As we enter the brand new 12 months, U.S. pure gasoline costs have some short-term bearish sentiment after breaking under a key pivot level at $3.61 per million British thermal models (MMBtu).

That’s what Artwork Hogan, Chief Market Strategist at B. Riley Wealth, advised Rigzone in an unique interview on Friday when requested why the U.S. pure gasoline worth is dropping right now.

“Rapid assist is seen at $3.35 per MMBtu, with the subsequent stage at $3.16 per MMBtu, the place consumers could step in,” he added.

“On the upside, $3.61 per MMBtu serves as the primary resistance, adopted by $3.92 per MMBtu, and $4.20 per MMBtu,” Hogan continued.

Within the interview, Hogan famous that pure gasoline costs “have been extraordinarily risky over the past 5 buying and selling days, with the commodity buying and selling as much as $4 per MMBtu to finish 2024”.

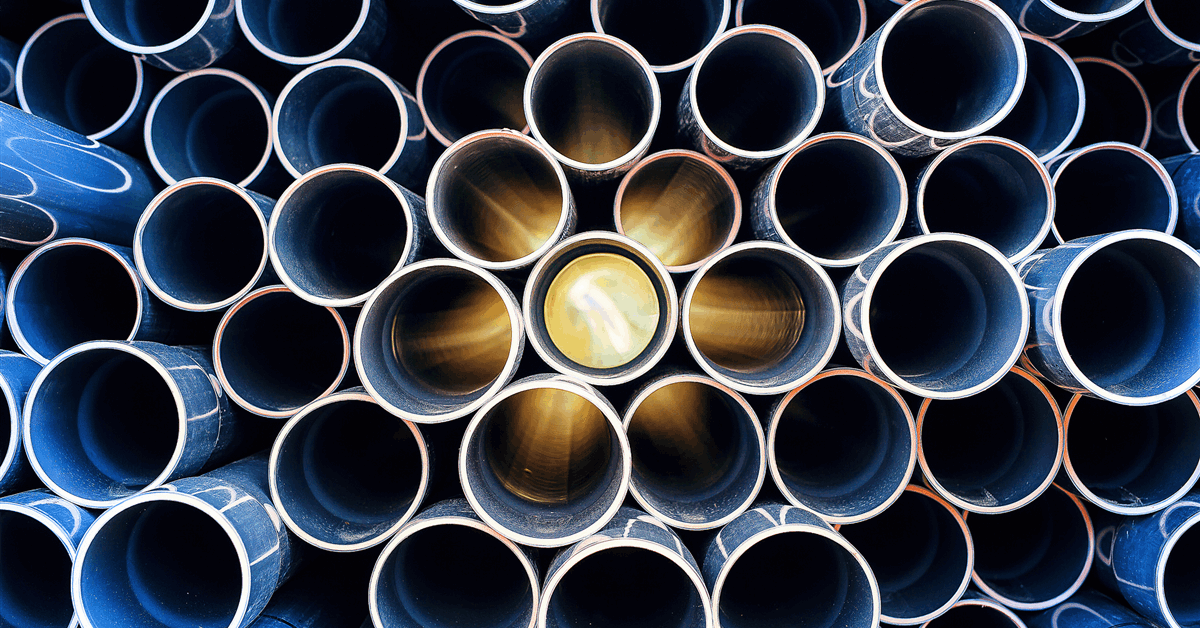

When he was requested why the U.S. pure gasoline worth is dropping right now in a separate unique interview on Friday, Phil Flynn, a senior market analyst on the PRICE Futures Group, advised Rigzone that “there appears to be some backing off of the arctic forecasts”.

“If we don’t get a deep freeze in Texas, the issues about freeze offs diminish,” he added.

“But I might not get too snug … forward of late day climate fashions that would ship us again to the upside,” Flynn continued.

In a market evaluation despatched to Rigzone earlier right now, Samer Hasn, a senior market analyst at XS.com, stated pure gasoline costs “proceed to right from current highs”.

“U.S. Henry Hub futures have fallen to $3.558 per MMBtu,” Hasn added out there evaluation.

In a media advisory despatched to Rigzone by the AccuWeather crew late Thursday, the corporate warned that “greater than 250 million folks throughout 40 states will really feel the results of the coldest and most persistent blasts of arctic air in a minimum of a number of years, reaching the central, southern, and japanese United States”.

“That is the primary snow and ice storm of 2025, and we may see widespread impacts,” AccuWeather Chief On-Air Meteorologist Bernie Rayno acknowledged within the media advisory.

“This storm shall be far sufficient south to trigger main issues in cities that will wrestle to take care of wintry climate and ice,” he added.

“Arctic air will surge southward within the wake of this storm with subfreezing temperatures for thousands and thousands of individuals,” he warned.

B. Riley Wealth’s web site notes that Hogan’s “distinguished monetary {industry} profession spans 30+ years, throughout which he has focused on the U.S. fairness markets”. The positioning factors out that Hogan has served as a member of the Board of Governors of Boston Inventory Trade, Inc., and a member of the Board of Administrators of NASDAQ OMX BX, Inc.

B. Riley Wealth affords a world-class wealth administration and monetary planning platform designed to supply purchasers with a full suite of providers together with brokerage, funding administration, insurance coverage and tax preparation providers, B. Riley’s web site states.

Flynn is described on the PRICE Futures Group web site as “one of many world’s main power market analysts, offering particular person buyers, skilled merchants, and establishments with up-to-the-minute funding and threat administration perception into world petroleum, gasoline, and power markets”. Flynn can also be a each day contributor to Fox Enterprise Community, the location highlights.

In accordance with its web site, the PRICE Futures Group’s mission is to “present merchants and buyers with industry-leading buying and selling options, informative market evaluation, and cutting-edge applied sciences which allow environment friendly decision-making”.

XS.com describes itself on its web site as an “award-winning world multi-asset fintech and monetary providers supplier”.

With world headquarters in State Faculty, PA, and different workplaces world wide, AccuWeather serves greater than 1.5 billion folks each day, the corporate’s web site states.

To contact the writer, electronic mail andreas.exarheas@rigzone.com