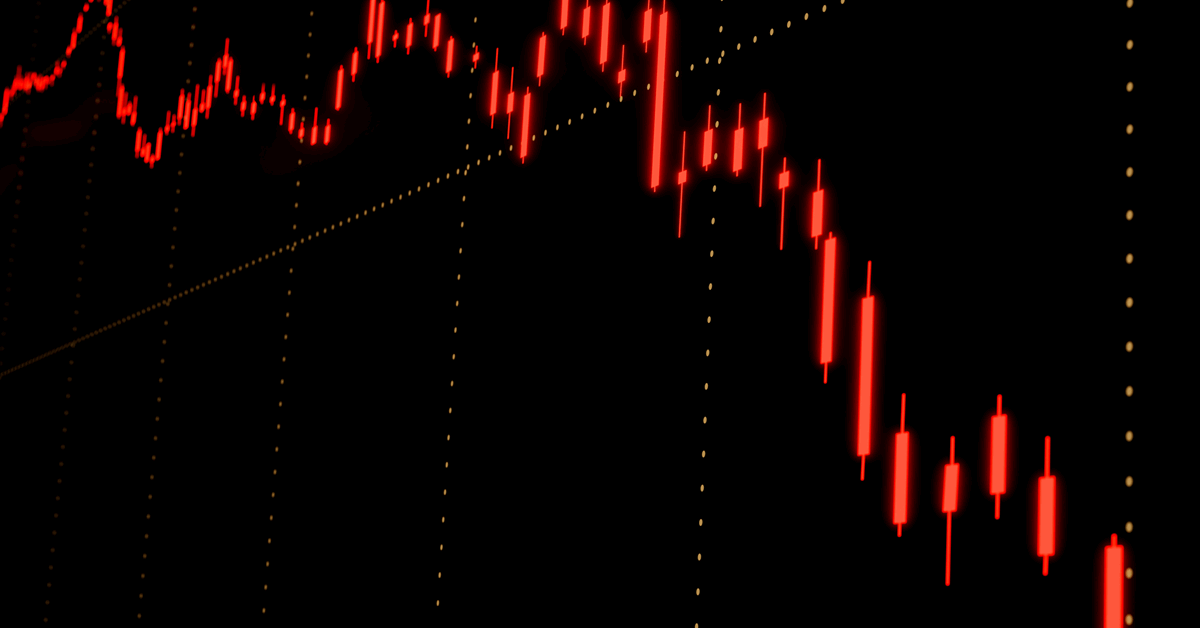

In an oil and fuel report despatched to Rigzone late Monday by the Macquarie staff, Macquarie strategists revealed that they’re forecasting that U.S. crude inventories can be down by 2.8 million barrels for the week ending March 21.

“This follows a 1.7 million barrel construct for the week ending March 14, with the crude steadiness realizing reasonably looser than our expectations amidst robust implied provide,” the strategists famous within the report.

“For this week’s crude steadiness, from refineries, we mannequin crude runs down barely (-0.1 million barrels per day) following a delicate print final week,” they added.

“Amongst web imports, we mannequin a average enhance, with exports modestly decrease (-0.2 million barrels per day) and imports modestly larger (+0.2 million barrels per day) on a nominal foundation,” they continued.

The strategists acknowledged within the report that timing of cargoes stays a supply of potential volatility on this week’s crude steadiness.

“From implied home provide (prod.+adj.+transfers), we search for a correction (-1.1 million barrels per day) this week,” the strategists went on to state.

“Rounding out the image, we anticipate one other small enhance in SPR [Strategic Petroleum Reserve] shares (+0.2 million barrels) this week,” they mentioned.

“Amongst merchandise, we search for attracts in gasoline (-2.7 million barrels) and distillate (-4.3 million barrels), with a construct in jet (+0.4 million barrels). We mannequin implied demand for these three merchandise at ~14.6 million barrels per day for the week ending March 21,” the strategists continued.

In its newest weekly petroleum standing report on the time of writing, which was launched on March 19 and included information for the week ending March 14, the U.S. Vitality Data Administration (EIA) highlighted that U.S. industrial crude oil inventories, excluding these within the SPR, elevated by 1.7 million barrels from the week ending March 7 to the week ending March 14.

This EIA report revealed that crude oil shares, not together with the SPR, stood at 437.0 million barrels on March 14, 435.2 million barrels on March 7, and 445.0 million barrels on March 15, 2024. Crude oil within the SPR stood at 395.9 million barrels on March 14, 395.6 million barrels on March 7, and 362.3 million barrels on March 15, 2024, the report confirmed. The EIA report highlighted that information might not add as much as totals resulting from unbiased rounding.

Whole petroleum shares – together with crude oil, whole motor gasoline, gasoline ethanol, kerosene kind jet gasoline, distillate gasoline oil, residual gasoline oil, propane/propylene, and different oils – stood at 1.596 billion barrels on March 14, the report highlighted. Whole petroleum shares have been up 1.9 million barrels week on week and up 22.5 million barrels yr on yr, the report confirmed.

In a market evaluation despatched to Rigzone on March 19, Quasar Elizundia, Skilled Analysis Strategist at Pepperstone, mentioned, “based on the newest weekly report from the Vitality Data Administration, U.S. crude inventories rose by 1.7 million barrels, a determine that shocked the market, producing downward strain”.

“This enhance displays a short-term weakening in home demand, heightening considerations amongst traders a few potential financial slowdown,” Elizundia added.

“Nonetheless, a vital decline in refined product shares may present short-term assist for costs. Gasoline inventories fell by 0.5 million barrels, whereas distillates dropped by 2.8 million. This contraction signifies a tight vitality market in key segments, which may restrict additional value declines,” Elizundia went on to state within the evaluation.

“The sustained discount in crude imports additionally emerges as a related issue. Imports stood at 5.4 million barrels per day, marking an 11 p.c yr over yr decline over the previous 4 weeks. This drop displays a strategic adjustment by U.S. importers, probably anticipating fluctuations in international provide,” Elizundia continued.

In an oil and fuel report despatched to Rigzone on March 17 by the Macquarie staff, Macquarie strategists revealed that they have been forecasting that U.S. crude inventories could be down by 1.2 million barrels for the week ending March 14.

The EIA’s subsequent weekly petroleum standing report is scheduled to be launched on March 26. It should embody information for the week ending March 21.

To contact the creator, electronic mail andreas.exarheas@rigzone.com