Eni SpA has accomplished the divestment of the Nikaitchuq and Oooguruk fields in Alaska to Hilcorp Vitality Co. for $1 billion.

The sale is a part of Italian government-controlled Eni’s aim to generate $8 billion of web portfolio influx between 2024 and 2027.

The built-in power firm’s strategic plan for the 4 years additionally consists of retaining capital prices at EUR 7 billion ($7.5 billion) yearly, down over 20 p.c in comparison with the earlier goal. Eni plans to execute capital self-discipline by “optimization, improved challenge high quality and better portfolio administration”, it stated in an announcement March 14 asserting strategic targets for 2024–27.

Saying the closure of the sale to Hilcorp this week, Eni stated in an announcement, “The transaction, which acquired the approval of all related authorities, is in keeping with Eni’s technique targeted on the rationalization of the upstream actions by rebalancing its portfolio and divesting non-strategic property”.

“Inside Eni’s monetary construction, supporting the Firm’s distinctive growth-oriented technique, Eni is dedicated to delivering a web €8 billion of web portfolio influx over the 2024-27 Plan and contemplating accomplished offers and actions in progress Eni now expects to considerably obtain the goal by 2025, in lower than two years”, added the assertion on the corporate’s web site.

“Proceeds are anticipated to return from three foremost sources: high-grading the Upstream portfolio, diluting down excessive fairness possession exploration discoveries, and accessing new swimming pools of capital through Eni’s satellite tv for pc technique to help the expansion of its transition companies whereas confirming progress in worth creation”.

The satellite tv for pc technique entails creating “targeted and lean firms capable of appeal to new capital to create worth by working and monetary synergies and the acceleration of development”, within the firm’s phrases.

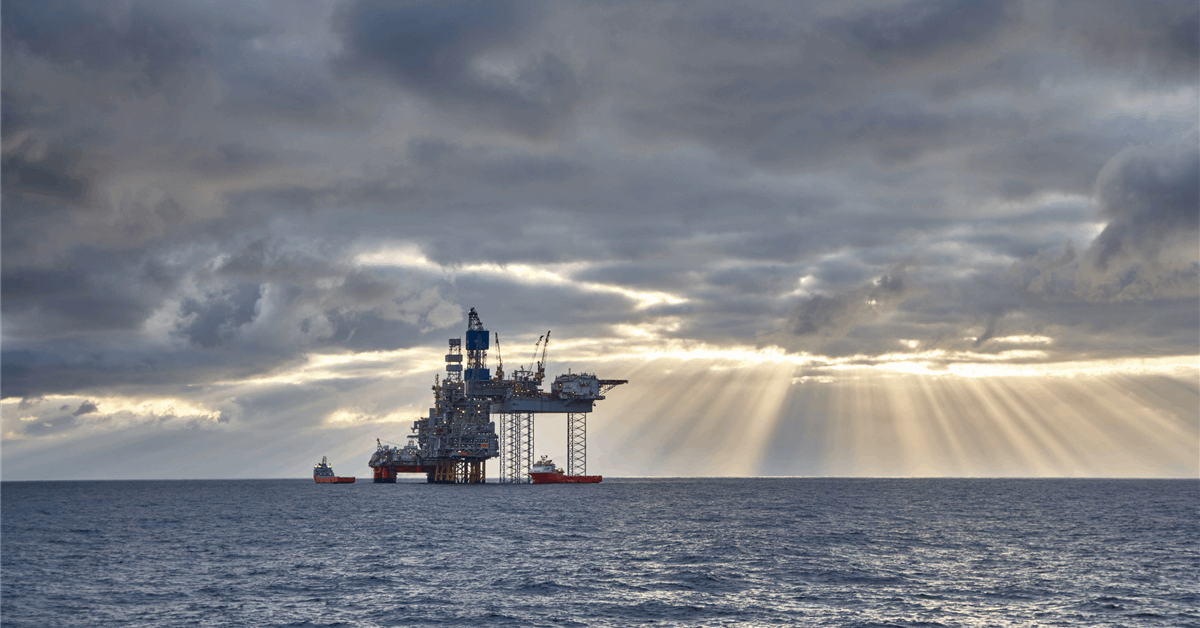

Nikaitchuq began producing January 2011. Situated offshore the North Slope in a water depth of three meters (9.8 ft), the sphere is estimated to carry 200 million barrels of oil. It’s Eni’s first operated asset in Arctic waters, in line with the corporate.

Oooguruk started manufacturing 2008. It sits round 5 kilometers (3.1 miles) off the coast of the North Slope.

“Eni will proceed to be current within the USA within the upstream of Gulf of Mexico in addition to in power transition tasks within the renewables, biofuels and magnetic fusion”, the assertion stated.

To contact the writer, electronic mail jov.onsat@rigzone.com

Generated by readers, the feedback included herein don’t replicate the views and opinions of Rigzone. All feedback are topic to editorial evaluation. Off-topic, inappropriate or insulting feedback shall be eliminated.