In a press release despatched to Rigzone this week, U.S. Vitality Growth Company (USEDC) introduced “plans to deploy as much as $1 billion throughout 2025, primarily within the Permian Basin”.

USEDC mentioned within the assertion that its announcement follows a record-breaking yr throughout which USEDC deployed almost $800 million into operated and non-operated tasks. Final yr, USEDC evaluated over 220 alternatives and accomplished 29 transactions, the corporate highlighted within the assertion, stating that these had been each will increase from 2023 totals.

USEDC additionally famous within the assertion that the corporate improved price effectivity, “seeing reductions in price per lateral foot whereas sustaining robust productiveness”. In 2023, USEDC closed 19 transactions and deployed almost $600 million, the corporate mentioned within the assertion. It highlighted that almost all of those had been within the Permian Basin, “with different tasks within the Barnett, Haynesville, and Powder River basins”.

“Constructing on the momentum of 2024, USEDC is coming into 2025 with an identical development mindset, aiming to take a position as much as $1 billion in U.S.-operated and non-operated oil and fuel tasks, primarily within the Permian Basin,” USEDC mentioned within the assertion.

Rigzone requested the corporate if this $1 billion funding will lead to any further jobs or job retention. Responding to the query, a USEDC spokesperson mentioned, “sure, we anticipate our anticipated capital deployment goals for 2025 to facilitate additional alternatives to develop and strengthen our crew”.

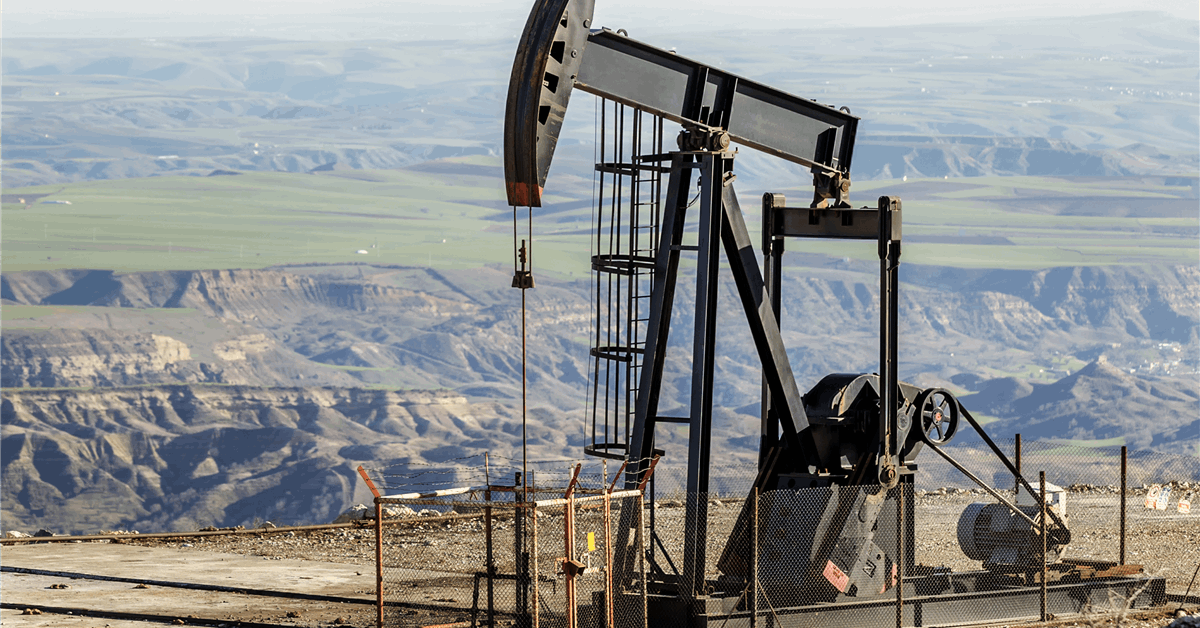

Within the assertion despatched to Rigzone this week, USEDC mentioned it expects the Permian Basin to stay the first focus of its funding in 2025 due largely to the economics of drilling and working wells within the basin. The corporate mentioned within the assertion that it has skilled constant outcomes and is assured in its skill to proceed to accumulate high-potential Permian Basin properties and effectively handle the prices of operated and non-operated ventures.

“We now have constructed a robust monitor document of sourcing and transacting on high-quality alternatives, and our skill to deploy capital effectively continues to drive robust outcomes,” Jordan Jayson, Chairman and CEO of USEDC.

“Our method stays the identical – we’ll proceed to guage alternatives that align with our disciplined funding technique and ship worth to our companions. With a robust basis and a focused method, we’re well-positioned to construct on our momentum coming into 2025,” he added.

“Our long-term acquisition and manufacturing methods proceed to generate stable efficiency throughout a portfolio of greater than 2,000 wells. Regardless of world value volatility and market uncertainty, the vitality market remained comparatively secure, and our status for finishing offers resulted in a document circulation of profitable transactions and capital deployment in 2024,” Jayson went on to state.

In a press release posted on its web site in December final yr, USEDC Government Vice President Matthew Iak mentioned, “regardless of the geopolitical uncertainty within the U.S. and the remainder of the world in 2024, the vitality markets have remained comparatively secure, and deal circulation has been robust”.

“It’s virtually paradoxical that in a tumultuous yr, globally and domestically, the vitality market’s outstanding achievement has been its really unremarkable stability,” he added.

“For USEDC, we continued to see a gentle, enticing deal circulation, many at advantageous value ranges for corporations with a stable capital construction and sturdy infrastructure,” he went on to state.

“We proceed to actively pursue and put money into offers throughout the Permian Basin, recognizing it as probably the greatest areas for predictable productiveness and returns,” he continued.

In one other assertion posted on its web site in June final yr, USEDC mentioned it was “strategically increasing its operations within the prolific Permian Basin”.

“Constructing on a sequence of current successes, the corporate is poised for important development and improvement in one of the crucial productive oil and fuel areas in the USA,” the corporate added in that assertion.

USEDC describes itself as a privately held exploration and manufacturing agency that manages property for itself and its companions. The corporate is headquartered within the Dallas-Fort Price metro space and has invested in, operated, and/or drilled roughly 4,000 wells in 13 states and Canada and deployed greater than $2 billion on behalf of itself and its companions, in accordance with its web site.

To contact the writer, e-mail andreas.exarheas@rigzone.com