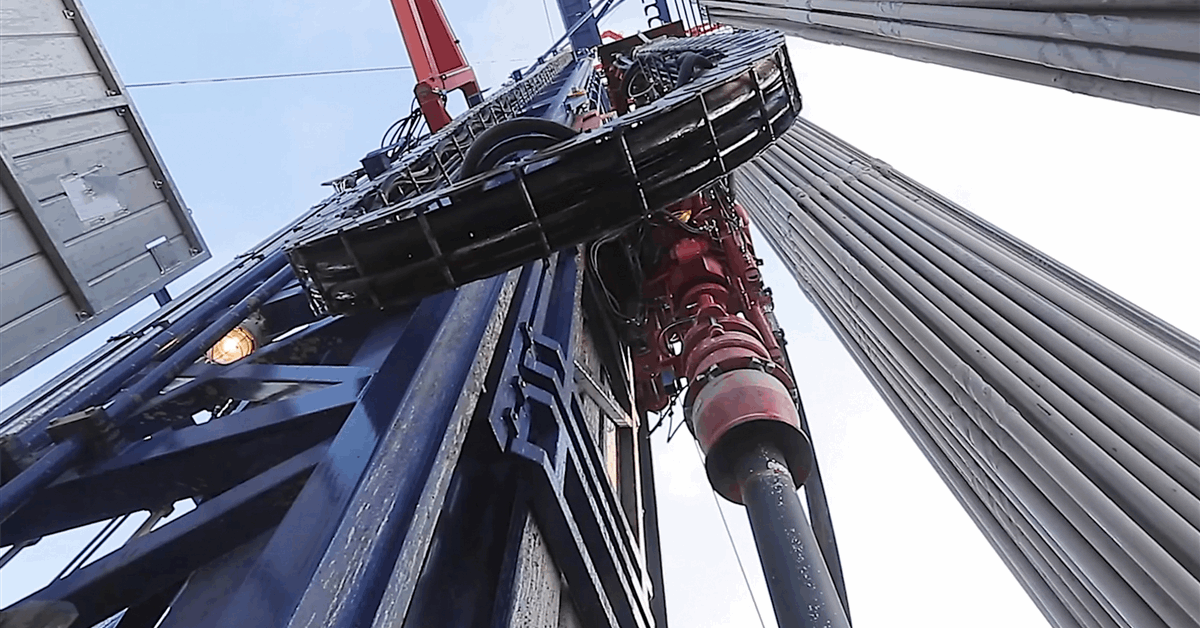

The board of the Export-Import Financial institution of america (EXIM) has accepted about $527 million in financing for an Exxon Mobil Corp.-supported gas-to-power undertaking in Guyana that the export credit score company stated would double the South American nation’s put in technology capability.

The mortgage to the Guyanese Finance Ministry will assist the development of a pure fuel separation plant and a 300-megawatt combined-cycle fuel turbine energy plant, in addition to help companies associated to the fuel pipeline close to the capital Georgetown.

“This undertaking will permit Guyana to transition to extra dependable and cleaner power for shoppers and companies by utilizing pure gas-powered generators to generate electrical energy”, EXIM stated in an internet assertion. “With out this gas-to-energy undertaking, Guyana will proceed to import gasoline oil, one of many highest polluting fossil fuels, and be unable to decommission a whole bunch of much less environment friendly native mills”.

The undertaking will keep away from over 460,000 tons of carbon dioxide a 12 months, the equal of consuming over a million barrels of oil, based on EXIM.

EXIM president and chair Reta Jo Lewis stated, “I’m particularly proud to proceed to help Financial institution priorities and constitution mandates together with tasks that align with the administration’s financial, power, and nationwide safety priorities”.

EXIM added, “The financing will help a U.S. three way partnership involving Lindsayca, a Texas-based firm, and CH4 Programs, a Puerto Rican small enterprise, and companies offered by ExxonMobil”.

“The financing may even help a couple of dozen U.S. firms”, it stated, including the undertaking will present about 1,500 jobs throughout 11 U.S. states and territories.

The mortgage can be an implementation of EXIM’s China and Transformational Exports Program, a mandate for the company to assist U.S. exporters dealing with competitors from Chinese language counterparts, EXIM stated.

In line with the Institute for Power Economics and Monetary Evaluation (IEEFA), the Guyanese undertaking would solely contribute to grid overbuild on the expense of the undertaking being bailed out resulting from debt.

“ExxonMobil would acquire essentially the most from the Fuel to Power Mission, by earnings from pipeline building, lending cash to Guyana, and promoting pure fuel”, the Lakewood, Ohio-based assume tank stated in an evaluation printed October 4, 2023.

“As a substitute of spending billions for an overbuilt, fossil fuel-reliant grid that may depart Guyana in debt for years, IEEFA discovered that Guyana might use its oil earnings for a dependable, low-cost rooftop photo voltaic resolution that will save billions whereas offering low-carbon electrical energy to the whole nation”, IEEFA added.

Guyana’s Division of Public Info (DPI) stated in a separate assertion in regards to the mortgage approval that an impartial technical and environmental feasibility examine had been carried out and a evaluate by the U.S. Congress handed earlier than the mortgage approval.

On criticisms that the mortgage helps a fossil gasoline undertaking, Guyanese Vice President Bharrat Jagdeo, in feedback relayed within the DPI assertion, pointed to EXIM’s assertion that the undertaking will end in emission discount.

“As well as, the federal government will likely be saving roughly $100 million yearly on gasoline prices, whereas electrical energy prices will likely be slashed by 50 %, resulting in an annual saving of $250 million”, the DPI assertion added.

Jagdeo stated, “It has an affect on each steadiness of fee of the nation and in addition within the pockets of Guyanese firms and people”. Jadeo famous the EXIM mortgage would cowl solely 25 % of the undertaking.

The DPI stated, “Roughly $2 billion is required to assemble the foremost facility, with the federal government expending its personal sources to finance the remainder of the undertaking, together with by a partnership with ExxonMobil”.

Rigzone despatched remark requests to ExxonMobil, EXIM and Guyana’s Finance Ministry and DPI in regards to the considerations raised by IEEFA.

To contact the writer, e-mail jov.onsat@rigzone.com

Generated by readers, the feedback included herein don’t replicate the views and opinions of Rigzone. All feedback are topic to editorial evaluate. Off-topic, inappropriate or insulting feedback will likely be eliminated.