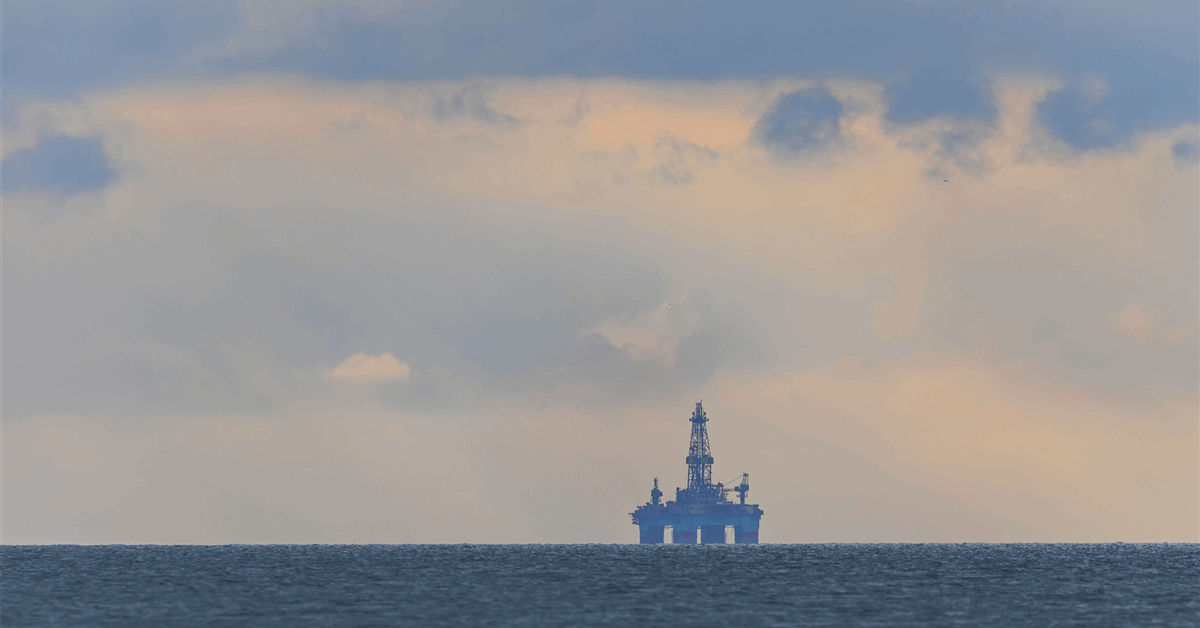

Oil dropped as the worldwide commerce warfare damage the outlook for demand, with information indicating indicators of pressure within the US economic system.

West Texas Intermediate slipped 2.6% to settle round $60 a barrel, the bottom shut in additional than two weeks. The extensively referenced US shopper confidence gauge weakened considerably in information launched Tuesday, one other signal of the pessimism stemming from President Donald Trump’s levies. Extra studies due this week, together with manufacturing information out of China, will shed additional gentle on the financial energy of the world’s greatest importer of crude.

A handful of spreads alongside the futures curve traded in contango on Tuesday as merchants brace for a “significant surplus” sooner or later, based on Morgan Stanley. At current, Brent’s nearer months are nonetheless pricier than these subsequent in sequence, forming a uncommon configuration with little historic precedent, based on the agency.

US crude is on monitor for the most important month-to-month loss since 2021, with costs battered by tit-for-tat tariffs between the US and its buying and selling companions, in addition to by OPEC+’s plans to revive extra manufacturing. Whereas many international locations are coming into into commerce negotiations with Washington, Beijing says it has to this point declined to interact.

There may be now an “elevated chance” that Saudi Arabia and different key OPEC+ nations decide to speed up deliberate provide will increase on the upcoming Might 5 assembly, JPMorgan analysts led by Natasha Kaneva mentioned in a notice.

“It’s turning into clear to the market that progress over latest months has primarily been pushed by stockpiling and pre-tariff hoarding,” mentioned Arne Lohmann Rasmussen, chief analyst at A/S World Threat Administration. “That impact is fading, which may result in a pointy decline in US progress as consumption begins drawing down current inventories as an alternative of boosting manufacturing.”

Geopolitical tensions are exhibiting indicators of cooling, growing the prospect of provides from some nations. Discussions concerning the Islamic Republic’s nuclear exercise have signaled progress, with the nation additionally pitching its sanctioned economic system as an funding alternative to the US.

Russian President Vladimir Putin declared a brand new three-day truce in his warfare on Ukraine that can begin on Might 8. Nonetheless, Putin is insisting that Russia should take management of 4 areas of Ukraine it doesn’t totally occupy as a part of any settlement to finish his warfare.

Elsewhere, Spain and Portugal returned to some semblance of normality after struggling Europe’s worst blackout in years, which pressured a number of oil refineries to halt.

Oil Costs:

- WTI for June supply retreated 2.6% to settle at $60.42 a barrel in New York.

- Brent for June settlement fell 2.4% to settle at $64.25 a barrel.

What do you assume? We’d love to listen to from you, be a part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all power professionals to Communicate Up about our trade, share information, join with friends and trade insiders and interact in an expert group that can empower your profession in power.

MORE FROM THIS AUTHOR

Bloomberg