Oil costs dropped “considerably” following information of an Iran-Israel ceasefire, Erik Meyersson, Chief EM Strategist at Skandinaviska Enskilda Banken AB (SEB), stated in a report despatched to Rigzone by the SEB crew on Tuesday.

Meyersson warned within the report that future talks will probably be troublesome if negotiation positions stay the identical, including that “all events have an curiosity in ending the combating, however want to beat the crux of nuclear enrichment in Iran, in addition to its ballistic missile program, to ensure that a sturdy deal”.

“Snapback sanctions and its penalties nonetheless stay a problem, and a ceasefire and not using a diplomatic breakthrough opens for Iranian rearmament and rebuilding of its nuclear services,” he added.

“This places the present ceasefire on precarious grounds, and absent a diplomatic breakthrough, the Iran-Israel Struggle might not but be over,” Meyersson warned.

Meyersson stated within the report that the U.S. has from the onset sought a minimal participation within the struggle and famous that it will likely be eager to restrict involvement to keep away from dissent over the struggle inside its personal political base.

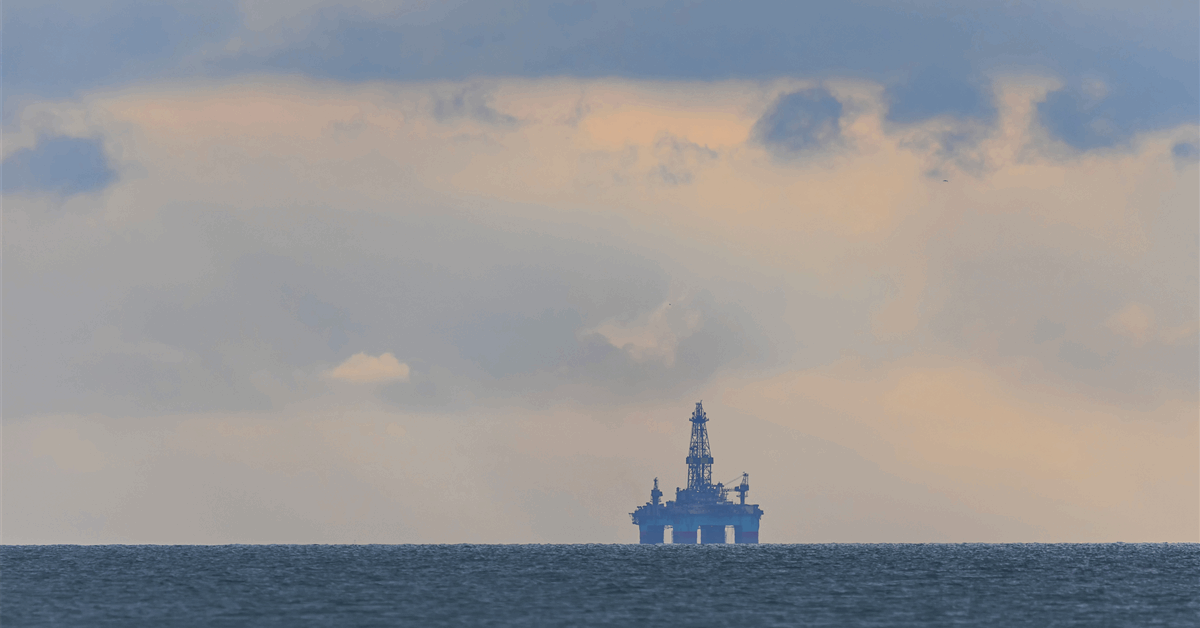

“As well as, an ongoing battle would pose dangers to the worldwide provide oil,” Meyersson highlighted within the report.

“With an Iranian regime more and more backed towards a wall, issues over whether or not it may goal transport or vitality infrastructure within the area had been on the rise,” he identified.

“Oil costs had been trending greater which, if sustained, may have pushed up world inflation charges up and central banks towards the next coverage charge trajectory,” he added.

In a market replace despatched to Rigzone by the Rystad Power crew late Monday, Rystad famous that oil costs tumbled yesterday after Iran’s retaliatory strikes on the U.S., “signaling a doable need from Iran to de-escalate by inflicting minimal harm to U.S. infrastructure within the area”.

“Rystad Power maintains that the scenario stays fluid with vitality markets nonetheless pricing the potential de-escalation. With tensions at an all-time excessive, the U.S. response and the chance of a broader struggle stays to be seen,” Rystad warned in that replace.

Janiv Shah, Rystad Power Vice President, Oil Markets Evaluation, highlighted within the replace that, on June 13, Israel “launched Operation Rising Lion, a sweeping navy marketing campaign concentrating on over 100 Iranian nuclear and navy services, together with the important thing websites of Natanz and Khondab, in addition to high-ranking Iranian navy management”.

“Within the aftermath of the assault, Brent crude surged to almost $78 per barrel earlier than stabilizing round $75 and subsequently tumbling to $70 after Iran’s retaliatory missile strike on Doha,” Shah added.

“Within the weeks main as much as the struggle, Israel and Iran exchanged missile salvos because the battle continued to escalate, culminating within the U.S. launching focused strikes towards three nuclear services over the weekend,” Shah continued.

“Rystad Power anticipates that prime market volatility will probably be anticipated within the close to time period because the extent of the harm emerges and the extent of Iran’s response turns into obvious,” Shah went on to state in that replace.

Additionally within the replace, Shah warned {that a} potential blockage of the Strait of Hormuz by Iran poses a big danger to vitality flows.

“Round 15 million barrels per day, or practically a 3rd of worldwide seaborne crude oil exports, transit via the strait. A full closure would have probably the most extreme influence on Asia, which receives practically 80 p.c of those flows,” Shah stated.

“If Iran’s counterstrike is seen as a de-escalation transfer, the doubtless case stays for the Strait to stay open, nevertheless within the case that it’s impacted and closes, the timeline is likely to be very transient,” Shah added.

“The waterway handles vital volumes for world markets and its significance can’t be understated,” Shah continued.

Rigzone has contacted the White Home, the Iranian Ministry of International Affairs, and Israel’s Ministry of International Affairs Spokesperson, Oren Marmorstein, for touch upon SEB’s report and Rystad Power’s market replace. On the time of writing, not one of the above have responded to Rigzone.

To contact the creator, e mail andreas.exarheas@rigzone.com