World oil and fuel contract exercise noticed a 35 p.c quarter on quarter lower in complete disclosed worth, from $55.3 billion within the second quarter to $35.7 billion within the third quarter.

That’s what GlobalData acknowledged in a launch despatched to Rigzone lately, including that, “regardless of this, regular contract volumes, significantly within the Center East, had been pushed by substantial initiatives”. GlobalData highlighted within the launch that its newest report on oil and fuel trade contracts revealed that general contract quantity “remained comparatively secure, with 1,519 contracts in Q3 2024 in comparison with 1,546 in Q2 2024”.

A chart displaying oil and fuel trade contracts by scope within the third quarter, which was included within the launch, confirmed that, in the course of the interval, there have been 687 contracts with an operations and upkeep focus, 494 contracts with a procurement focus, and 157 contracts with a number of scopes.

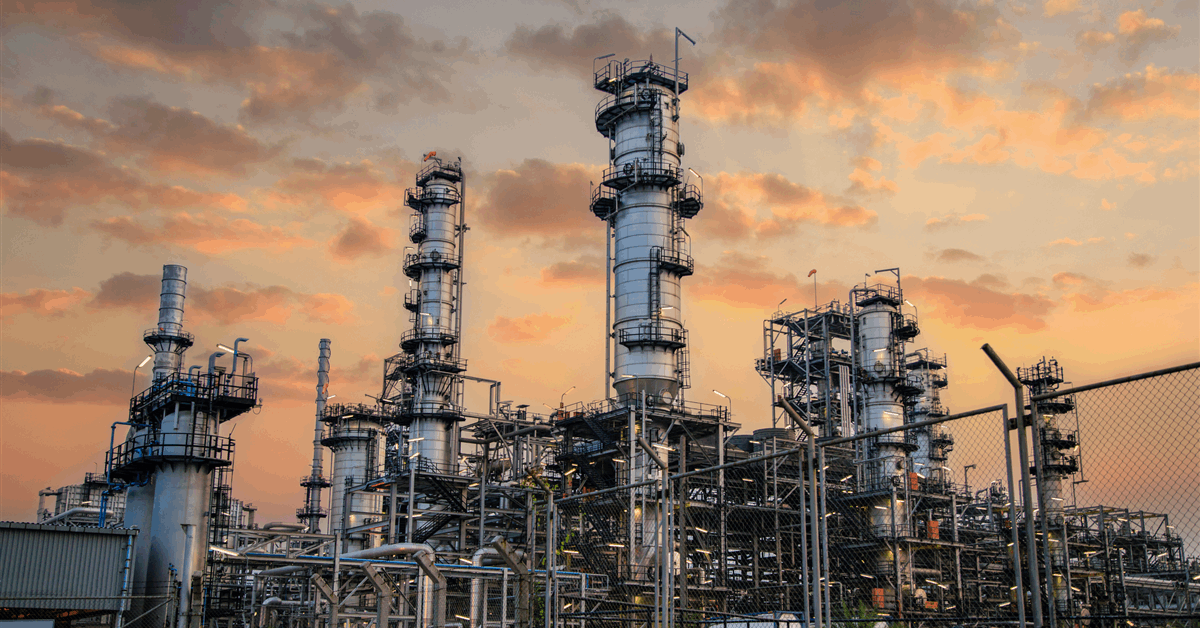

Notable contracts awarded throughout Q3 embody Bechtel Power’s roughly $4.3 billion lump-sum turnkey EPC contract for Prepare 4 and associated infrastructure on the Rio Grande Liquefied Pure Fuel (LNG) export undertaking within the Port of Brownsville, Texas, the discharge acknowledged.

GlobalData’s launch additionally famous that Saipem “made important contributions with a number of key contracts such because the $4 billion settlement with QatarEnergy LNG for the North Area offshore compression program in Qatar”.

GlobalData additionally highlighted within the launch that Saipem “secured a $2 billion contract from Saudi Aramco for the EPCI of wellhead platform topsides, jackets, tie-in platforms, inflexible flowlines, submarine composite cables, and fiber optic cables for the Marjan area in Saudi Arabia” and identified that it “additional it acquired two contracts general valued roughly $1 billion for the EPCI of jackets, manufacturing deck modules, subsea pipelines (each inflexible and versatile), and subsea energy cables for the Marjan, Zuluf, and Safaniyah fields in Saudi Arabia”.

Within the launch, Pritam Kad, an oil and fuel analyst at GlobalData, mentioned, “contract exercise within the Center East has offered little stability, serving to to offset the general worth decline”.

“That is pushed by Saipem’s $4 billion contract from QatarEnergy LNG for the North Area offshore compression program in Qatar and important contracts price over $3 billion from Saudi Aramco for Engineering, Procurement, Development, and Set up (EPCI) work on the Zuluf, Safaniyah, and Marjan area improvement initiatives in Saudi Arabia,” Kad added.

“The surge in large-scale offshore and subsea initiatives, significantly within the Center East, underscores the continued emphasis on increasing power infrastructure to fulfill rising demand,” Kad continued.

“As corporations safe high-value contracts throughout key oilfields, the sector will not be solely reinforcing its strategic partnerships but in addition positioning itself to help long-term progress in power manufacturing, with an growing concentrate on sustainability and technological innovation in undertaking execution,” Kad went on to state.

In a launch despatched to Rigzone by the GlobalData workforce again in August, GlobalData mentioned international oil and fuel contract exercise “acquired a lift from Petrobras’ key upstream contracts within the second quarter of 2024”.

“The trade witnessed a notable 47 p.c quarter on quarter improve in complete disclosed worth to succeed in $54.91 billion in Q2 2024 from $37.3 billion in Q1,” GlobalData added.

In that launch, GlobalData highlighted that its newest oil and fuel contract exercise report on the time confirmed that “general oil and fuel contracts quantity decreased marginally from 1,473 in Q1 2024 to 1,377 in Q2 2024”.

Kad famous on this launch that “Petrobras’ monumental awards, together with the $8.15 billion P-84 and P-85 FPSO development contract to Seatrium, the $1.8 billion contract for subsea engineering to the Sapura consortium, and an extra $2.5 billion for pipelay vessels, inflexible risers, and flowlines contracts to Subsea 7, had been the driving forces behind the surge within the general oil and fuel contracts worth”.

In a launch despatched to Rigzone by the GlobalData workforce in November 2023, GlobalData mentioned the oil and fuel trade’s general disclosed contract worth witnessed 1 / 4 on quarter lower of 26 p.c in Q3 2023.

That launch identified that the corporate’s newest contract exercise report on the time confirmed that general contract worth decreased from $57.4 billion in Q2 2023 to $42.6 billion in Q3 2023.

“On the similar time, the contract quantity additionally noticed a drop from 1,425 in Q2 2023 to 1,128 in Q3 2023,” GlobalData famous in that launch.

To contact the writer, e mail andreas.exarheas@rigzone.com