Executives from a few of the world’s prime oil and gasoline producers supplied full-throated assist for President Donald Trump’s “Vitality Dominance” on Monday, at the same time as monetary markets slumped on broader issues about his financial agenda.

The hallways and periods on the primary day of the annual CERAWeek by S&P International convention in Houston have been full of buzzy chatter and the vibes of an trade that’s trying ahead to an upswing.

Chevron Corp. Chief Government Officer Mike Wirth advised delegates the dialog round local weather change and vitality manufacturing is headed for a “reset.” Shell Plc boss Wael Sawan boasted of a “lengthy runway” forward for pure gasoline demand, whereas Saudi Aramco CEO Amin Nasser stated the failings within the vitality transition have been uncovered.

However because the executives spoke, New York oil futures dropped to a six-month low, whereas US equities have been hammered amid tariff-driven anxiousness. The strikes underscore how Trump’s push for US fossil gasoline hegemony dangers bumping up towards the financial repercussions of the commerce struggle set in movement by his administration.

US Vitality Secretary Chris Wright defended Trump’s agenda.

“Uncertainty is unsettling and that results in a lack of confidence — that results in concern,” he stated in an interview with Bloomberg Tv’s Alix Metal. “However look, life is lengthy. This administration has been in 50 days.”

“There’s a lot optimistic happening, however sure, you’re seeing the sausage making up shut and private. On the finish of the day, we wish to decrease prices for People,” Wright stated. “You’ve acquired to offer it somewhat little bit of time.”

On Tuesday, oil costs crawled again from its lows, recovering as a slide in international markets confirmed indicators of abating. West Texas Intermediate traded above $66 a barrel.

The US fossil gasoline trade is essential to Trump’s promise of a brand new “golden age” for the world’s greatest economic system. His administration represents a uncommon alternative for oil and gasoline corporations to lock in allowing for all the things from drilling leases to liquefied export terminals.

However the actuality is more likely to be lower than easy. Trump’s commerce tariffs are set increase costs for metal utilized in oil and gasoline pipes. Motion on immigration threatens to restrict the provision of staff. Crude costs are down roughly 15% since Trump was inaugurated on Jan. 20, which is able to make it more durable for even aggressive producers to elevate output as margins get compressed.

“If we have gotten somewhat extra nationalistic — and I’m not saying that’s a foul factor — nevertheless it does resonate with me that it’s going to have elevated inflation,” stated Larry Fink, CEO of BlackRock Inc. Deportations are going to have “extreme impacts” on the development sector, he stated. “I’ve even advised members of the Trump staff that we’re going to expire of electricians.”

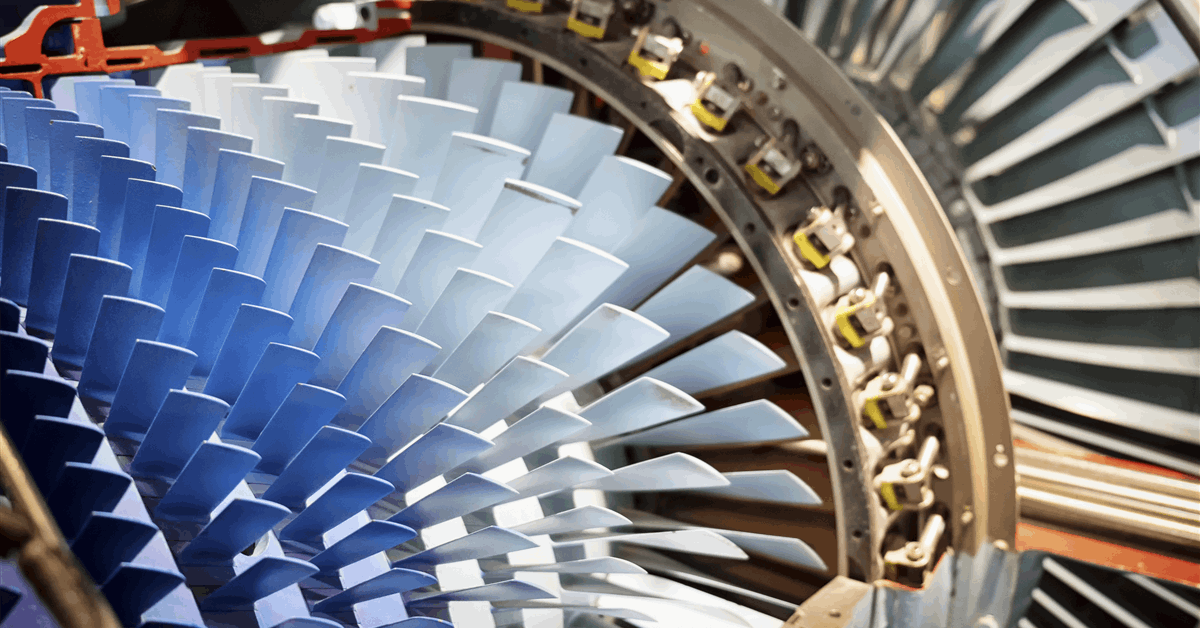

Fuel-fired energy technology is of explicit concern given it’s seemingly significance in underpinning the build-out of knowledge facilities for synthetic intelligence. Even earlier than the newest tariffs, the price of constructing gasoline energy technology has gone up threefold lately because of the long-lead occasions on generators, sluggish allowing, and a scarcity of labor, stated NextEra Vitality Inc. CEO John Ketchum.

“It’s all the above: We want renewables, we want gasoline, we want nuclear,” stated Ketchum, who needs the US to keep up Biden-era tax credit for renewables tasks.

“It’s all going to come back in at completely different occasions and it’s all going to come back in at completely different value profiles, however let’s not simply go and make selections that power us into one expertise,” he stated in an interview.

The oil and gasoline trade’s prime lobbyist is assured he can obtain carve-outs from Trump’s tariff coverage by making the case that imported metal and tubular items will increase home vitality manufacturing. US liquefied pure gasoline export capability is on the right track to develop 60% by 2027, requiring quite a lot of imported metal.

“The president and his staff absolutely acknowledge to assist meet the vitality dominance agenda you’re going to wish a commerce agenda that falls inside that body as nicely,” Mike Sommers, CEO of the American Petroleum Institute, stated in an interview. “There actually is a few uncertainty however there’s uncertainty with each administration.”

Even with the uncertainty, oil producers together with Chevron and Shell welcomed the the Trump administration’s pro-growth agenda, contrasting it with what they understand as overly stringent regulatory and local weather stances by the Biden administration and in Europe’s political circles.

“There’s no query the narrative is altering,” Sawan stated.

Generated by readers, the feedback included herein don’t replicate the views and opinions of Rigzone. All feedback are topic to editorial assessment. Off-topic, inappropriate or insulting feedback will probably be eliminated.

MORE FROM THIS AUTHOR

Bloomberg