Israeli authorities have allowed the Chevron Corp.-operated Leviathan pure gasoline and condensate subject to restart manufacturing, after ordering a pause about two weeks in the past amid Israel’s change of assaults with Iran.

The Leviathan consortium had invoked a pressure majeure after the Power and Infrastructures Ministry, appearing on a “safety suggestion”, requested that manufacturing on the subject be briefly halted, in response to NewMed Power LP, one of many consortium companions.

NewMed Power has now mentioned that order had been lifted. It mentioned it intends to hunt state compensation for losses.

“In response to the Partnership’s [NewMed Energy] preliminary estimate, primarily based, inter alia, on the forecasted manufacturing from the Leviathan reservoir and from the Karish lease, the halting of manufacturing for the mentioned interval resulted in a lack of revenue from the sale of pure gasoline and condensate (gross, earlier than royalties) and revenue from overriding royalties from the Karish lease within the sum complete of approx. $38.8 million”, NewMed Power, a gasoline and condensate exploration and manufacturing firm owned by Israel’s Delek Group, instructed the Tel Aviv Inventory Alternate.

“The Partnership intends to discover the potential for receiving compensation from the State in reference to the halting of the gasoline manufacturing, though at this stage there isn’t any certainty as to receipt of such compensation and the quantity thereof”, it added.

The Israel-Hamas battle has additionally delayed the development of a 3rd pipeline for the sector. A regulatory disclosure by NewMed Power October 6, 2024, mentioned the suspension of the undertaking might final about six months.

The brand new conduit is predicted to develop the utmost supply to Israel Pure Fuel Traces Ltd. from about 1.2 billion cubic ft a day (Bcfd) to round 1.4 Bcfd from mid-2025, in response to a NewMed Power submitting July 2, 2023, that introduced an funding of roughly $568 million for Leviathan’s third pipeline.

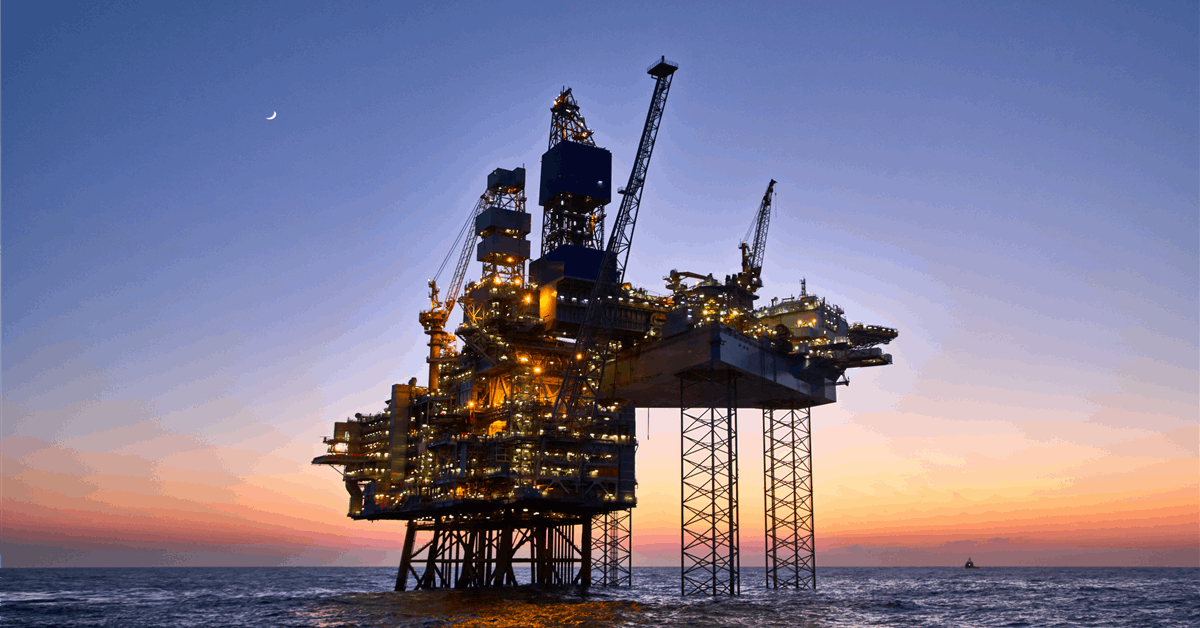

Leviathan’s two working pipelines carry output from 4 wells to an offshore platform that processes the gasoline. The gasoline is then piped to shore into Israel’s nationwide grid, by way of which it’s distributed to customers in Israel, Egypt and Jordan.

Earlier this 12 months the consortium submitted to the Israeli authorities a revised growth plan for Leviathan’s enlargement undertaking.

The brand new plan for Section 1B would develop Leviathan’s manufacturing capability to about 23 billion cubic meters (812.24 billion cubic ft) a 12 months. That’s up from the earlier plan of round 21 Bcm every year.

Leviathan, found 2010 off the coast of Haifa metropolis, began manufacturing December 2019 underneath Section 1A, which has a capability of about 12 Bcm a 12 months.

The consortium plans to implement the revised Section 1B plan in both one go or two levels.

Stage 1 would drill three manufacturing wells, add new subsea techniques and increase processing services on the prevailing platform to lift Leviathan’s manufacturing capability to about 21 Bcm a 12 months. The whole value is estimated to be $2.4 billion gross. Thus far the companions have permitted $505 million, in response to a NewMed Power regulatory submitting on February 23, 2025.

Stage 2 “primarily contains the drilling of extra manufacturing wells and associated subsea techniques, and on this context, insofar as required, the laying of a fourth pipeline between the sector and the platform, in a fashion that’s anticipated to extend the utmost each day manufacturing capability by one other ~2 BCM per 12 months, i.e. to a complete amount of ~23 BCM per 12 months”, NewMed Power mentioned.

Chevron operates Leviathan with a 39.66 % stake by way of Chevron Mediterranean Ltd. NewMed Power is almost all stakeholder at 45.34 %. Ratio Energies LP, a neighborhood participant, owns 15 %.

To contact the creator, electronic mail jov.onsat@rigzone.com