A coalition of monetary, technical and environmental companions has launched a framework that goals to assist traders, lenders, and oil and fuel firms combine methane and flaring efficiency into debt financing.

The Methane Finance Working Group, an initiative launched at COP28 in 2023, launched steerage to “ship and deploy market-tested finance mechanisms that facilitate decarbonization throughout the oil and fuel sector, whereas increasing the alternatives to realize measurable methane emission reductions,” the Environmental Protection Fund (EDF) mentioned in an announcement.

The steerage supplied by the group “features a third-party verification course of from trusted scientific and engineering consultants, establishing an unbiased benchmark to guage and assess firm methane efficiency through the financing course of,” in keeping with the assertion.

The steerage gives suggestions to adapt market-tested monetary devices to construction bonds, use of proceeds devices, loans and different standard debt transactions focusing on methane and flaring reductions from the oil and fuel trade. It’s designed to serve each lenders and debtors, the assertion mentioned.

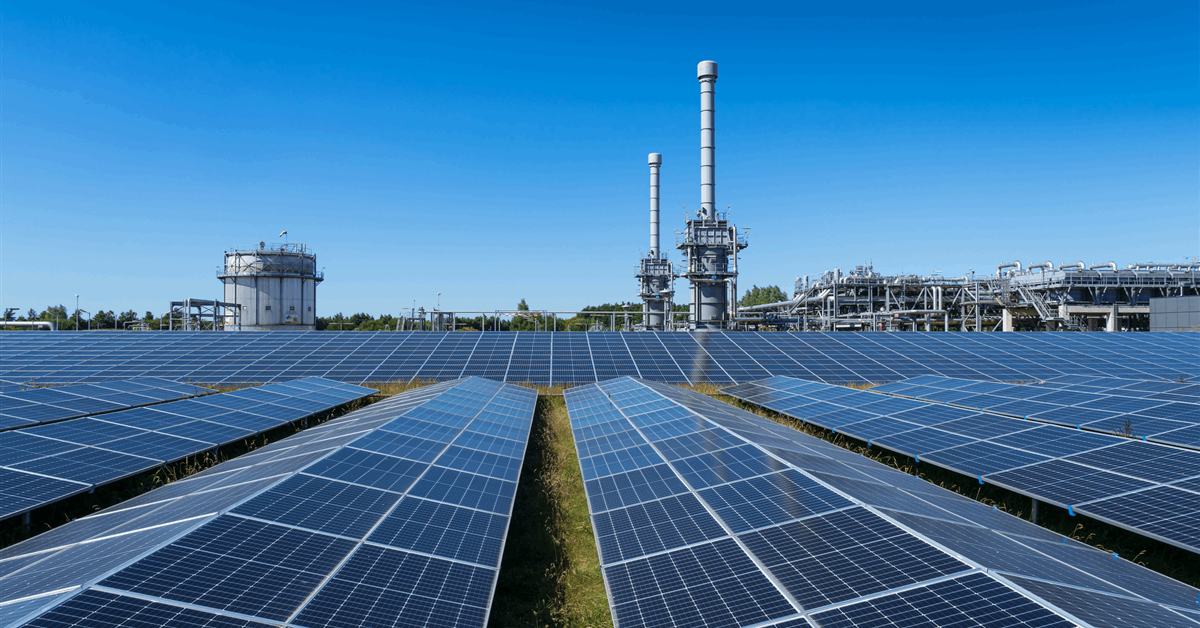

Though the know-how for methane discount exists, capital flows stay restricted because of structural limitations. Many firms lack entry to finance tailor-made to methane mitigation, whereas traders battle to evaluate emissions efficiency constantly, the EDF mentioned.

Related bonds have been utilized efficiently in different sectors, akin to international energy utilities, which has cumulatively issued $500 billion in labeled bonds, the EDF famous.

