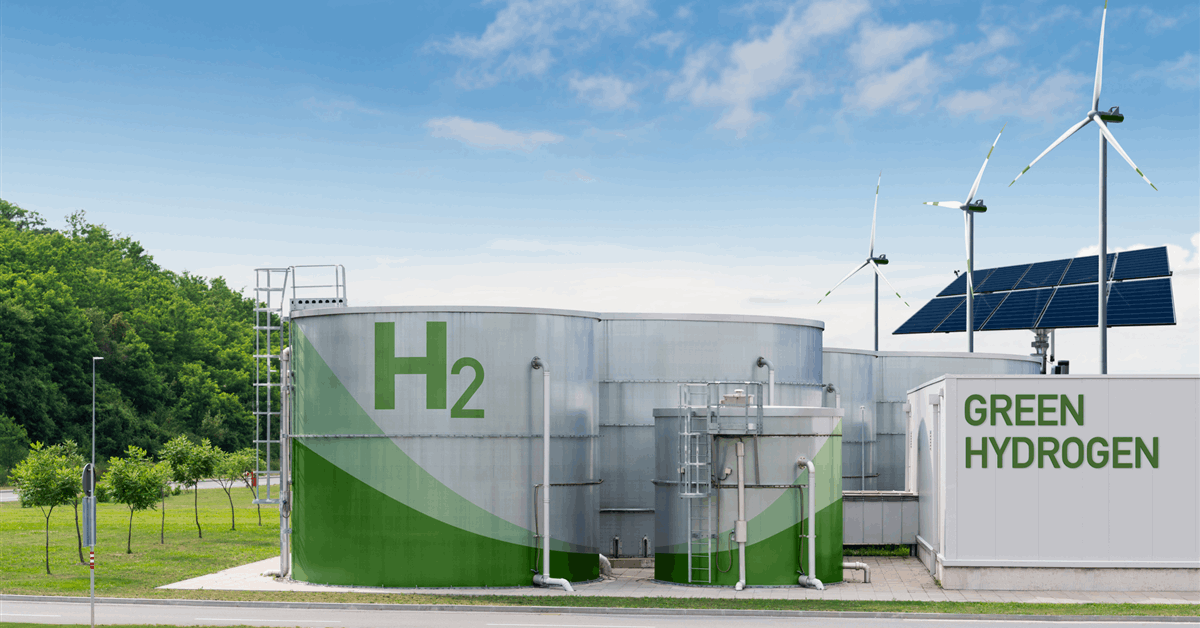

Fifteen renewable hydrogen manufacturing initiatives throughout 5 international locations have secured a complete of EUR 992 million ($1.12 billion) in grants after the second spherical of the European Hydrogen Financial institution.

The quantity is a fraction of the EUR 4.8 billion requested by mission proposals within the bidding spherical. The submitted bids represented about 6.3 gigawatts (GW), based on the European Fee.

The 15 chosen “are anticipated to supply almost 2.2 million tonnes of renewable hydrogen over 10 years, avoiding greater than 15 million tonnes of CO2 emissions”, the Fee stated in a web-based assertion.

“The hydrogen will likely be produced in sectors akin to transportation, the chemical business, or the manufacturing of methanol and ammonia”.

The grant comes within the type of a subsidy meant to assist shut the worth distinction between manufacturing prices and the worth patrons are at the moment keen to pay. Winners will obtain a set premium per kilogram of renewable hydrogen produced over a interval of as much as 10 years.

“Of the chosen initiatives, 12 are dedicated to producing renewable hydrogen with fastened premium assist between EUR 0.20 and EUR 0.60 per kilogram”, the Fee stated.

“For the primary time, the public sale offered a devoted price range for hydrogen producers with off-takers within the maritime sector, that are entities utilizing the hydrogen produced by the mission for finishing up or making use of bunkering actions”.

Eight of the chosen initiatives are in Spain, three are in Norway and two are in Germany. Finland and the Netherlands every have one.

The most important by way of manufacturing quantity is the Netherlands’ Zeevonk Electrolyser mission, which had a bid quantity of 411 kilotons of hydrogen over 10 years. It was adopted by Meridian SAS’ KASKADE mission in Germany (354 kilotons over 10 years). Koppo Energia Oy’s Kristinestad PtX mission in Finland rounded up the highest three with a bid quantity of 258 kilotons over 10 years.

The Fee earlier permitted extra affords by Austria, Lithuania and Spain totaling EUR 836 million below the Hydrogen Financial institution’s “public sale as a service”. Public sale as a service permits international locations to choose initiatives that participated within the public sale however didn’t win EU funding. This mechanism permits member-states to have a aggressive number of initiatives to fund utilizing their inside budgets with out holding their very own public sale.

“The second public sale below the European Hydrogen Financial institution reaffirms our dedication to constructing a strong renewable hydrogen market in Europe – one that’s key to reaching local weather neutrality in an economical and aggressive manner”, commented Fee Govt Vice President for Clear, Simply and Aggressive Transition Teresa Ribera. “We’re rising EUs vitality independence with constructive impacts in safety and jobs.

“The robust response to the public sale clearly displays the vitality and rising confidence in Europe’s rising renewable hydrogen business”.

The chosen initiatives now must signal a grant settlement with the European Local weather, Infrastructure and Atmosphere Govt Company. Agreements are anticipated to be signed by October. The chosen initiatives should attain monetary shut inside 2.5 years and begin manufacturing inside 5 years of signing the grant settlement.

Beneath the primary Hydrogen Financial institution public sale, seven initiatives throughout Finland, Norway, Portugal and Spain have been awarded a complete of EUR 720 million.

The seven initiatives have been to obtain subsidies of EUR 8 million to EUR 245 million, based on an announcement by the Fee April 30, 2024.

Germany availed of the public sale as a service below the primary bidding spherical and acquired Fee state help approval for its supply of EUR 350 million.

A third European Hydrogen Financial institution public sale is deliberate to be held by year-end with a suggestion of as much as EUR 1 billion.

“The Fee will quickly additionally launch the Hydrogen Mechanism below the European Hydrogen Financial institution”, the Fee added. “This on-line platform will carry collectively patrons and sellers and allow market individuals to share data and discover potential industrial companions”.

To contact the creator, e mail jov.onsat@rigzone.com

What do you assume? We’d love to listen to from you, be part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all vitality professionals to Converse Up about our business, share data, join with friends and business insiders and have interaction in knowledgeable neighborhood that can empower your profession in vitality.