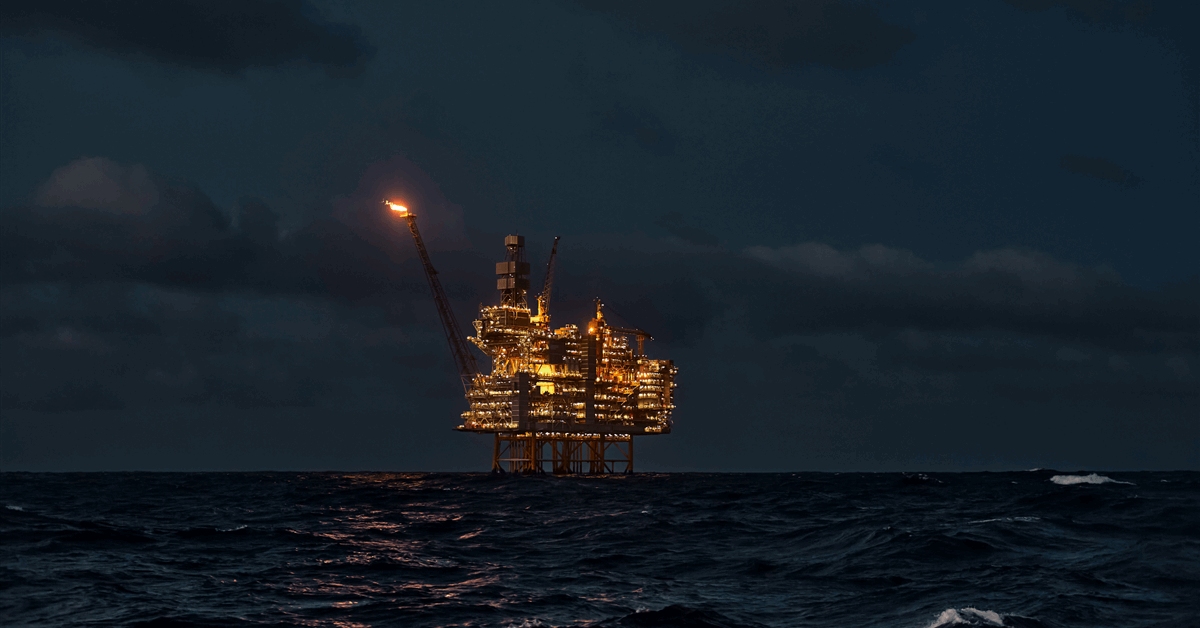

Oil snapped a five-session rally as key technical markers present positive factors pushed by tightness in international bodily crude markets might have gone too far.

West Texas Intermediate fell 0.5% to settle beneath $74 a barrel, reversing earlier positive factors after futures had been unable to breach a psychological degree of $75. WTI’s immediate unfold dipped from a close to three-month excessive to 65 cents in an indication of evaporating dealer confidence that demand is outstripping provide.

The relative power index additionally confirmed costs at overbought ranges, a studying that signifies crude was due for a pullback. Market optimism is being restricted by expectations for a glut, the attainable revival of idled OPEC+ manufacturing and lackluster demand from prime importer China.

“Fundamentals have improved sufficient for crude costs to discover a ground, however not sufficient to maintain a sturdy rally,” mentioned Jon Byrne, an analyst at Strategas Securities. In the meanwhile, “$75 is the ceiling, with alternatives on the brief facet.”

The commodity earlier grazed October highs after Saudi Arabia hiked oil costs to Asian clients, a vote of confidence for crude demand. That adopted a bounce in Oman and Dubai crude costs on the finish of final 12 months on scant provide from Iran and Russia.

In broader markets, the US greenback plummeted after the Washington Submit reported that US President-elect Donald Trump will restrict his plans for tariffs. The greenback has since recovered a number of the losses after Trump denied the report on social media. A weaker greenback makes commodities priced within the foreign money extra engaging.

Final week, crude broke out of its slim buying and selling vary as US stockpiles fell for the sixth straight week whereas inventories on the very important storage hub of Cushing, Oklahoma, held at a 17-year seasonal low.

Oil Costs:

- WTI for February supply fell 0.5% to settle at $73.56 a barrel in New York.

- Brent for March settlement slipped 0.3% to settle at $76.30 a barrel.

What do you assume? We’d love to listen to from you, be part of the dialog on the

Rigzone Vitality Community.

The Rigzone Vitality Community is a brand new social expertise created for you and all vitality professionals to Converse Up about our trade, share information, join with friends and trade insiders and have interaction in an expert neighborhood that can empower your profession in vitality.

MORE FROM THIS AUTHOR

Bloomberg