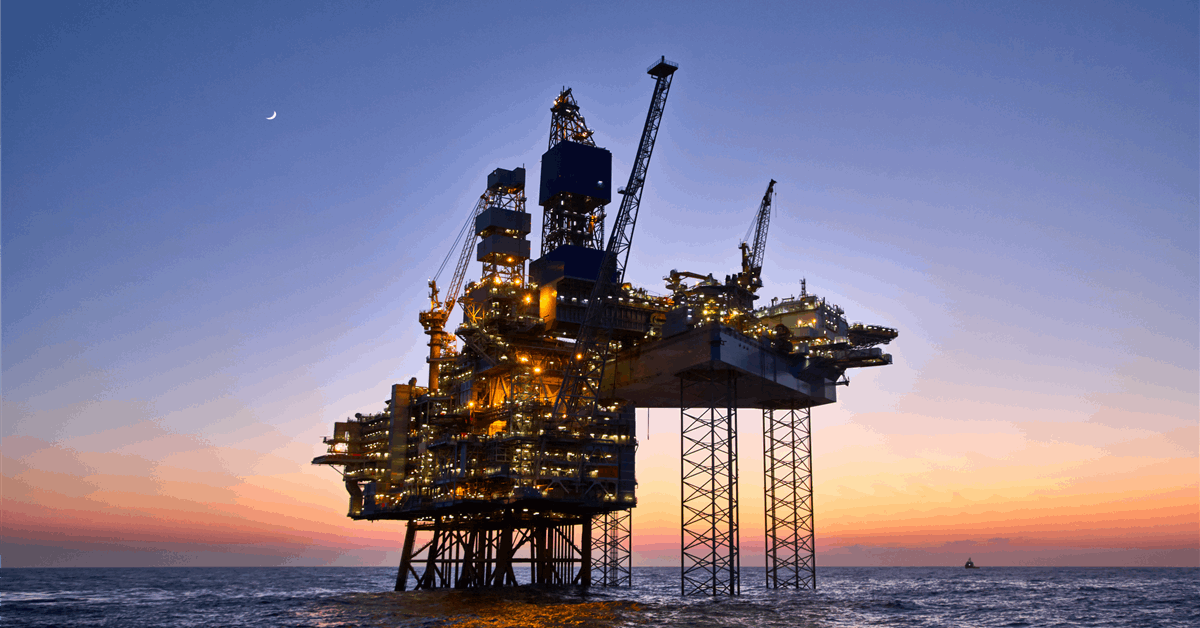

Gunvor Group, one of many world’s greatest impartial oil merchants, piled into the North Sea crude market throughout a wider rout in futures markets.

The North Sea crude market, residence to the world’s most vital bodily oil-price benchmark Dated Brent, typically sees particular person merchants taking comparatively giant positions, which means Gunvor’s actions aren’t definitive proof of bullishness.

Nonetheless, the Geneva-based agency — which took some hits on oil buying and selling final yr, together with within the North Sea — snapped up three cargoes of benchmark-setting crude in a pricing window run by S&P World Commodity Insights on Monday. It was additionally a big purchaser of Contracts for Distinction that additional assist to outline Dated Brent.

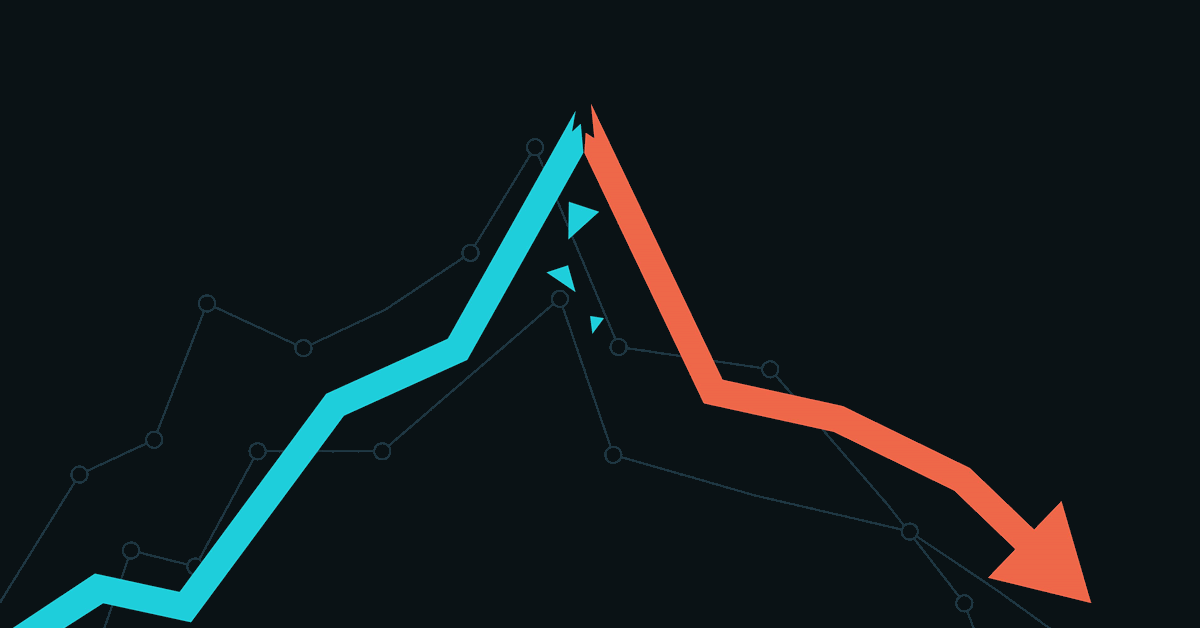

Whereas it’s not unusual for particular person corporations to make daring North Sea trades, the timing of Gunvor’s transfer is eye-catching. Brent futures collapsed 14% within the three periods via Monday because the market evaluated the demand influence of sweeping US tariffs on all of the nation’s principal buying and selling companions.

A Gunvor spokesperson declined to remark.

Shopping for exercise from different members within the North Sea market has been restricted, as has buying and selling of each Mediterranean and West African barrels. A number of bodily oil merchants mentioned they had been ready to see what the influence of the tariffs and countermeasures will likely be, whereas some others had been seeking to promote.

Dated Brent helps to set costs for greater than two-thirds of the world’s traded crude oil, in addition to influencing an online of related derivatives.

In an interview with Bloomberg final month, the dealer’s co-founder and CEO Torbjörn Törnqvist acknowledged that the agency had misplaced cash on some oil trades. Gunvor, which he mentioned was renewing its management after the losses, posted a 42% stoop in web income in 2024 as vitality market chaos eased.

An overhaul in its prime management crew has seen the departures of a number of senior merchants in latest months.

Regardless of the tumble in oil futures, differentials of key North Sea grades have been largely held up, with some even creeping increased.

Generated by readers, the feedback included herein don’t mirror the views and opinions of Rigzone. All feedback are topic to editorial assessment. Off-topic, inappropriate or insulting feedback will likely be eliminated.

MORE FROM THIS AUTHOR

Bloomberg