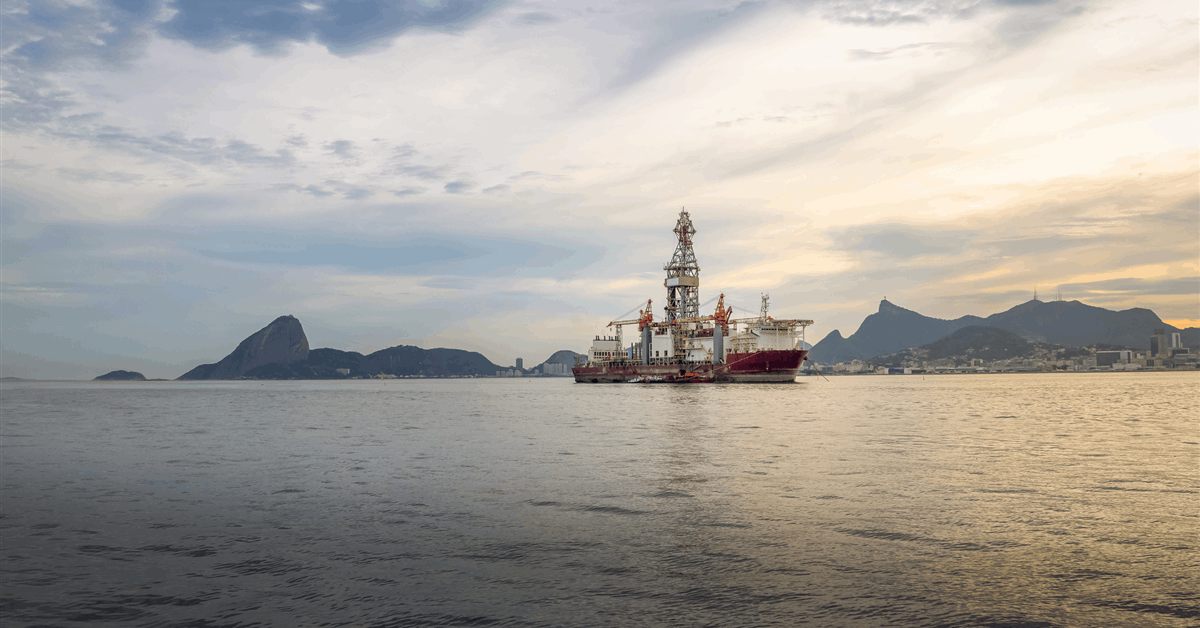

Oil rose essentially the most in six weeks as President Donald Trump affirmed plans to impose tariffs on the highest two suppliers of crude to the US.

West Texas Intermediate futures climbed about 2.5% to settle above $70 a barrel after Trump stated in a social media publish that the proposed levies on Canada and Mexico will go into impact on March 4.

The tariffs threaten to disrupt North America’s tightly built-in oil business and lift demand for US crude to backfill any Canadian or Mexican barrels which can be diverted elsewhere to keep away from the levies. Nonetheless, the tariffs’ results could also be blunted by the truth that many American refineries have been constructed to deal with these international locations’ heavy crudes, quite than domestically produced gentle oil, leaving them restricted choices for substitution. The US receives about about 4 million barrels a day from Canada and about 400,000 barrels a day from Mexico.

Even with Thursday’s acquire, crude remains to be on observe for its largest month-to-month loss since September because the prospect of commerce wars weighs on the outlooks for financial progress and power demand within the US and China, the world’s two largest shoppers. Costs had settled on Wednesday on the lowest since Dec. 10, following conflicting bulletins from the White Home on the varied commerce levies into consideration. In his publish on Thursday, Trump additionally stated China shall be charged an extra 10% tariff from March 4.

“The jury may be very a lot out on how the political and financial agenda of Donald Trump will influence progress,” stated Tamas Varga, an analyst at PVM Oil Associates Ltd. in London. “Reciprocal tariffs, tax and spending cuts might elevate inflationary stress and dent financial prosperity.”

There are additionally tentative indicators that barrels in some areas might start to movement once more. OPEC member Iraq stated that it had reached a pact with Kurdistan to renew crude exports via a pipeline shuttered for nearly two years, with out offering a timeframe. An imminent restart of the hyperlink has been touted many occasions earlier than with out coming to fruition.

Ukraine President Volodymyr Zelenskiy will go to the US on Friday, Trump stated. That comes because the US continues discussions to finish the three-year battle, a possible shift that would spur a loosening of sanctions on Russian flows.

Doable provide constraints are potential as nicely, together with renewed US efforts to squeeze flows from Iran and Venezuela, together with expectations that OPEC+ will as soon as once more defer a plan to progressively elevate output.

Oil Costs:

- WTI for April supply rose 2.5% to settle at $70.35 a barrel in New York.

- Brent for April settlement gained 2.1% to settle at $74.04 a barrel.

What do you assume? We’d love to listen to from you, be a part of the dialog on the

Rigzone Vitality Community.

The Rigzone Vitality Community is a brand new social expertise created for you and all power professionals to Converse Up about our business, share data, join with friends and business insiders and have interaction in an expert group that may empower your profession in power.

MORE FROM THIS AUTHOR

Bloomberg