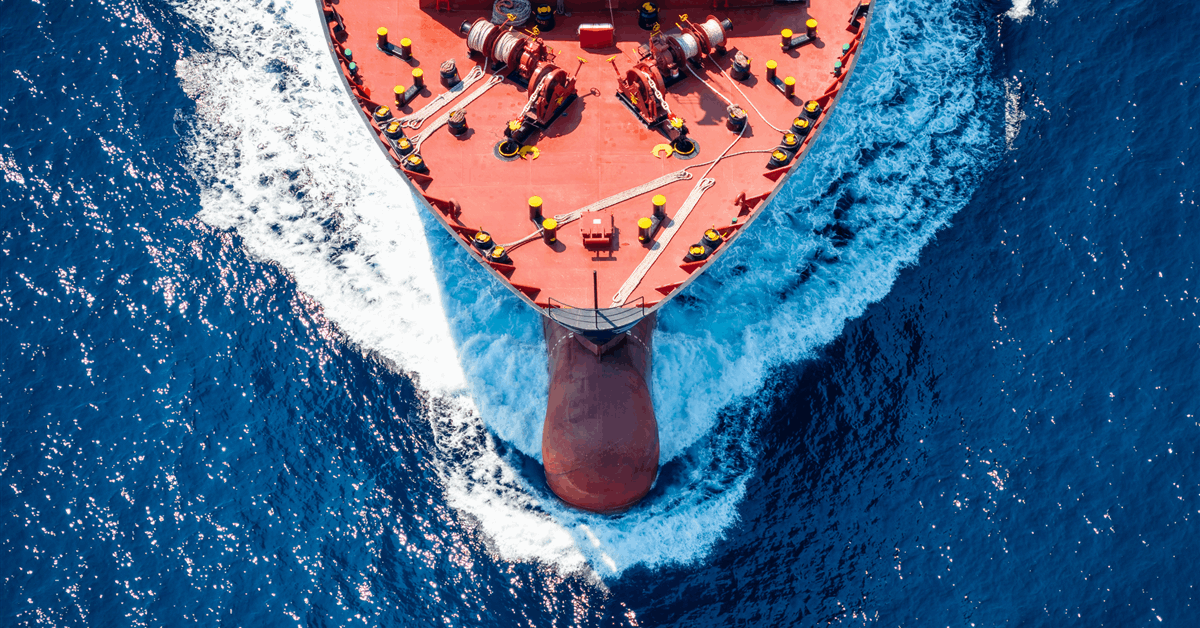

Equinor ASA has introduced a remaining funding resolution on Empire Wind 1 and monetary shut for $3 billion in debt financing for the under-construction undertaking offshore Lengthy Island, anticipated to energy 500,000 New York properties.

The Norwegian majority state-owned vitality main stated in a press release it intends to farm down possession “to additional improve worth and cut back publicity”.

Equinor has taken full possession of Empire Wind 1 and a pair of since final 12 months, in a swap transaction with 50 % co-venturer BP PLC that allowed the previous to exit the Beacon Wind lease, additionally a 50-50 enterprise between the 2.

Equinor has but to finish a portion of the transaction beneath which it will additionally purchase BP’s 50 % share within the South Brooklyn Marine Terminal lease, in response to the newest transaction replace on Equinor’s web site. The lease includes a terminal conversion undertaking that was meant to function an interconnection station for Beacon Wind and Empire Wind, as agreed on by the 2 corporations and the state of New York in 2022.

“The anticipated complete capital investments, together with charges for using the South Brooklyn Marine Terminal, are roughly $5 billion together with the impact of anticipated future tax credit (ITCs)”, stated the assertion on Equinor’s web site saying monetary shut.

Equinor didn’t disclose its backers, solely saying, “The ultimate group of lenders consists of a number of the most skilled lenders within the sector together with lots of Equinor’s relationship banks”.

“Empire Wind 1 would be the first offshore wind undertaking to attach into the New York Metropolis grid”, the assertion added.

“The redevelopment of the South Brooklyn Marine Terminal and development of Empire Wind 1 will create greater than 1,000 union jobs within the development section”, Equinor stated.

On February 22, 2024, the Bureau of Ocean Power Administration (BOEM) introduced it had allowed Equinor to proceed with the development of Empire Wind 1 and a pair of, which might rise partially in New York and partially in New Jersey. “Collectively these tasks would have a complete capability of two,076 megawatts of fresh, renewable vitality that BOEM estimates might energy greater than 700,000 properties annually”, the Inside Division sub-agency stated in a press release then.

On March 1, 2024, the New York State Power Analysis and Improvement Authority (NYSERDA) introduced the 810-MW Empire Wind 1 as one of many conditional winners in its fourth offshore wind solicitation spherical.

On March 27, 2024, Empire Offshore Wind LLC stated it had inked a union deal securing development work for the undertaking to transform the delivery terminal right into a staging and assembling facility that may serve the 2 Empire Wind amenities.

On June 5, 2024, Equinor introduced a purchase order and sale settlement with NYSERDA for Empire Wind 1.

“At a strike value of $155.00 per MW/h [megawatt hour] Empire Wind 1 is anticipated to ship ahead wanting actual base undertaking returns inside the guided vary for renewable tasks”, Equinor stated on the time.

To contact the writer, e-mail jov.onsat@rigzone.com

What do you assume? We’d love to listen to from you, be a part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all vitality professionals to Communicate Up about our business, share information, join with friends and business insiders and have interaction in an expert group that may empower your profession in vitality.