Constellation Power Company is buying Calpine Corp. to create the “nation’s largest clear power supplier”.

The 2 corporations have entered into an settlement beneath which Constellation will purchase Calpine in a money and inventory transaction valued at an fairness buy value of roughly $16.4 billion, composed of fifty million shares of Constellation inventory and $4.5 billion in money plus the idea of roughly $12.7 billion of Calpine’s web debt.

After accounting for money that’s anticipated to be generated by Calpine between signing and the anticipated time limit, in addition to the worth of tax attributes at Calpine, the web buy value is $26.6 billion, Constellation stated in a information launch.

The acquisition “creates the cleanest and most dependable era portfolio within the USA, with a various, coast-to-coast portfolio of zero- and low-emission era property,” Constellation stated.

The transaction is anticipated to shut inside 12 months of signing, topic to the satisfaction of customary closing circumstances, together with the expiration or termination of the ready interval pursuant to the Hart-Scott-Rodino Act, and regulatory approvals from the Federal Power Regulatory Fee, the Canadian Competitors Bureau, the New York Public Service Fee, the Public Utility Fee of Texas and different regulatory businesses.

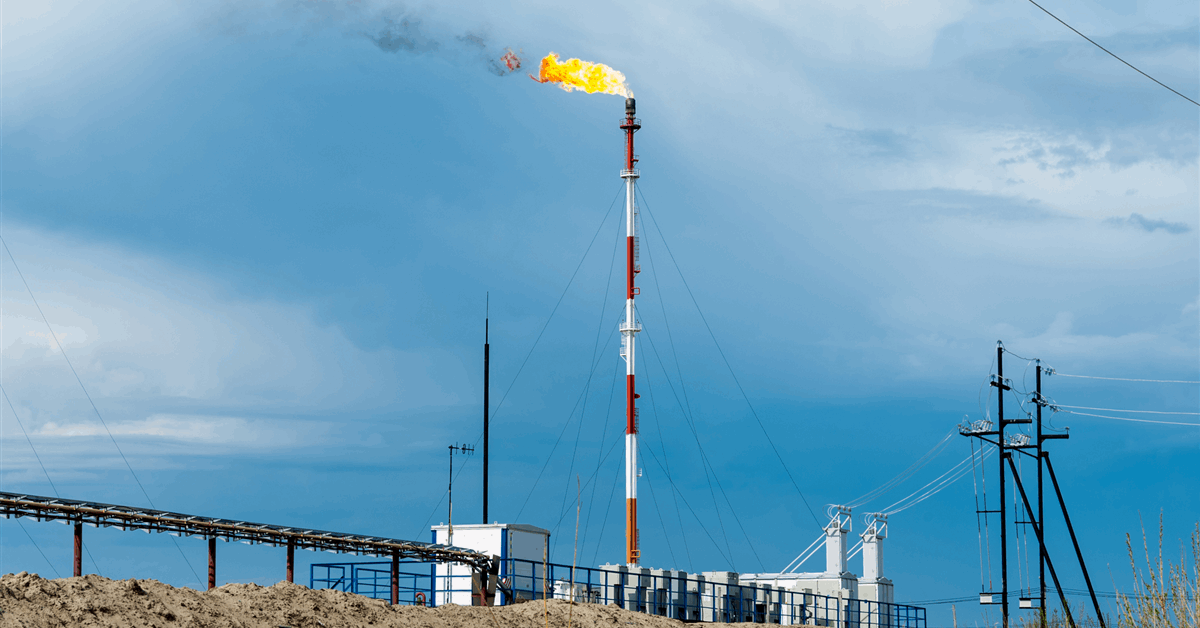

The mix of Constellation and Calpine may have practically 60 gigawatts (GW) of capability from zero- and low-emission sources, together with nuclear, pure gasoline, geothermal, hydro, wind, photo voltaic, cogeneration and battery storage. The mixed firm’s footprint will embody a considerably expanded presence in Texas, the quickest rising marketplace for energy demand, in addition to different key strategic states, together with California, Delaware, New York, Pennsylvania, and Virginia, in line with the discharge.

Constellation additionally famous that the mixture additionally varieties the “nation’s main aggressive retail electrical provider,” offering 2.5 million prospects with a broader array of personalized power and sustainability options and new product choices.

Calpine’s low-emission pure gasoline vegetation “will play a key function in sustaining grid reliability for many years to come back,” Constellation stated. The Baltimore-based firm acknowledged it would put money into including extra zero-emission power to the grid by extending the lifetime of present clear power sources, exploring new superior nuclear initiatives, investing in renewables and rising the output of present nuclear vegetation, along with restarting the Crane Clear Power Middle in Pennsylvania.

“This acquisition will assist us higher serve our prospects throughout America, from households to companies and utilities,” Constellation President and CEO Joe Dominguez stated. “By combining Constellation’s unmatched experience in zero-emission nuclear power with Calpine’s industry-leading, best-in-class, low-carbon pure gasoline and geothermal era fleets, we can provide the broadest array of power services and products out there within the {industry}. Each corporations have been on the forefront of America’s transition to cleaner, extra dependable and safe power, and people shared values will information us as we pursue investments in new and present clear applied sciences to satisfy rising demand”.

Calpine President and CEO Andrew Novotny stated, “That is an unimaginable alternative to convey collectively high tier era fleets, main retail buyer companies and the most effective folks in our {industry} to assist drive a stronger American economic system for a cleaner, more healthy and extra sustainable future. Collectively, we might be higher positioned to convey accelerated funding in all the pieces from zero-emission nuclear to battery storage that can energy our economic system in a approach that places folks and our surroundings first”.

Upon the shut of the transaction, Constellation stated it would proceed to be headquartered in Baltimore and can proceed to take care of a major presence in Houston, the place Calpine is at the moment headquartered.

To contact the writer, e mail rocky.teodoro@rigzone.com

Generated by readers, the feedback included herein don’t mirror the views and opinions of Rigzone. All feedback are topic to editorial evaluation. Off-topic, inappropriate or insulting feedback might be eliminated.