Oil rose as geopolitical tensions from Russia to Iran ratcheted larger whereas energy in fairness markets elevated the enchantment of danger property.

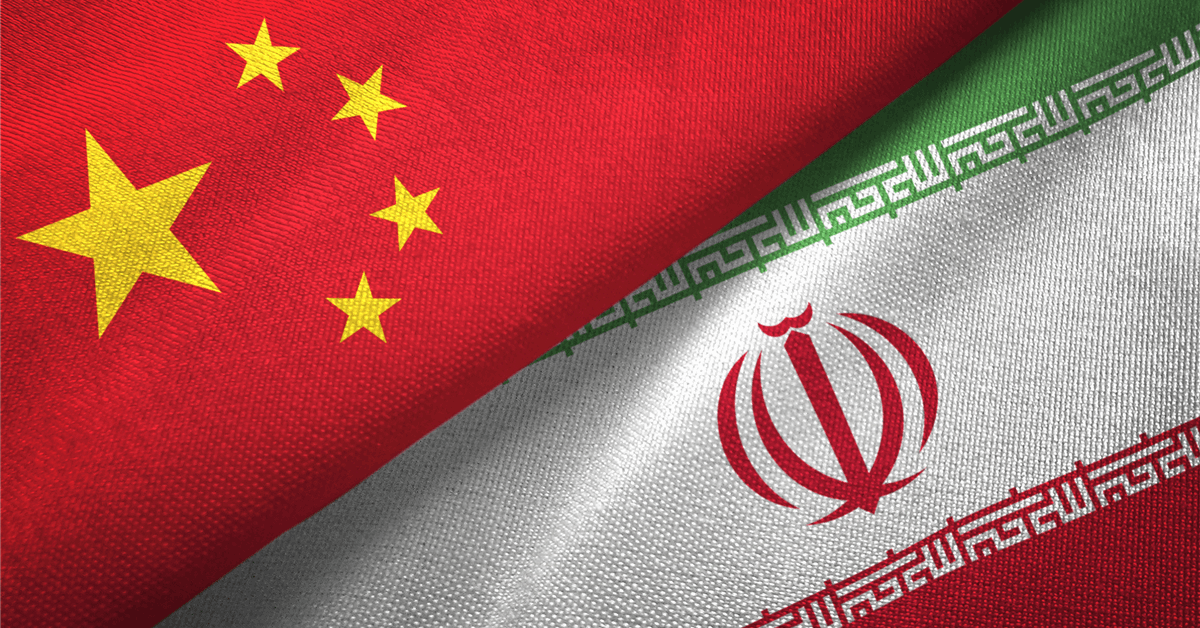

West Texas Intermediate climbed greater than 1% to settle above $71 a barrel, a rise of greater than 6% for the week, whereas Brent settled above $75 for the primary time since Nov. 7. The Russia-Ukraine battle has quickly intensified following months of bloody attrition, with the usage of longer-range missiles by either side this week. On the similar time, Iran mentioned it’s going to improve its nuclear fuel-making capability after it was censured by the UN’s Worldwide Atomic Vitality Company.

A achieve in fairness markets additionally gave crude a lift, although the rally was capped by a stronger greenback that makes commodities priced within the foreign money much less engaging. Euro-area enterprise exercise unexpectedly shrank, an indication of the dangers from heightened discord over commerce.

Nonetheless, bullish indicators for crude emerged this week. WTI’s nearest timespread strengthened to 48 cents — indicating tighter provides — after briefly flipping right into a bearish contango construction earlier this week for the primary time since February.

Oil has swung between weekly positive aspects and losses since mid-October, with a robust greenback, ample provide and indications of weak demand offering headwinds. On the similar time, geopolitical tensions — together with the Kremlin’s revamp of its nuclear doctrine this week — have induced non permanent positive aspects however failed to supply an prolonged uplift within the face of widespread expectations of a crude surplus subsequent 12 months.

“The market remains to be complacent about geopolitical disruption danger,” Bob McNally, president of Rapidan Vitality Group, mentioned in a Bloomberg Tv interview. “President Trump will likely be prepared to crimp Russian power exports to get leverage for offers he desires to chop.”

The US, in the meantime, sanctioned Russia’s Gazprombank, closing a loophole that Washington stored open over the course of the conflict as a result of the lender is essential for power markets. The penalties improve the danger of a cut-off of a few of the remaining Russian fuel flows to a handful of central European nations.

Oil Costs:

- WTI for January supply was up 1.6% to settle at $71.24 a barrel.

- Brent for January settled 1.3% larger at $75.17 a barrel.

What do you assume? We’d love to listen to from you, be a part of the dialog on the

Rigzone Vitality Community.

The Rigzone Vitality Community is a brand new social expertise created for you and all power professionals to Communicate Up about our trade, share information, join with friends and trade insiders and interact in an expert group that may empower your profession in power.

MORE FROM THIS AUTHOR

Bloomberg