertion. The worth had been elevated from two confidential affords of $5.04 per share and later $5.42 per share in March, the corporate famous revealed.

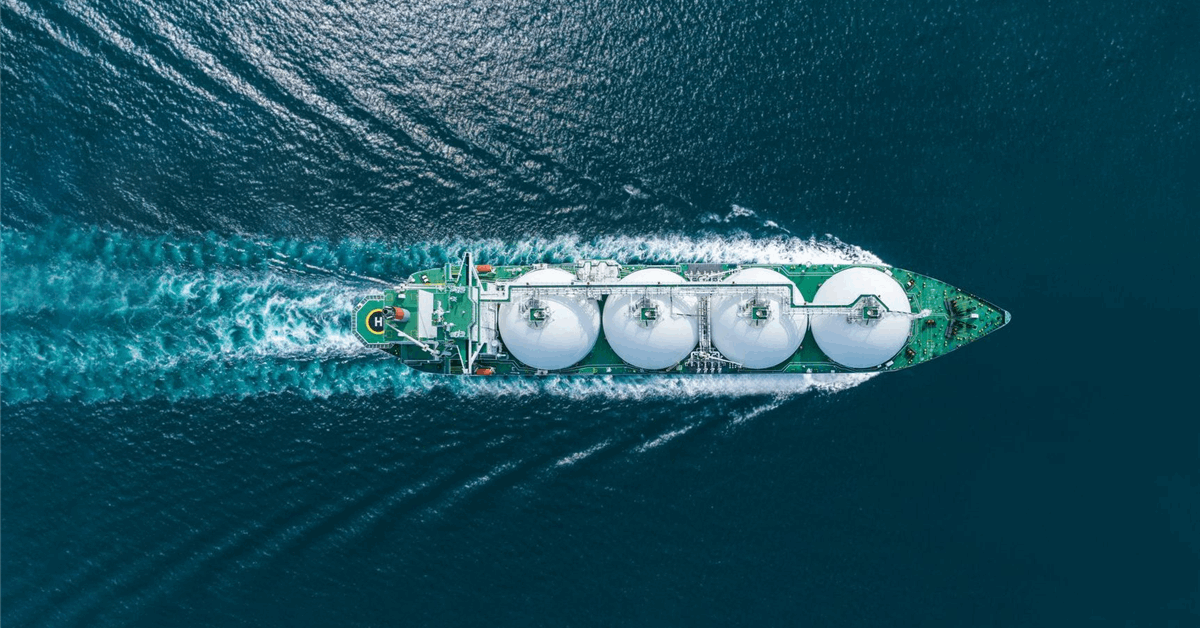

XRG stated in a separate assertion that the consortium “goals to construct on Santos’ sturdy and longstanding legacy as a trusted and dependable vitality producer, unlocking extra fuel provide for Santos’ prospects, and strengthening home and worldwide vitality safety”.

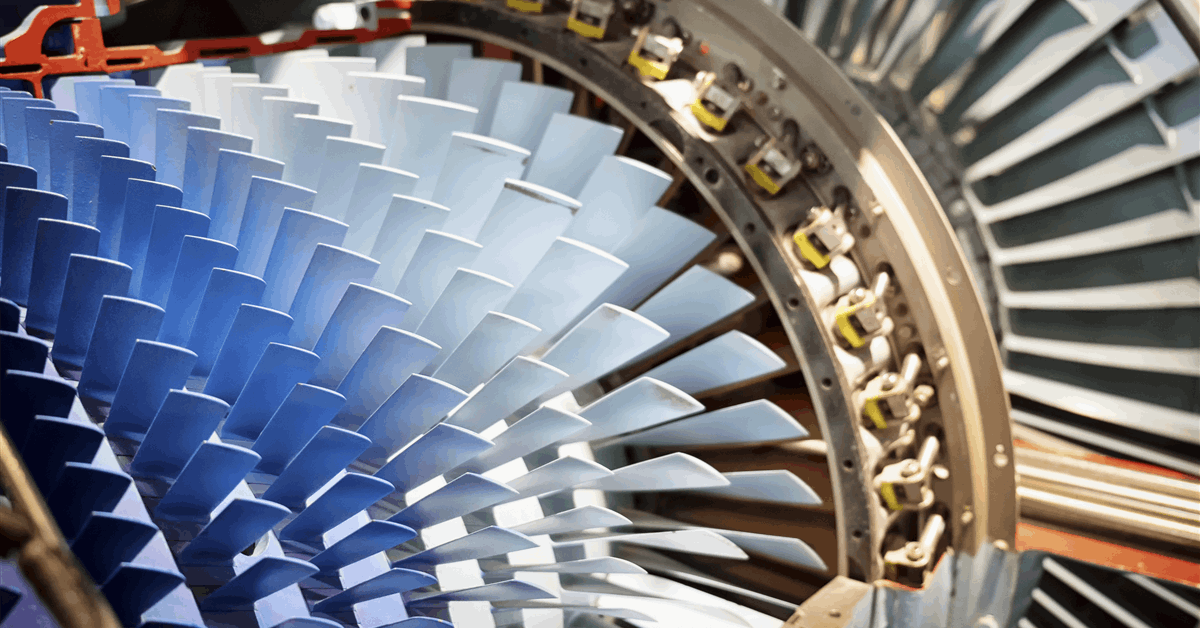

The proposed transaction “is aligned with XRG’s technique and ambition to construct a number one built-in world fuel and LNG [liquefied natural gas] enterprise,” the corporate added.

The consortium has dedicated to retaining Santos’ headquarters in Adelaide, model, and operational footprint in Australia and key worldwide working hubs. It additionally plans to “work intently with the prevailing administration staff to speed up progress and assist native employment and the communities the place Santos operates,” XRG stated.

Additional, the consortium seems to put money into Santos’ progress and additional growth of its fuel and LNG-focused enterprise “which is able to present dependable and inexpensive vitality and low carbon options to prospects in Australia, the Asia Pacific and past”.

The consortium additionally goals for Santos to stay “a contributor to the transformation of vitality programs and continues to make future-facing investments in Santos’ carbon seize and storage initiatives, low carbon fuels, different decarbonization initiatives and the applying of AI to drive effectivity and worth throughout operations,” XRG stated.

To contact the creator, e mail rocky.teodoro@rigzone.com

Generated by readers, the feedback included herein don’t replicate the views and opinions of Rigzone. All feedback are topic to editorial evaluation. Off-topic, inappropriate or insulting feedback can be eliminated.