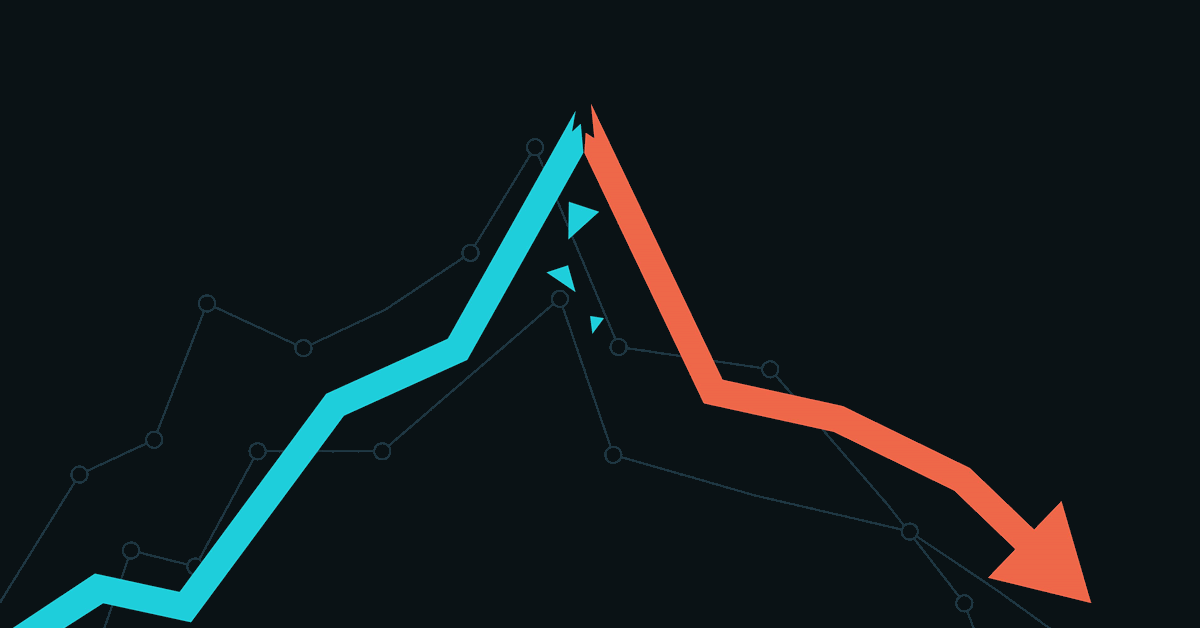

Oil fell to shut under $60 a barrel for the primary time since 2021 after the Trump administration moved to accentuate a tit-for-tat commerce conflict with China, inflaming issues in regards to the trajectory of world demand progress.

West Texas Intermediate futures fell for a fourth straight session to shut at $59.58 a barrel earlier than grazing a recent four-year low after settlement. US President Donald Trump is planning to proceed with implementing tariffs that may quantity to 104% on many Chinese language items simply after midnight, in line with a White Home official.

That might mark one other important escalation within the actions towards China, a significant crude-importing financial system. Beijing had responded earlier by saying it’s ready to “battle to the tip” by way of retaliatory commerce measures.

