Abu Dhabi’s predominant oil firm is evaluating whether or not it will possibly purchase a few of BP Plc’s key property ought to the embattled British agency resolve to interrupt itself up or come underneath strain to divest extra models, in keeping with folks with data of the matter.

Abu Dhabi Nationwide Oil Co. has been internally finding out the prospects for buying some BP property and has held preliminary consultations with bankers, the folks stated, asking to not be recognized as a result of the discussions are non-public. Additionally it is contemplating partnering with one other bidder to separate a number of the property, they stated.

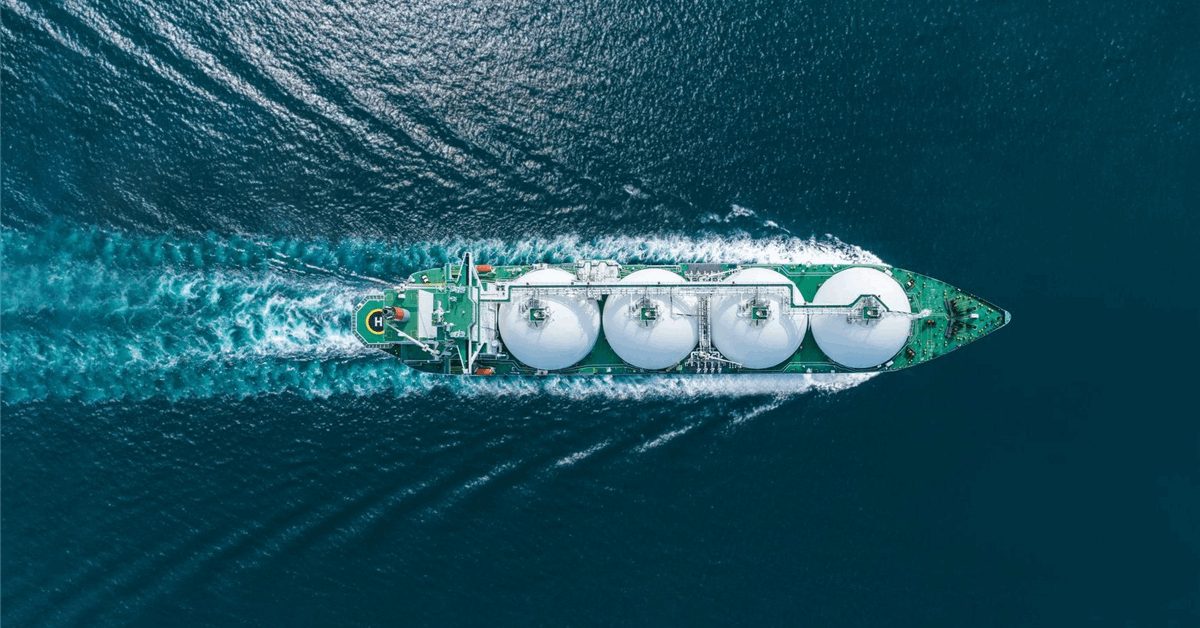

ADNOC is most thinking about BP’s LNG and gasoline fields, relatively than taking up your complete firm, although it has additionally thought-about that possibility, the folks stated. ADNOC, some of the lively dealmakers in current months, not too long ago began a world unit referred to as XRG PJSC, which is on the hunt for gasoline and chemical compounds offers because it targets an $80 billion enterprise worth.

Any deal is more likely to be pursued by way of XRG, a number of the folks stated. ADNOC or XRG may additionally have a look at BP’s gas retailing enterprise, in keeping with the folks.

Adnoc referred inquiries to XRG, which declined to remark. The corporate’s plans are nonetheless into account and it could additionally resolve to not bid for any property in any respect, the folks accustomed to the scenario stated. BP additionally declined to remark.

BP has been battling a protracted underperformance stemming largely from its earlier give attention to a web zero technique. Chief Government Officer Murray Auchincloss is making an attempt to reset that with a pivot again to grease and gasoline, and guarantees to promote property. Different oil firms have been working the numbers on BP, whose market worth has slid by a 3rd in simply over a yr to under $80 billion.

Adnoc isn’t thinking about BP’s oil manufacturing property or refineries, the folks stated. That makes the choice of shopping for all of BP unattractive, they stated. The political dangers related to taking up the storied British firm outright can also be more likely to deter Adnoc, in keeping with the folks accustomed to its inside pondering.

A few of that threat performed out final yr when a agency with ties to UAE Deputy Prime Minister Sheikh Mansour bin Zayed Al Nahyan bumped into bother in its effort to purchase the UK’s Telegraph after the nation introduced plans to dam overseas states from proudly owning newspapers. Nevertheless, Abu Dhabi-based entities have not too long ago began to dip into British property, indicating that tensions between the 2 may very well be beginning to thaw.

One other hurdle for a full takeover of BP can be funding. Even for money wealthy ADNOC – which additionally has the power to faucet billions of {dollars} from the debt market – the worth tag would nonetheless be big, given it must pay fully in money because it doesn’t have publicly traded inventory.

Adnoc and BP have an extended historical past of working collectively on initiatives. The London-headquartered firm helped uncover oil in Abu Dhabi greater than half a century in the past, and is a minority shareholder in Adnoc’s largest onshore discipline which produces the corporate’s benchmark Murban crude.

BP final yr agreed to take a ten % stake in a LNG plant underneath development within the emirate, and has a three way partnership to develop gasoline in Egypt and the jap Mediterranean area.

ADNOC’s unit XRG in Could stated it goals to grow to be one of many world’s high built-in gasoline firms over the subsequent decade, with an enormous bounce in LNG capability totaling 25 million tons a yr.

Generated by readers, the feedback included herein don’t replicate the views and opinions of Rigzone. All feedback are topic to editorial evaluate. Off-topic, inappropriate or insulting feedback shall be eliminated.