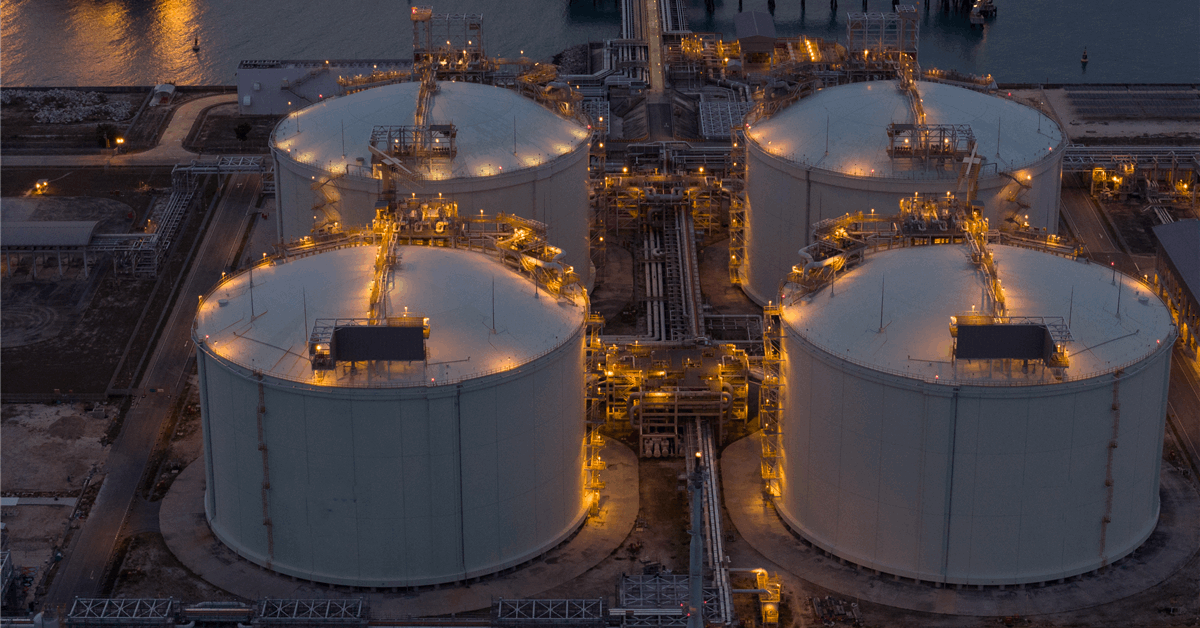

Methane efficiency is a rising think about international liquefied pure fuel (LNG) markets, the place patrons are more and more evaluating upstream emissions when sourcing fuel. As worldwide scrutiny over lifecycle emissions intensifies, monetary and operational methane transparency has develop into a aggressive differentiator for producers and exporters, in keeping with the assertion.

“Decreasing methane emissions throughout the oil and fuel trade is likely one of the quickest and best methods to sluggish local weather warming within the close to time period. However the monetary system hasn’t been designed to help this at scale. This new steerage goals to fill that hole with confirmed debt instruments which have already delivered monetary returns and inspired emissions reductions in different sectors,” Dominic Watson, senior supervisor for vitality transition on the EDF mentioned. “These sensible monetary options can speed up methane discount and assist firms meet rising international demand for cleaner fuel”.

“As a nationwide vitality firm dedicated to defending [the] atmosphere, SOCAR is proud to help the launch of the Methane Finance Working Group,” SOCAR Vice President Afgan Isayev mentioned. “We imagine unlocking focused finance is crucial to accelerating the deployment of confirmed methane mitigation applied sciences throughout the vitality sector. This initiative is a crucial step in mobilizing collective motion towards more practical and clear methane administration”.

“To realize the oil and fuel sector’s personal methane discount targets, firms — particularly nationwide oil firms — want higher entry to capital. By aligning funding with real-world impression, this steerage may also help speed up the deployment of current applied sciences that minimize methane and flaring, strengthen the position of pure fuel in international vitality safety, and ship on each local weather and business priorities,” Landon Derentz, senior director on the Atlantic Council, mentioned.

The Methane Finance Working Group goals to help the implementation of the Oil and Gasoline Decarbonization Constitution, which commits over 50 oil and fuel firms, together with 29 nationwide oil firms, to cut back methane and flaring emissions to near-zero, in keeping with the assertion.

To contact the creator, e mail rocky.teodoro@rigzone.com

Generated by readers, the feedback included herein don’t replicate the views and opinions of Rigzone. All feedback are topic to editorial evaluate. Off-topic, inappropriate or insulting feedback might be eliminated.