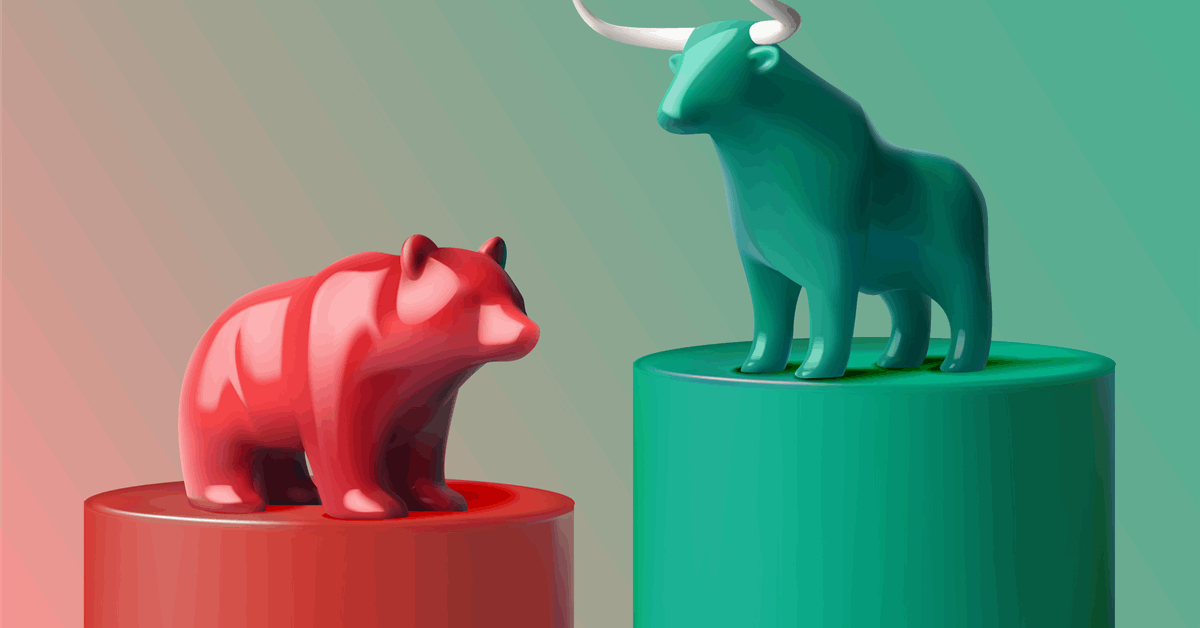

Crude, together with equities, bonds and different commodities, has been roiled this month because the US president presses on together with his aggressive commerce coverage. The ructions have stoked issues a couple of international slowdown or recession that may jeopardize power demand. On the similar time, OPEC+ delivered a bigger-than-expected output hike, hurting the outlook for oil market balances.

“We are able to count on much more flip-flopping within the near-term, for higher or worse,” mentioned Christina Qi, chief govt officer of Databento, a market knowledge supplier. “Until there’s some sort of clear directional catalyst, like a choice from OPEC or a significant central financial institution, the dynamic goes to remain very push-and-pull.”

Banks have been speeding to chop their forecasts in latest days in consequence. Societe Generale SA sees West Texas Intermediate at $57 a barrel by the tip of the yr, whereas Goldman Sachs Group Inc. warned of $40 Brent in an excessive case. A high US oil govt is already calling on the Trump administration to elucidate how a world commerce conflict will assist home producers.

The turbulence additionally pressured the US Vitality Data Administration to delay its month-to-month report, which had been due Tuesday. The company mentioned it was re-running its fashions to account for the newest market developments.

Chinese language crude consumers are prone to halt imports of American oil because the commerce conflict drags on, which can embody levies imposed by Beijing on US items, in line with native trade guide JLC. Corporations may as a substitute look to supply extra cargoes from Russia, the Center East, West Africa and South America, it mentioned.

On the similar time, choices markets have been exhibiting elevated wagers on decrease costs. Report volumes of bearish contracts traded final week, whereas places on Brent have been fetching their largest premiums to bullish calls since December 2021.

Oil Costs:

- WTI for Could supply slid 1.9% to settle at $59.58 a barrel in New York.

- Brent for June settlement dipped 2.2% to settle at $62.82 a barrel.

What do you assume? We’d love to listen to from you, be a part of the dialog on the

Rigzone Vitality Community.

The Rigzone Vitality Community is a brand new social expertise created for you and all power professionals to Converse Up about our trade, share data, join with friends and trade insiders and have interaction in an expert group that can empower your profession in power.

MORE FROM THIS AUTHOR

Bloomberg